Answered step by step

Verified Expert Solution

Question

1 Approved Answer

p Please show me each step how to come up with the number. Word File Edit View Insert Format Tools Table Window Help o g

p

Please show me each step how to come up with the number.

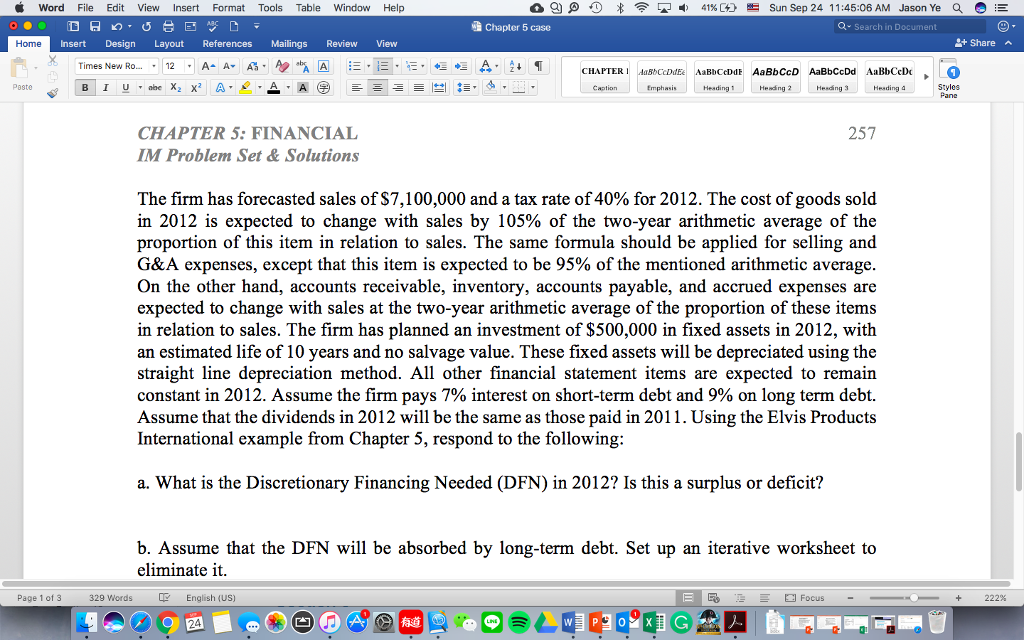

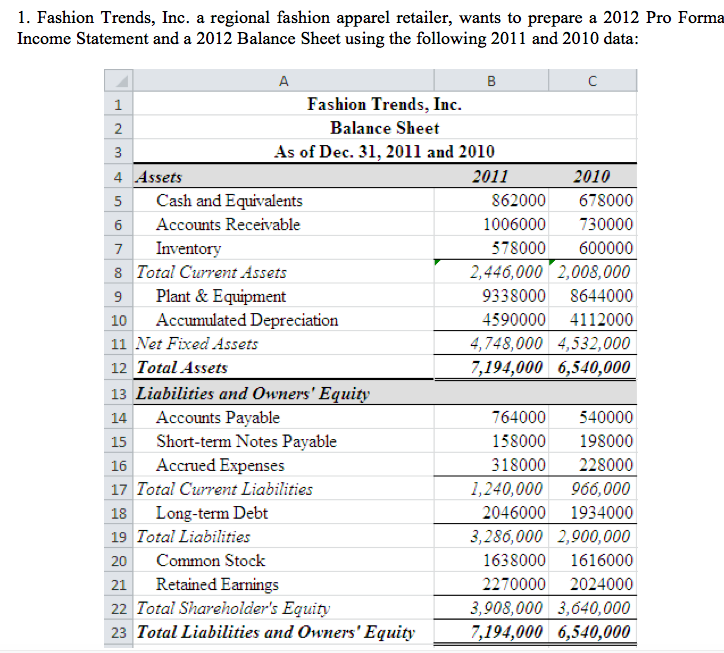

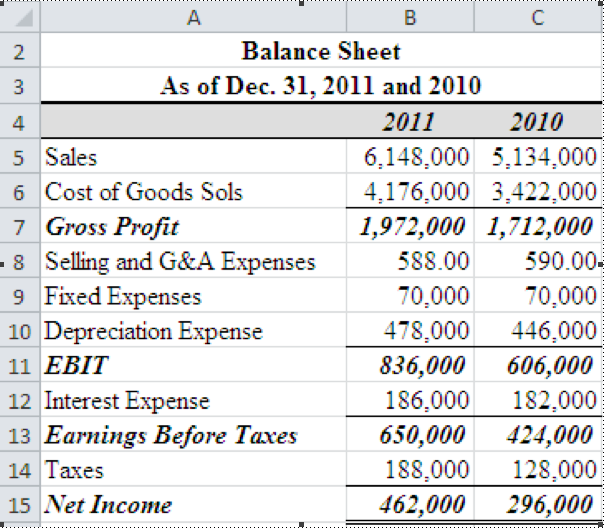

Word File Edit View Insert Format Tools Table Window Help o g 1) * 41% CD Sun Sep 24 1 1 :45:06 AM Jason Ye a E Chapter 5 case Q Search in Document Home Insert Design Layout References Mailings Review View +Share Heading 1 Hending 2Hesdng 3Heading 4 Pane 257 CHAPTER 5: FINANCIAL IM Problem Set& Solutions The firm has forecasted sales of $7,100,000 and a tax rate of 40% for 2012. The cost of goods sold in 2012 is expected to change with sales by 105% of the two-year arithmetic average of the proportion of this item in relation to sales. The same formula should be applied for selling and G&A expenses, except that this item is expected to be 95% of the mentioned arithmetic average On the other hand, accounts receivable, inventory, accounts payable, and accrued expenses are expected to change with sales at the two-year arithmetic average of the proportion of these items in relation to sales. The firm has planned an investment of S500,000 in fixed assets in 2012, with an estimated life of 10 years and no salvage value. These fixed assets will be depreciated using the straight line depreciation method. All other financial statement items are expected to remain constant in 2012. Assume the firm pays 7% interest on short-term debt and 9% on long term debt. Assume that the dividends in 2012 will be the same as those paid in 2011. Using the Elvis Products International example from Chapter 5, respond to the following a. What is the Discretionary Financing Needed (DFN) in 2012? Is this a surplus or deficit? b. Assume that the DFN will be absorbed by long-term debt. Set up an iterative worksheet to eliminate it Page 1 of3 329 Words English (US) Focus- ..-+ 222%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started