Answered step by step

Verified Expert Solution

Question

1 Approved Answer

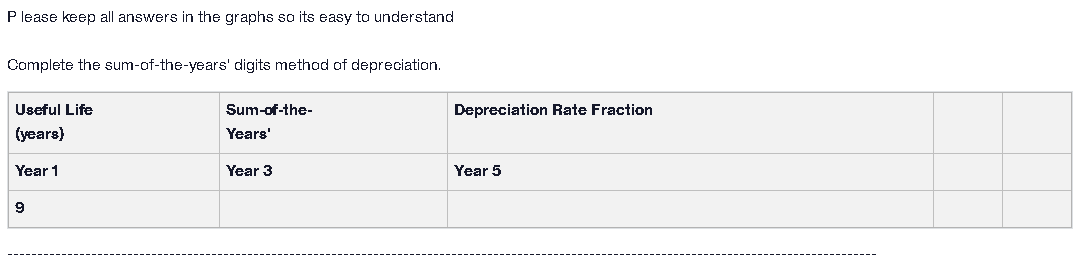

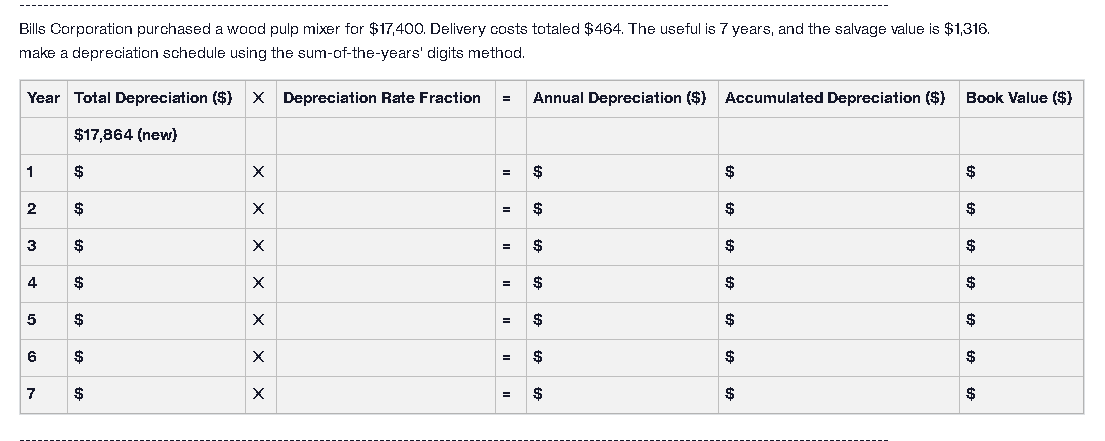

P lease keep all answers in the graphs so its easy to understand Complete the sum-of-the-years' digits method of depreciation. Bills Carparation purchased a woad

| ||||||

|---|---|---|---|---|---|---|

|

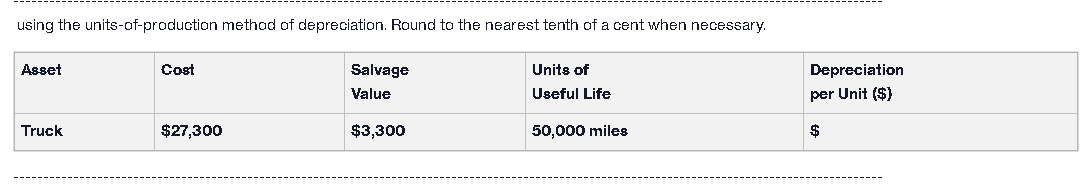

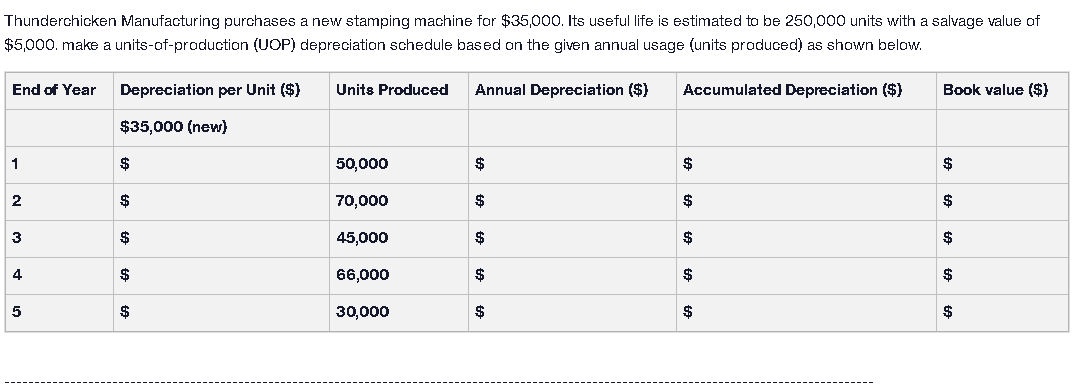

P lease keep all answers in the graphs so its easy to understand Complete the sum-of-the-years' digits method of depreciation. Bills Carparation purchased a woad pulp mixer far $17,400. Delivery costs tataled $464. The useful is 7 years, and the salvage value is $1,316. make a depreciation schedule using the sum-of-the-years' digits methad. using the units-of-production method of depreciation. Round to the nearest tenth of a cent when necessary. Thunderchicken Manufacturing purchases a new stamping machine for $35,000. Its useful life is estimated to be 250,000 units with a salvage value of 35,000. make a units-of-production (UOP) depreciation schedule based on the given annual usage (units produced) as shown below. P lease keep all answers in the graphs so its easy to understand Complete the sum-of-the-years' digits method of depreciation. Bills Carparation purchased a woad pulp mixer far $17,400. Delivery costs tataled $464. The useful is 7 years, and the salvage value is $1,316. make a depreciation schedule using the sum-of-the-years' digits methad. using the units-of-production method of depreciation. Round to the nearest tenth of a cent when necessary. Thunderchicken Manufacturing purchases a new stamping machine for $35,000. Its useful life is estimated to be 250,000 units with a salvage value of 35,000. make a units-of-production (UOP) depreciation schedule based on the given annual usage (units produced) as shown below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started