Answered step by step

Verified Expert Solution

Question

1 Approved Answer

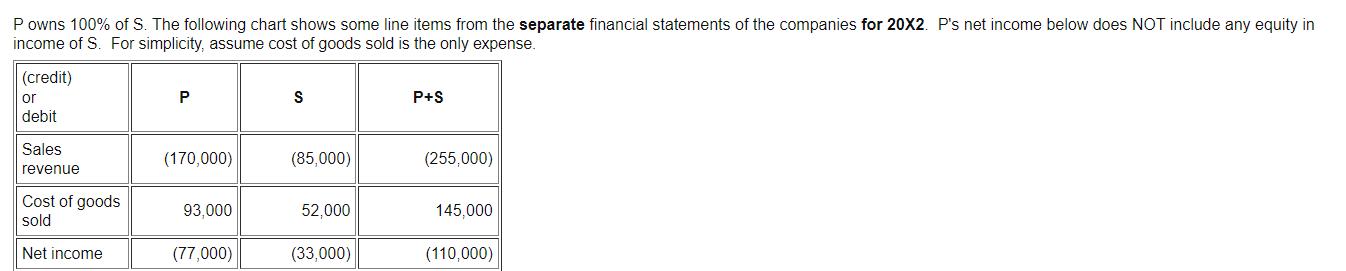

P owns 100% of S. The following chart shows some line items from the separate financial statements of the companies for 20X2. P's net

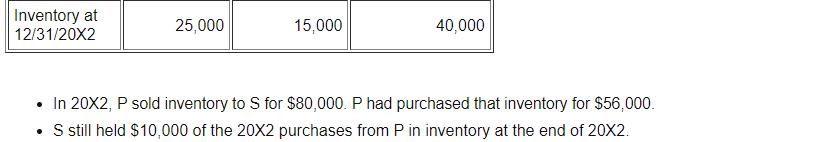

P owns 100% of S. The following chart shows some line items from the separate financial statements of the companies for 20X2. P's net income below does NOT include any equity in income of S. For simplicity, assume cost of goods sold is the only expense. (credit) or debit Sales revenue Cost of goods sold Net income (170,000) 93,000 (77,000) (85,000) 52,000 (33,000) P+S (255,000) 145,000 (110,000) Inventory at 12/31/20X2 25,000 15,000 40,000 In 20X2, P sold inventory to S for $80,000. P had purchased that inventory for $56,000. S still held $10,000 of the 20X2 purchases from P in inventory at the end of 20X2. What did P report as a gross profit on the sales to S? (Provide a dollar amount, not a ratio.) How much gross profit is deferred from 20X2 to 20X3 as a result of the inventory sale on the consolidated income statement? What will be the Sales revenue on the consolidated income statement for 20X2? What will be the Cost of goods sold on the consolidated income statement for 20X2? P owns 100% of S. The following chart shows some line items from the separate financial statements of the companies for 20X2. P's net income below does NOT include any equity in income of S. For simplicity, assume cost of goods sold is the only expense. (credit) or debit Sales revenue Cost of goods sold Net income (170,000) 93,000 (77,000) (85,000) 52,000 (33,000) P+S (255,000) 145,000 (110,000) Inventory at 12/31/20X2 25,000 15,000 40,000 In 20X2, P sold inventory to S for $80,000. P had purchased that inventory for $56,000. S still held $10,000 of the 20X2 purchases from P in inventory at the end of 20X2. What did P report as a gross profit on the sales to S? (Provide a dollar amount, not a ratio.) How much gross profit is deferred from 20x2 to 20X3 as a result of the inventory sale on the consolidated income statement? What will be the Sales revenue on the consolidated income statement for 20X2? What will be the Cost of goods sold on the consolidated income statement for 20X2?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the various values we can follow these steps 1 Calculate Gross Profit for P on sales to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started