Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P Company is a manufacturer of personal computers founded two decades ago. Y Company is a manufacturer of electronic cameras and is renowned for

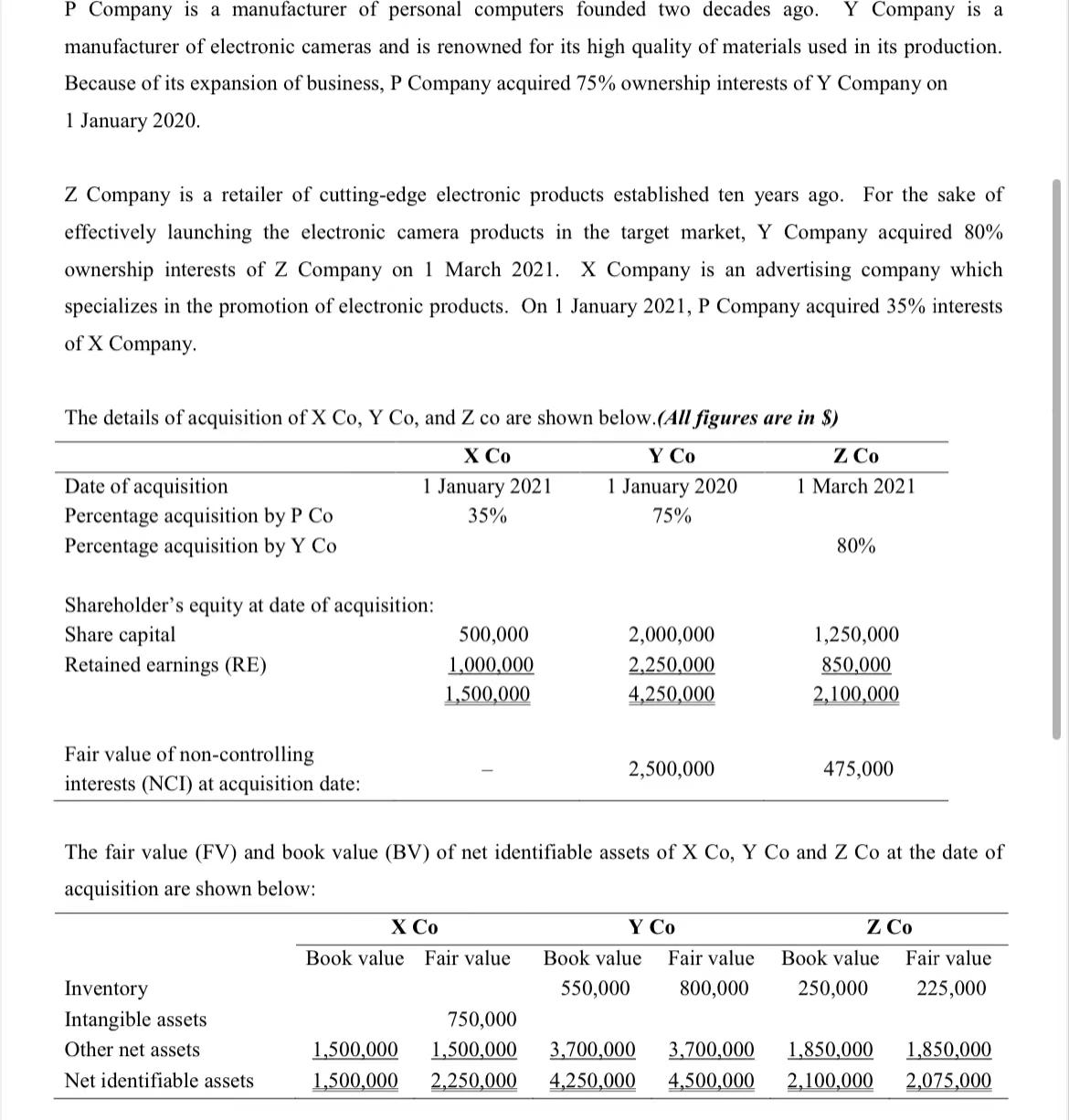

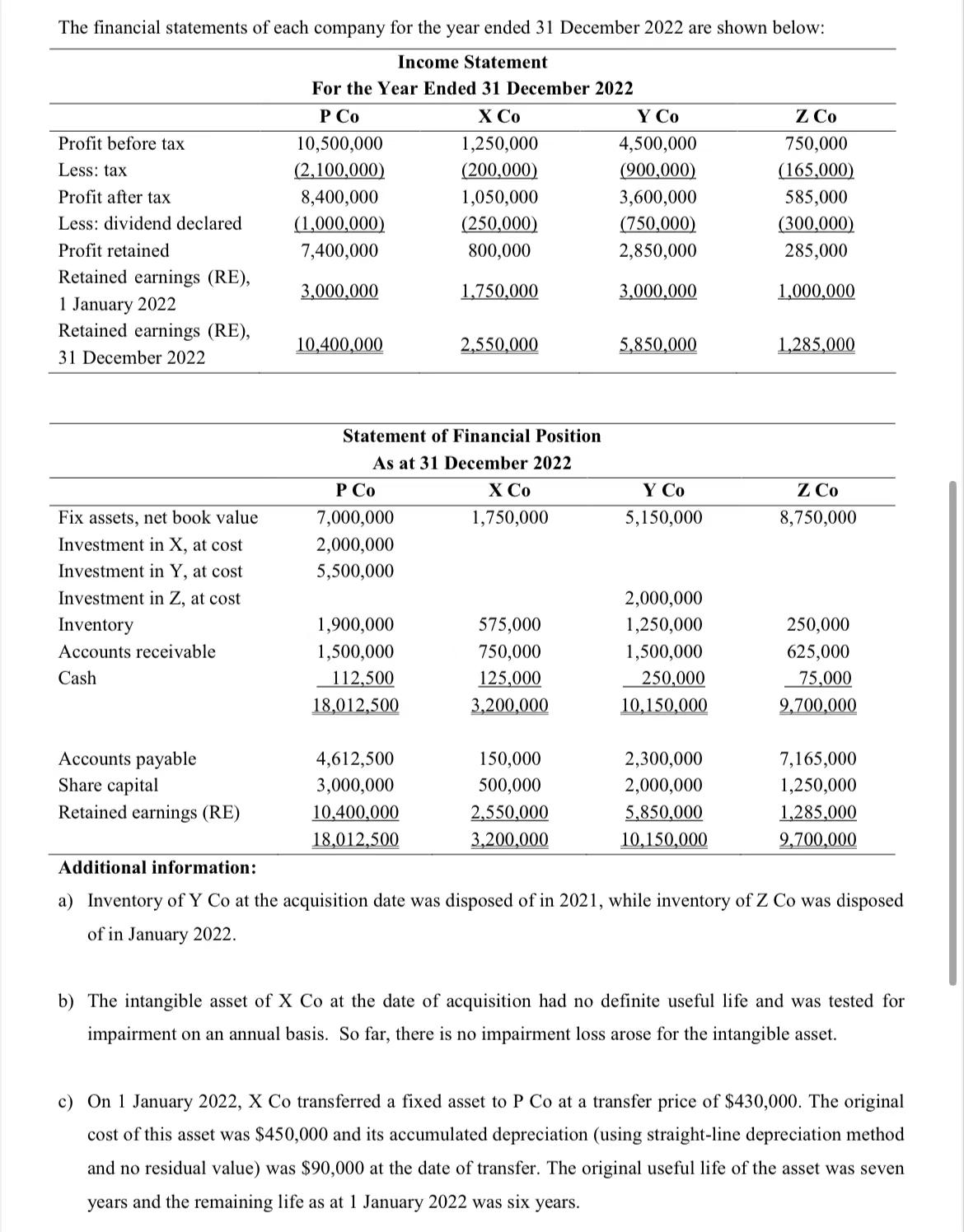

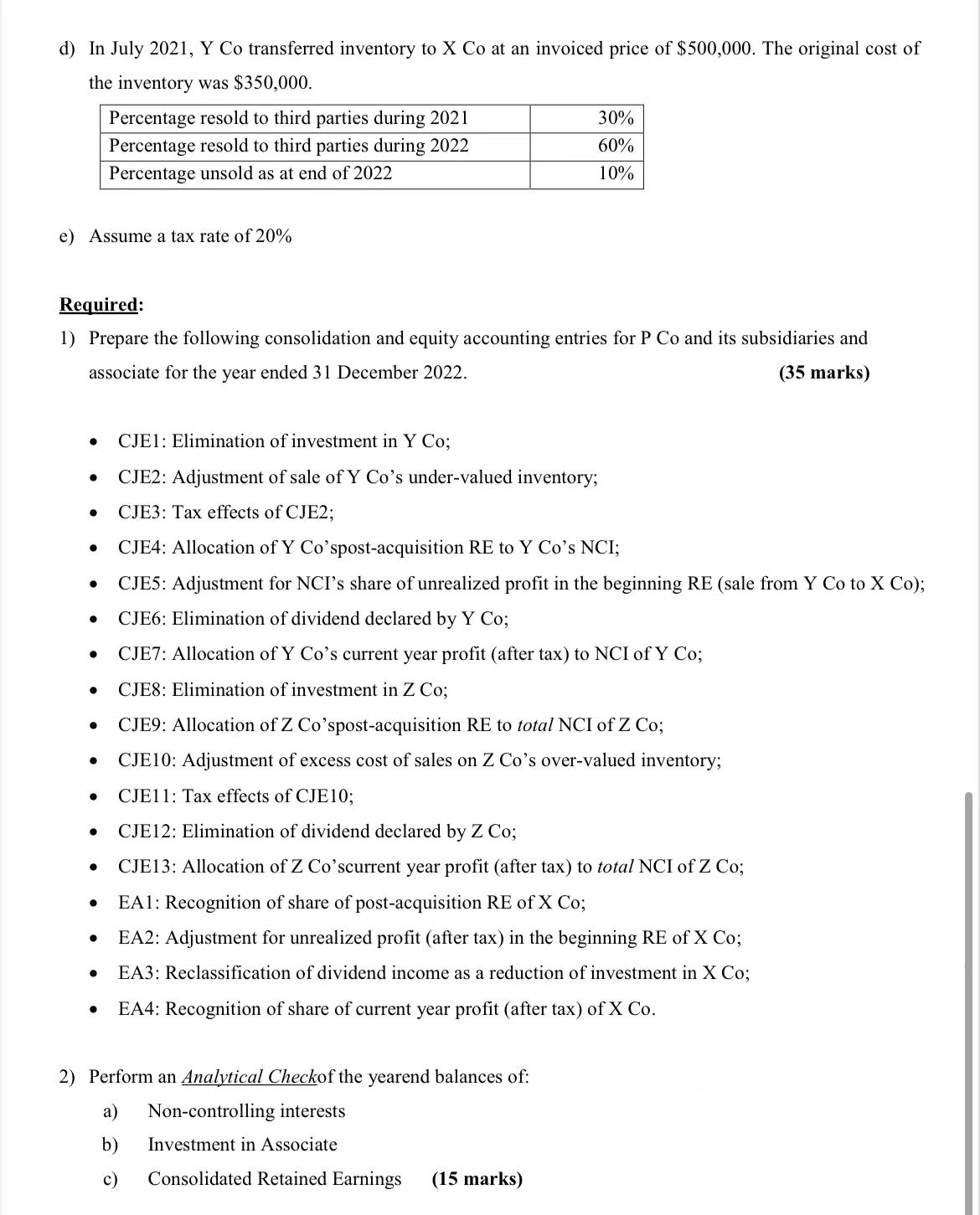

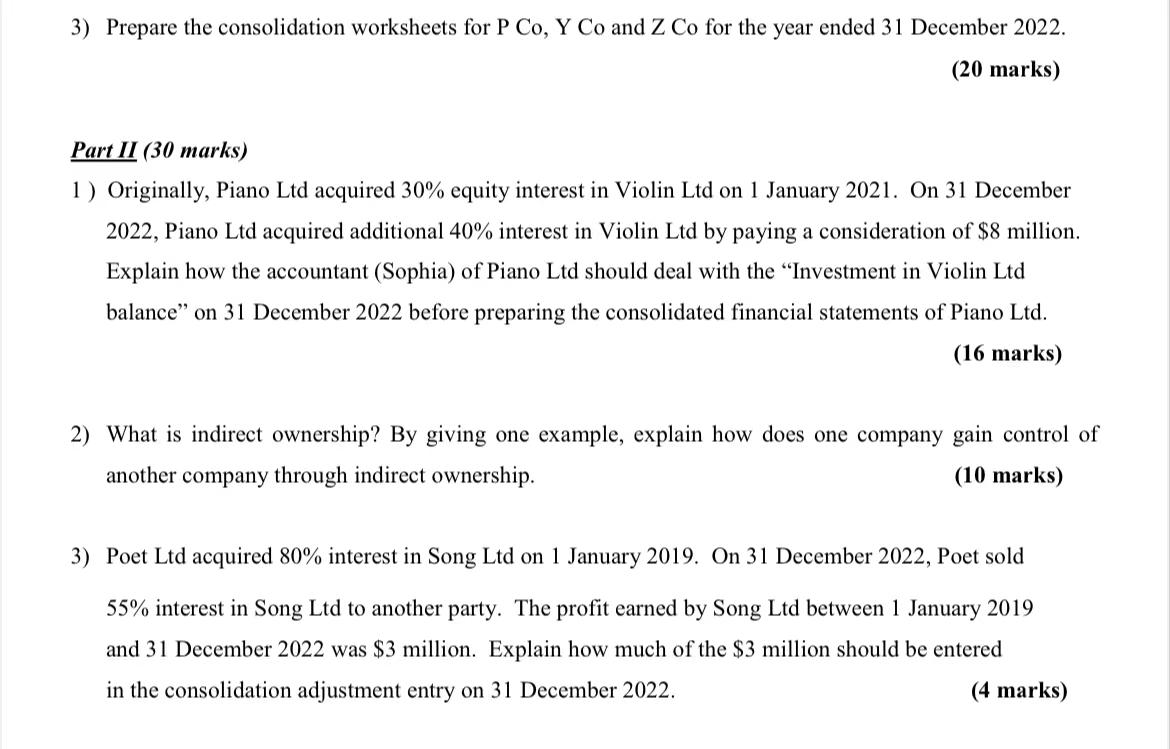

P Company is a manufacturer of personal computers founded two decades ago. Y Company is a manufacturer of electronic cameras and is renowned for its high quality of materials used in its production. Because of its expansion of business, P Company acquired 75% ownership interests of Y Company on 1 January 2020. Z Company is a retailer of cutting-edge electronic products established ten years ago. For the sake of effectively launching the electronic camera products in the target market, Y Company acquired 80% ownership interests of Z Company on 1 March 2021. X Company is an advertising company which specializes in the promotion of electronic products. On 1 January 2021, P Company acquired 35% interests of X Company. The details of acquisition of X Co, Y Co, and Z co are shown below. (All figures are in $) X Co Y Co 1 January 2021 35% 1 January 2020 75% Date of acquisition Percentage acquisition by P Co Percentage acquisition by Y Co Shareholder's equity at date of acquisition: Share capital Retained earnings (RE) Fair value of non-controlling interests (NCI) at acquisition date: 500,000 1,000,000 1,500,000 Inventory Intangible assets Other net assets Net identifiable assets 2,000,000 2,250,000 4,250,000 X Co Book value Fair value 2,500,000 Y Co Fair value 800,000 The fair value (FV) and book value (BV) of net identifiable assets of X Co, Y Co and Z Co at the date of acquisition are shown below: Book value 550,000 ZCo 1 March 2021 750,000 1,500,000 1,500,000 3,700,000 3,700,000 1,500,000 2,250,000 4,250,000 4,500,000 80% 1,250,000 850,000 2,100,000 475,000 Z Co Book value 250,000 Fair value 225,000 1,850,000 1,850,000 2,100,000 2,075,000 The financial statements of each company for the year ended 31 December 2022 are shown below: Income Statement For the Year Ended 31 December 2022 P Co X Co 10,500,000 1,250,000 (2,100,000) (200,000) 8,400,000 1,050,000 (1,000,000) (250,000) 7,400,000 800,000 1,750,000 Profit before tax Less: tax Profit after tax Less: dividend declared Profit retained Retained earnings (RE), 1 January 2022 Retained earnings (RE), 31 December 2022 Fix assets, net book value Investment in X, at cost Investment in Y, at cost Investment in Z, at cost Inventory Accounts receivable Cash Accounts payable Share capital Retained earnings (RE) 3,000,000 10,400,000 Statement of Financial Position As at 31 December 2022 X Co 1,750,000 P Co 7,000,000 2,000,000 5,500,000 1,900,000 1,500,000 112,500 18,012,500 2,550,000 4,612,500 3,000,000 10,400,000 18,012,500 575,000 750,000 125,000 3,200,000 150,000 500,000 2,550,000 3,200,000 Y Co 4,500,000 (900,000) 3,600,000 (750,000) 2,850,000 3,000,000 5,850,000 Y Co 5,150,000 2,000,000 1,250,000 1,500,000 250,000 10,150,000 2,300,000 2,000,000 5,850,000 10,150,000 Z Co 750,000 (165,000) 585,000 (300,000) 285,000 1,000,000 1,285,000 Z Co 8,750,000 250,000 625,000 75,000 9,700,000 7,165,000 1,250,000 1,285,000 9,700,000 Additional information: a) Inventory of Y Co at the acquisition date was disposed of in 2021, while inventory of Z Co was disposed of in January 2022. b) The intangible asset of X Co at the date of acquisition had no definite useful life and was tested for impairment on an annual basis. So far, there is no impairment loss arose for the intangible asset. c) On 1 January 2022, X Co transferred a fixed asset to P Co at a transfer price of $430,000. The original cost of this asset was $450,000 and its accumulated depreciation (using straight-line depreciation method and no residual value) was $90,000 at the date of transfer. The original useful life of the asset was seven years and the remaining life as at 1 January 2022 was six years. d) In July 2021, Y Co transferred inventory to X Co at an invoiced price of $500,000. The original cost of the inventory was $350,000. e) Assume a tax rate of 20% Required: 1) Prepare the following consolidation and equity accounting entries for P Co and its subsidiaries and associate for the year ended 31 December 2022. (35 marks) Percentage resold to third parties during 2021 Percentage resold to third parties during 2022 Percentage unsold as at end of 2022 CJE12: Elimination of dividend declared by Z Co; CJE13: Allocation of Z Co'scurrent year profit (after tax) to total NCI of Z Co; EA1: Recognition of share of post-acquisition RE of X Co; EA2: Adjustment for unrealized profit (after tax) in the beginning RE of X Co; EA3: Reclassification of dividend income as a reduction of investment in X Co; EA4: Recognition of share of current year profit (after tax) of X Co. 30% 60% 10% CJE1: Elimination of investment in Y Co; CJE2: Adjustment of sale of Y Co's under-valued inventory; CJE3: Tax effects of CJE2; CJE4: Allocation of Y Co'spost-acquisition RE to Y Co's NCI; CJE5: Adjustment for NCI's share of unrealized profit in the beginning RE (sale from Y Co to X Co); CJE6: Elimination of dividend declared by Y Co; CJE7: Allocation of Y Co's current year profit (after tax) to NCI of Y Co; CJE8: Elimination of investment in Z Co; CJE9: Allocation of Z Co'spost-acquisition RE to total NCI of Z Co; CJE 10: Adjustment of excess cost of sales on Z Co's over-valued inventory; CJE11: Tax effects of CJE10; 2) Perform an Analytical Checkof the yearend balances of: a) Non-controlling interests b) Investment in Associate c) Consolidated Retained Earnings (15 marks) 3) Prepare the consolidation worksheets for P Co, Y Co and Z Co for the year ended 31 December 2022. (20 marks) Part II (30 marks) 1) Originally, Piano Ltd acquired 30% equity interest in Violin Ltd on 1 January 2021. On 31 December 2022, Piano Ltd acquired additional 40% interest in Violin Ltd by paying a consideration of $8 million. Explain how the accountant (Sophia) of Piano Ltd should deal with the "Investment in Violin Ltd balance" on 31 December 2022 before preparing the consolidated financial statements of Piano Ltd. (16 marks) 2) What is indirect ownership? By giving one example, explain how does one company gain control of another company through indirect ownership. (10 marks) 3) Poet Ltd acquired 80 % interest in Song Ltd on 1 January 2019. On 31 December 2022, Poet sold 55% interest in Song Ltd to another party. The profit earned by Song Ltd between 1 January 2019 and 31 December 2022 was $3 million. Explain how much of the $3 million should be entered in the consolidation adjustment entry on 31 December 2022. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Consolidation and Equity Accounting Entries for P Co and its subsidiaries and associate for the year ended 31 December 2022 CJE1 Elimination of investment in Y Co Investment in Y Co 8750000 Equity i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started