Question

P obtained control over S by purchasing 65% of its outstanding voting shares for $251,875 on December 31, 2012. P records its investment in S

P obtained control over S by purchasing 65% of its outstanding voting shares for $251,875 on December 31, 2012. P records its investment in S on the cost basis and uses the fair value enterprise (entity) theory. At that date, S had common shares of $150,000 and retained earnings of $110,000. At the date of purchase, P assessed Ss plant assets at $32,000 over their net book value. In addition, P noted that patents valued by S at zero actually had a fair value of 36,000. The plant assets had a remaining useful life of 8 years at acquisition date; patents had a remaining useful life of 12 years. Goodwill created upon purchase is tested for impairment at least annually

Additional Information:

a) At December 31, 2016, goodwill had a recoverable (unimpaired) value of $$46,000. The impairment loss occurred in 2016.

b) At December 31, 2016, patents had a recoverable (unimpaired) value of $21,750. The impairment loss occurred in 2016.

c) On December 31, 2016, P declared dividends of $40,000 to its shareholders. On that same date, S declared dividends to its shareholders of $25,000.

d) Amortization expense is included in selling expenses; impairment losses are included in other expenses.

Required:

a) Calculate the acquisition differential, goodwill and non-controlling interest at acquisition date, December 31, 2012. Prepare the acquisition eliminating entry at acquisition date on the consolidation worksheet. (7 marks)

b) Prepare the schedule of amortization of acquisition differential and impairment (5 marks)

c) Calculate consolidated net income for the year ended December 31, 2016. Separate the portion attributable to P and to non-controlling interest. (4 marks)

d) Prepare the consolidated income statement for year 2016. (3 marks)

e) Calculate the opening balance of consolidated retained earnings at January 1, 2016 (5 marks)

f) Calculate the ending balance of retained earnings at December 31, 2016. (1 mark) g) Calculate the ending balance of non-controlling interest that would appear on the consolidated balance sheet at December 31, 2016 (2 marks)

h) Calculate the balance of Plant Assets @ net that would show on the consolidated balance sheet at December 31, 2016. (2 marks)

i) Assume that P used the equity method to record its investment in S. What would be the value of the Investment in S account on the Ps separate entity balance sheet at December 31, 2016. (3 marks)

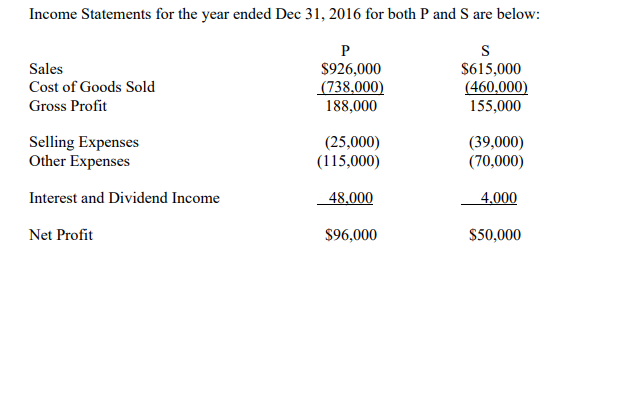

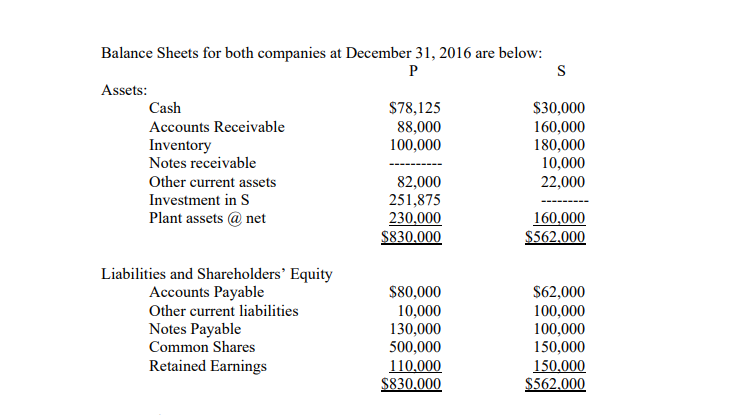

Income Statements for the year ended Dec 31, 2016 for both P and Sare below: Sales Cost of Goods Sold Gross Profit P $926,000 (738,000) 188,000 S $615,000 (460,000) 155,000 Selling Expenses Other Expenses (25,000) (115,000) (39,000) (70,000) Interest and Dividend Income 48,000 4,000 Net Profit $96,000 $50,000 Balance Sheets for both companies at December 31, 2016 are below: P S Assets: Cash $78,125 $30,000 Accounts Receivable 88,000 160,000 Inventory 100,000 180,000 Notes receivable 10,000 Other current assets 82,000 22,000 Investment in s 251,875 Plant assets @ net 230,000 160,000 $830,000 $562.000 Liabilities and Shareholders' Equity Accounts Payable Other current liabilities Notes Payable Common Shares Retained Earnings $80,000 10,000 130,000 500,000 110,000 $830,000 $62,000 100,000 100,000 150,000 150,000 $562,000 Income Statements for the year ended Dec 31, 2016 for both P and Sare below: Sales Cost of Goods Sold Gross Profit P $926,000 (738,000) 188,000 S $615,000 (460,000) 155,000 Selling Expenses Other Expenses (25,000) (115,000) (39,000) (70,000) Interest and Dividend Income 48,000 4,000 Net Profit $96,000 $50,000 Balance Sheets for both companies at December 31, 2016 are below: P S Assets: Cash $78,125 $30,000 Accounts Receivable 88,000 160,000 Inventory 100,000 180,000 Notes receivable 10,000 Other current assets 82,000 22,000 Investment in s 251,875 Plant assets @ net 230,000 160,000 $830,000 $562.000 Liabilities and Shareholders' Equity Accounts Payable Other current liabilities Notes Payable Common Shares Retained Earnings $80,000 10,000 130,000 500,000 110,000 $830,000 $62,000 100,000 100,000 150,000 150,000 $562,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started