Answered step by step

Verified Expert Solution

Question

1 Approved Answer

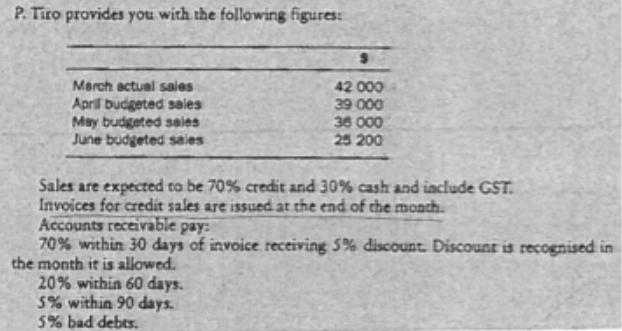

P. Tiro provides you with the following figures: March actual sales April budgeted sales May budgeted sales June budgeted saies 42.000 39 000 36

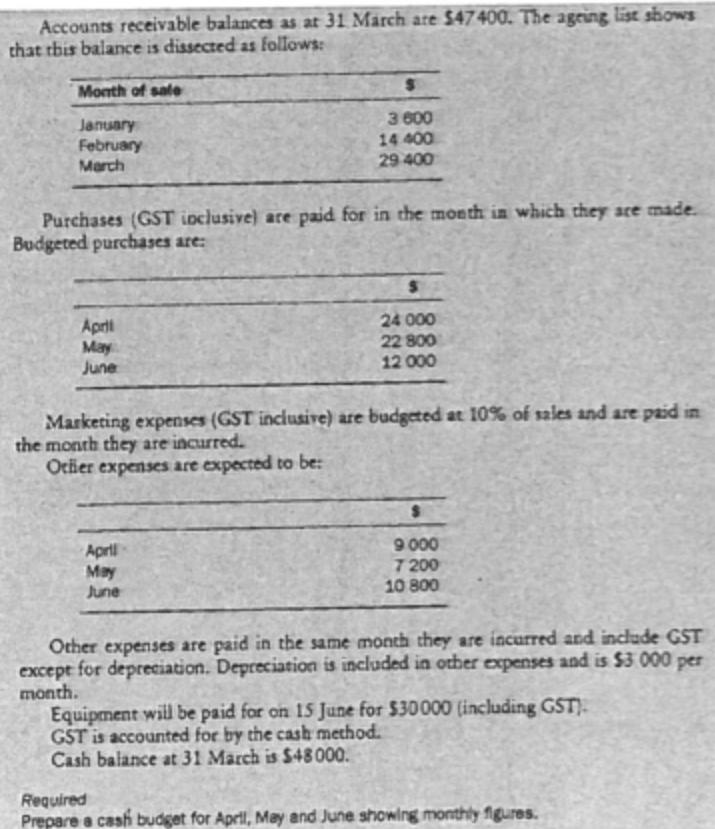

P. Tiro provides you with the following figures: March actual sales April budgeted sales May budgeted sales June budgeted saies 42.000 39 000 36 000 25 200 Sales are expected to be 70% credit and 30% cash and iaclude GST. Invoices for credit sales are issued at the end of the monch. Accounts receivable pay: 70% within 30 days of invoice receiving 5% discount. Discount is recognised in the month it is allowed. 20% within 60 days. 5% within 90 days. 5% bad debts. Accounts receivable balances as at 31 March are $47400. The ageing list shows that this balance is dissected as follows: Month of sale 3 600 14 400 29 400 January February March Purchases (GST ipclusive) are paid for in the month in which they ace made. Budgeted purchases are: 24 000 April May June 22 800 12 000 Marketing expenses (GST inclusive) are budgeted at 10% of sales and are paid in the month they are incurred. Ocier expenses are expected to be: April May June 9 000 7 200 10 800 Other expenses are paid in the same month they are incurred and include GST except for depreciation. Depreciation is included in other expenses and is $3 000 per month. Equipment will be paid for on 15 June for $30000 (including GST). GST is accounted for by the cash method. Cash balance at 31 March is S48000. Required Prepare a cash budget for April, May and June showing monthly figures.

Step by Step Solution

★★★★★

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

March April May June Bad Debts Discounts Sales 42000 39000 36000 25200 Cash sales30 126...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started