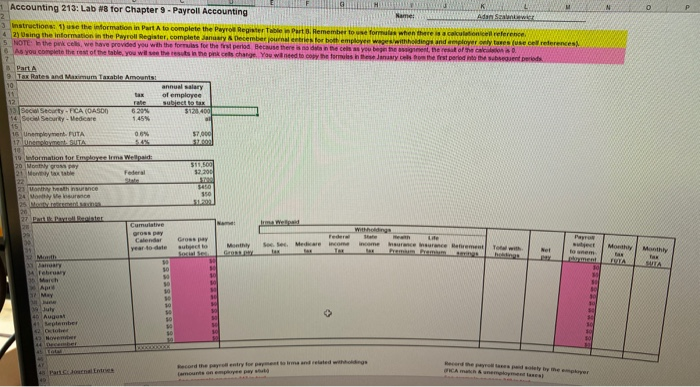

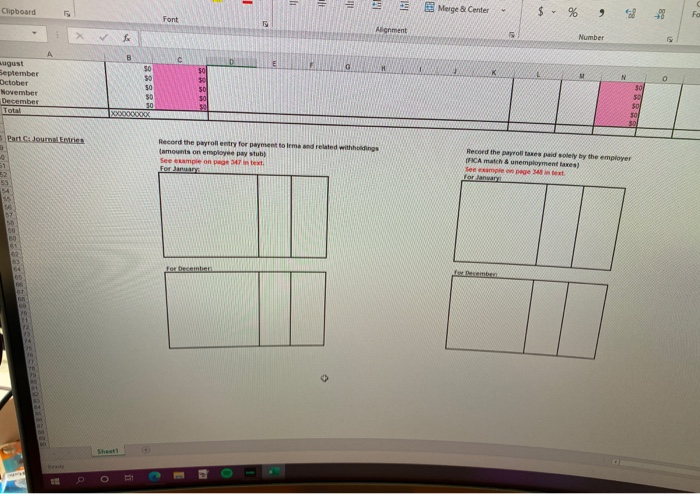

P KA Accounting 213: Lab 8 for Chapter 9 - Payroll Accounting amel Adan Saw 3 Instruction 1) use the information in Part A to complete the Payroll Register Table Parts Hemember to formules when there is a calculation reference 2) Using the information in the Payroll Register complete January December journal entries for both employee wage with holdings and employer only are se crederences 5 NOTE the pink cells, we have provided you with the formules for the first period. Because there is no dia in the cell you be gent, the rest of the can As you complete the rest of the table, you will see the pink ces change. You wined to formulsary cells to the first personer 4 Part Tax Rates and Maximum Taxable Amounts 10 19 12 rate Social Storty -PCA (OASON 6.2014 14 Si Security - Medicare 1.45 15 15 unemployment. PUTA 0.6% 17. USTA 54% annual salary of employee subject to a $123400 57000 522 19 normation forma Wetpaid: 20 Monthly grossey 21 Montaxe Federal $1,500 12.200 350 23 Martha sth insurance 24 Montero 24 20 Cumulative Grosspay Calendar year to date Gray Pay Monthly See Medal income wome to censurance Benement Monthly nem 10 TUTA TY A February 20 March Apu May 19 10 40 A 41 pm Oo 45 Pantanal Record the parentry for payment to me and related with amounts on employee pay - = = BE Clipboard Il Merge & Center $ - % 58 - Fo Font Allgnment Number A D H K 0 august September October November December Total 30 50 50 50 SO 50 XXOO000x $0 30 Part. Journal Entries Record the payroll entry for payment to me and related withholdings amounts on employee paystub See example on page 347 in text 0 51 Record the payroll taxes paid solely by the employer FCA match & unemployment les Sempre page 4 text For December 09 Instructions: 1) use the information in Part A to complete the Payroll Register Table in Part B. Remember tune formules when there is calculation cell reference 2) Using the information in the Payroll Register, complete January & December Journal entries for both employee weswithholdings and employer only takes use cel references) 5 NOTE: In the pink cols, we have provided you with the form for the first perle. Because there is no data with ces as you be the same, the rest of the calculation 6 As you complete the rest of the you will see the results in the pink col change. You will need to copy the formes dy host period to me subsequent periods P KA Accounting 213: Lab 8 for Chapter 9 - Payroll Accounting amel Adan Saw 3 Instruction 1) use the information in Part A to complete the Payroll Register Table Parts Hemember to formules when there is a calculation reference 2) Using the information in the Payroll Register complete January December journal entries for both employee wage with holdings and employer only are se crederences 5 NOTE the pink cells, we have provided you with the formules for the first period. Because there is no dia in the cell you be gent, the rest of the can As you complete the rest of the table, you will see the pink ces change. You wined to formulsary cells to the first personer 4 Part Tax Rates and Maximum Taxable Amounts 10 19 12 rate Social Storty -PCA (OASON 6.2014 14 Si Security - Medicare 1.45 15 15 unemployment. PUTA 0.6% 17. USTA 54% annual salary of employee subject to a $123400 57000 522 19 normation forma Wetpaid: 20 Monthly grossey 21 Montaxe Federal $1,500 12.200 350 23 Martha sth insurance 24 Montero 24 20 Cumulative Grosspay Calendar year to date Gray Pay Monthly See Medal income wome to censurance Benement Monthly nem 10 TUTA TY A February 20 March Apu May 19 10 40 A 41 pm Oo 45 Pantanal Record the parentry for payment to me and related with amounts on employee pay - = = BE Clipboard Il Merge & Center $ - % 58 - Fo Font Allgnment Number A D H K 0 august September October November December Total 30 50 50 50 SO 50 XXOO000x $0 30 Part. Journal Entries Record the payroll entry for payment to me and related withholdings amounts on employee paystub See example on page 347 in text 0 51 Record the payroll taxes paid solely by the employer FCA match & unemployment les Sempre page 4 text For December 09 Instructions: 1) use the information in Part A to complete the Payroll Register Table in Part B. Remember tune formules when there is calculation cell reference 2) Using the information in the Payroll Register, complete January & December Journal entries for both employee weswithholdings and employer only takes use cel references) 5 NOTE: In the pink cols, we have provided you with the form for the first perle. Because there is no data with ces as you be the same, the rest of the calculation 6 As you complete the rest of the you will see the results in the pink col change. You will need to copy the formes dy host period to me subsequent periods