Answered step by step

Verified Expert Solution

Question

1 Approved Answer

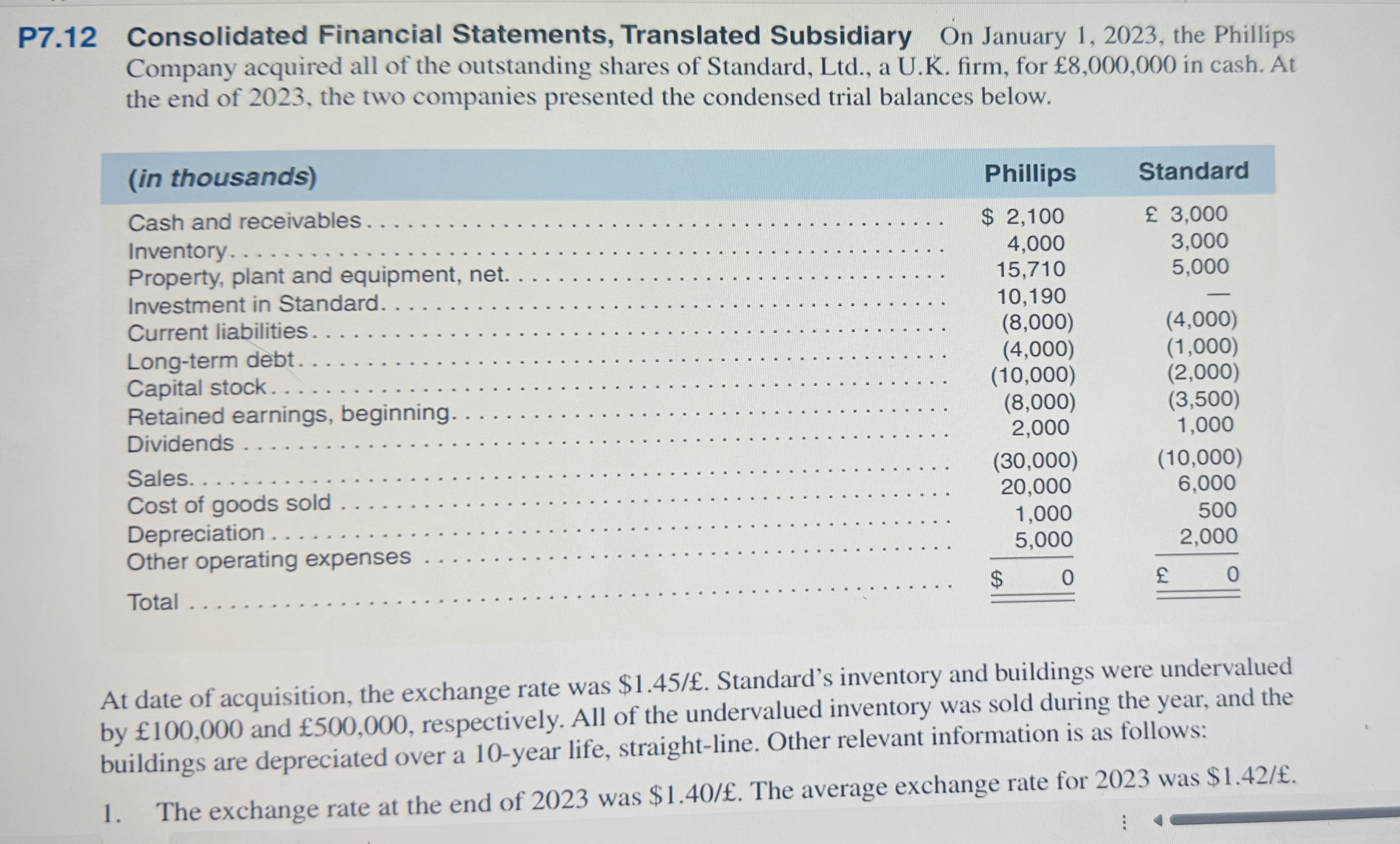

P 7 . 1 2 Consolidated Financial Statements, Translated Subsidiary On January 1 , 2 0 2 3 , the Phillips Company acquired all of

P Consolidated Financial Statements, Translated Subsidiary On January the Phillips Company acquired all of the outstanding shares of Standard, Ltd a UK firm, for in cash. At the end of the two companies presented the condensed trial balances below. Phillips' entry to update the investment for equity in net income

and its share of Standard's translation gain:

Step : Consolidation working paper entries

Ref. Description

Debit

Credit

C Income from subsidiary

Equity in OCL of Standard

To reverse equity method entries for

E

To eliminate Standard's stockholders' equity as of January

R

End of year rates

Other comprehensive loss

Enter amount of Cost over BV from J

To record the beginningofyear revaluations.

At date of acquisition, the exchange rate was $ Standard's inventory and buildings were undervalued by and respectively. All of the undervalued inventory was sold during the year, and the buildings are depreciated over a year life, straightline. Other relevant information is as follows:

The exchange rate at the end of was $ The average exchange rate for was $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started