Answered step by step

Verified Expert Solution

Question

1 Approved Answer

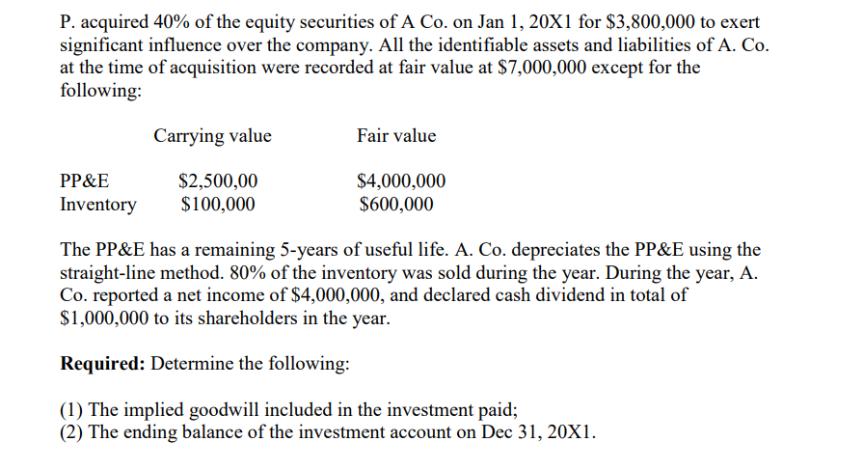

P. acquired 40% of the equity securities of A Co. on Jan 1, 20X1 for $3,800,000 to exert significant influence over the company. All

P. acquired 40% of the equity securities of A Co. on Jan 1, 20X1 for $3,800,000 to exert significant influence over the company. All the identifiable assets and liabilities of A. Co. at the time of acquisition were recorded at fair value at $7,000,000 except for the following: PP&E Inventory Carrying value Fair value $4,000,000 $600,000 $2,500,00 $100,000 The PP&E has a remaining 5-years of useful life. A. Co. depreciates the PP&E using the straight-line method. 80% of the inventory was sold during the year. During the year, A. Co. reported a net income of $4,000,000, and declared cash dividend in total of $1,000,000 to its shareholders in the year. Required: Determine the following: (1) The implied goodwill included in the investment paid; (2) The ending balance of the investment account on Dec 31, 20X1.

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer To determine the implied goodwill included in the investment paid and the ending balance of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started