Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P Corporation acquired 80 percent of S Corporation's common stock on March 31, 20X4 for $360,000. At that date, the fair value of the

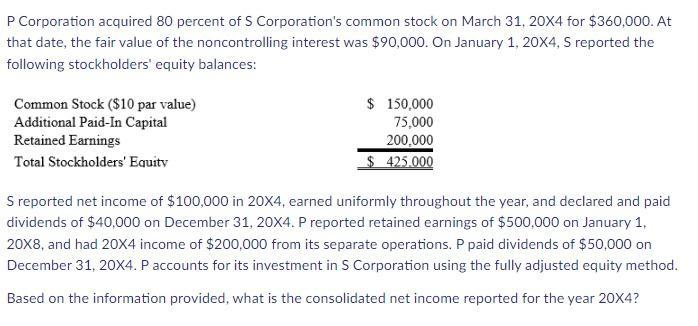

P Corporation acquired 80 percent of S Corporation's common stock on March 31, 20X4 for $360,000. At that date, the fair value of the noncontrolling interest was $90,000. On January 1, 20X4, S reported the following stockholders' equity balances: Common Stock ($10 par value) Additional Paid-In Capital Retained Earnings Total Stockholders' Equity $ 150,000 75,000 200,000 $425.000 S reported net income of $100,000 in 20X4, earned uniformly throughout the year, and declared and paid dividends of $40,000 on December 31, 20X4. P reported retained earnings of $500,000 on January 1, 20X8, and had 20X4 income of $200,000 from its separate operations. P paid dividends of $50,000 on December 31, 20X4. P accounts for its investment in S Corporation using the fully adjusted equity method. Based on the information provided, what is the consolidated net income reported for the year 20X4?

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The answer provided below has been dev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started