Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P Company owns an 70% controlling interest in S Company. S company regularly sells merchandise to P company, which then sold to outside parties.

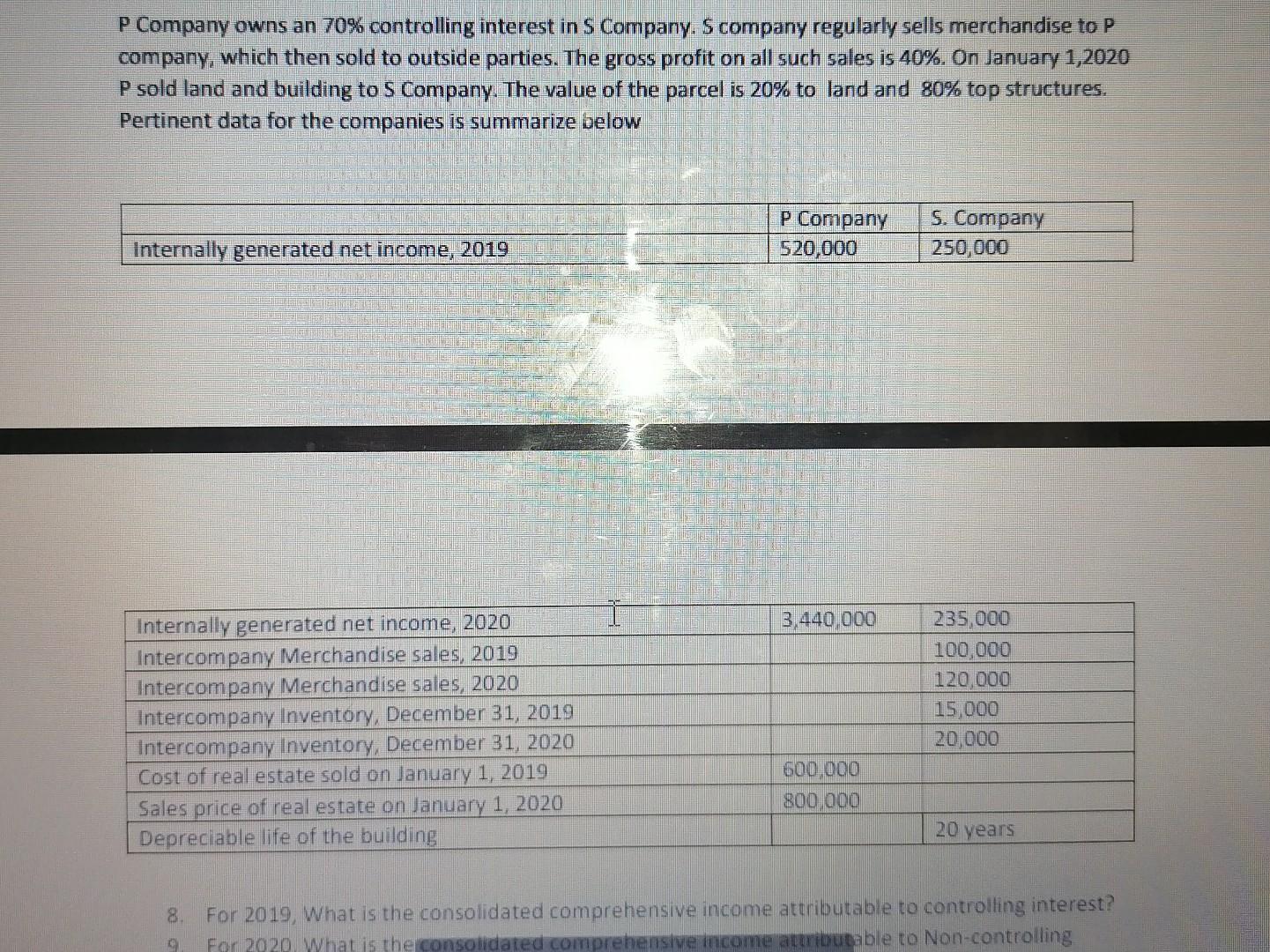

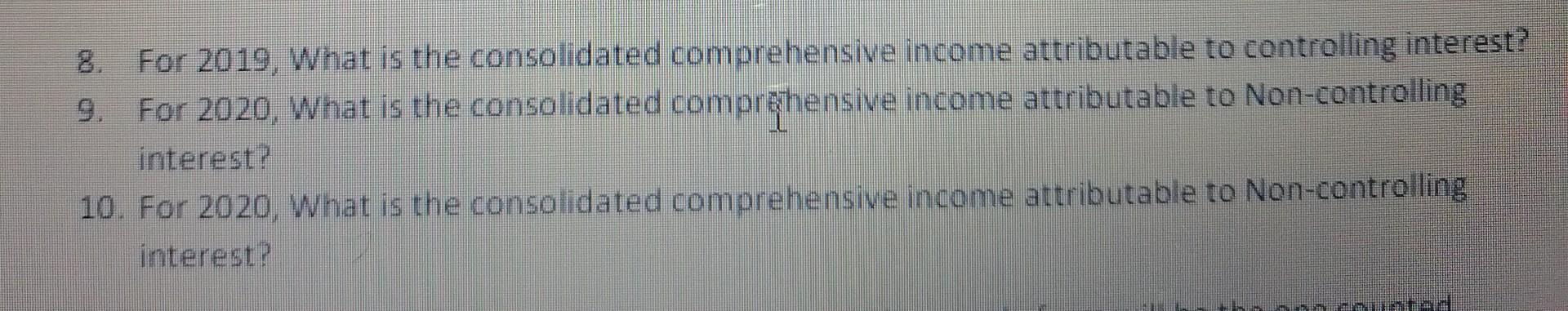

P Company owns an 70% controlling interest in S Company. S company regularly sells merchandise to P company, which then sold to outside parties. The gross profit on all such sales is 40%. On January 1,2020 P sold land and building to S Company. The value of the parcel is 20% to land and 80% top structures. Pertinent data for the companies is summarize below Internally generated net income, 2019 Internally generated net income, 2020 Intercompany Merchandise sales, 2019 Intercompany Merchandise sales, 2020 Intercompany Inventory, December 31, 2019 Intercompany Inventory, December 31, 2020 Cost of real estate sold on January 1, 2019 Sales price of real estate on January 1, 2020 Depreciable life of the building P Company 520,000 3,440,000 600,000 800,000 S. Company 250,000 235,000 100,000 120,000 15,000 20,000 20 years 8. For 2019, What is the consolidated comprehensive income attributable to controlling interest? For 2020. What is the consolidated comprehensive income attributable to Non-controlling For 2019, What is the consolidated comprehensive income attributable to controlling interest? 9. For 2020, What is the consolidated comprehensive income attributable to Non-controlling interest? 10. For 2020, What is the consolidated comprehensive income attributable to Non-controlling interest? BATAN

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

8 For 2019 the consolidated comprehensive income attributable to controlling int...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started