Answered step by step

Verified Expert Solution

Question

1 Approved Answer

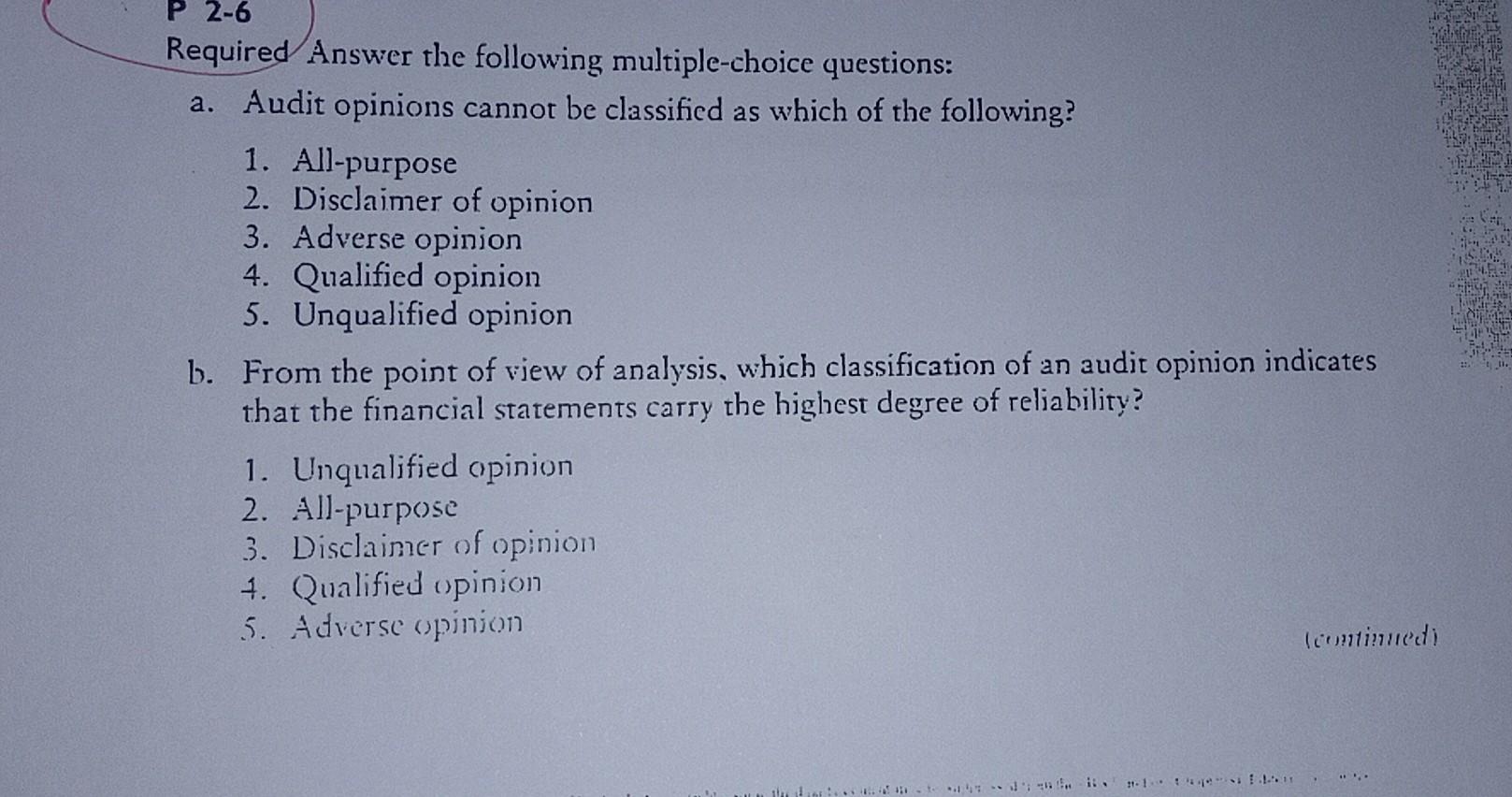

P 2-6 Required Answer the following multiple-choice questions: a. Audit opinions cannot be classified as which of the following? 1. All-purpose 2. Disclaimer of opinion

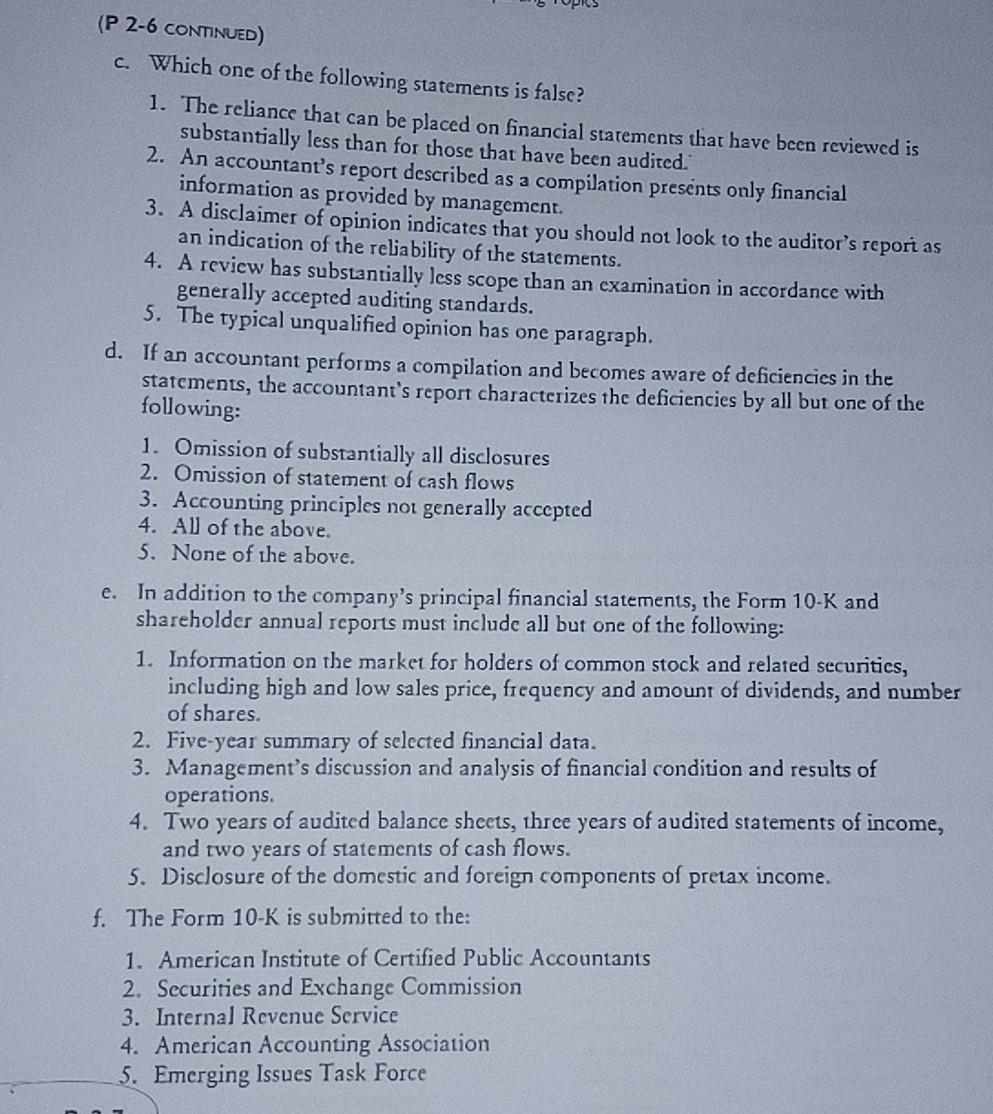

P 2-6 Required Answer the following multiple-choice questions: a. Audit opinions cannot be classified as which of the following? 1. All-purpose 2. Disclaimer of opinion 3. Adverse opinion 4. Qualified opinion 5. Unqualified opinion b. From the point of view of analysis, which classification of an audit opinion indicates that the financial statements carry the highest degree of reliability? 1. Unqualified opinion 2. All-purpose 3. Disclaimer of opinion 4. Qualified opinion 5. Adverse opinion ;11217 ) 16:... to.it 31.1.11 (P 2-6 CONTINUED) c. Which one of the following statements is false? 1. The reliance that can be placed on financial statements that have been reviewed is substantially less than for those that have been audited. 2. An accountant's report described as a compilation presents only financial information as provided by management. 3. A disclaimer of opinion indicates that you should not look to the auditor's report as an indication of the reliability of the statements. 4. A review has substantially less scope than an examination in accordance with generally accepted auditing standards. 5. The typical unqualified opinion has one paragraph. d. If an accountant performs a compilation and becomes aware of deficiencies in the statements, the accountant's report characterizes the deficiencies by all but one of the following: 1. Omission of substantially all disclosures 2. Omission of statement of cash flows 3. Accounting principles nou generally accepted 4. All of the above. 5. None of the above. e. In addition to the company's principal financial statements, the Form 10-K and shareholder annual reports must include all but one of the following: 1. Information on the market for holders of common stock and related securities, including high and low sales price, frequency and amount of dividends, and number of shares. 2. Five-year summary of selected financial data. 3. Management's discussion and analysis of financial condition and results of operations. 4. Two years of audited balance sheets, three years of audited statements of income, and two years of statements of cash flows. 5. Disclosure of the domestic and foreign components pretax income. f. The Form 10-K is submitted to the: 1. American Institute of Certified Public Accountants 2. Securities and Exchange Commission 3. Internal Revenue Service 4. American Accounting Association 5. Emerging Issues Task Force

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started