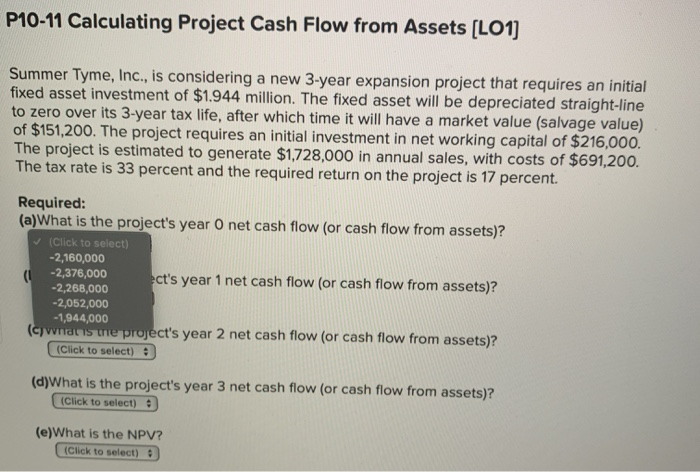

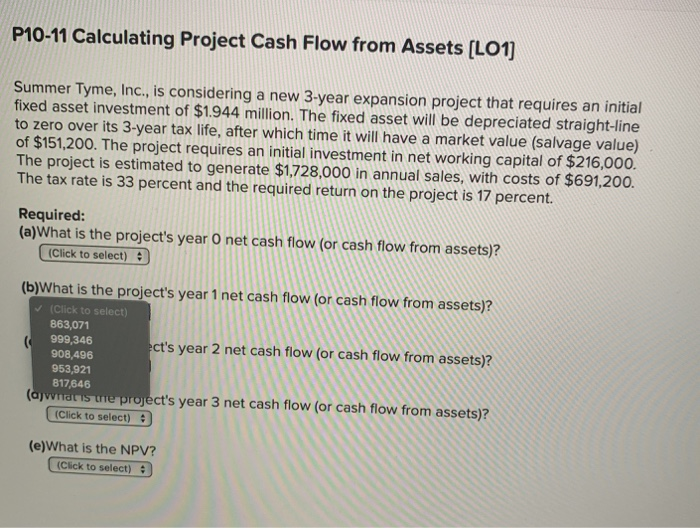

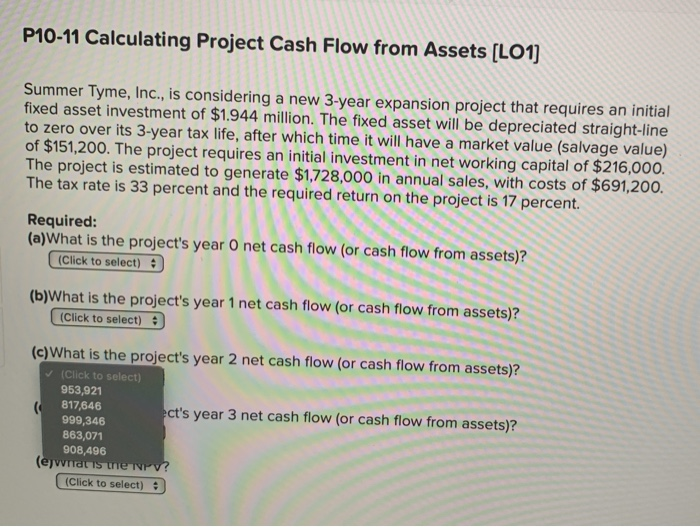

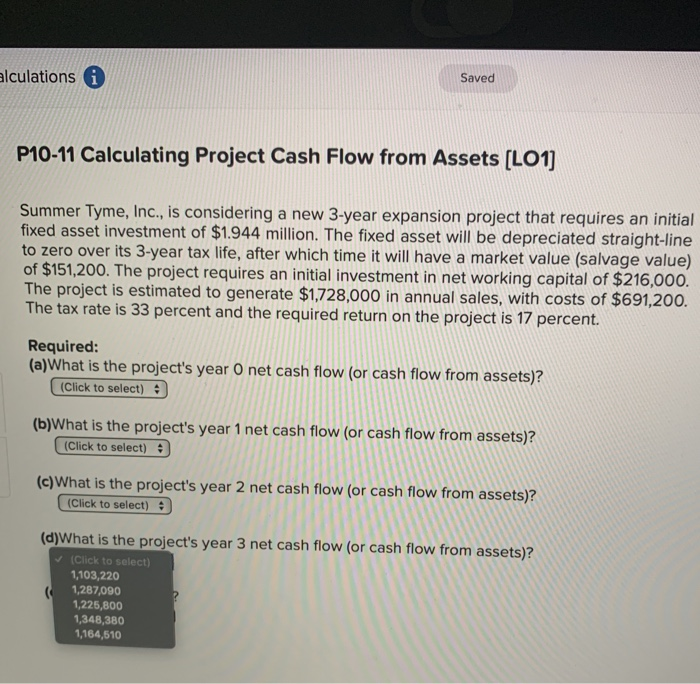

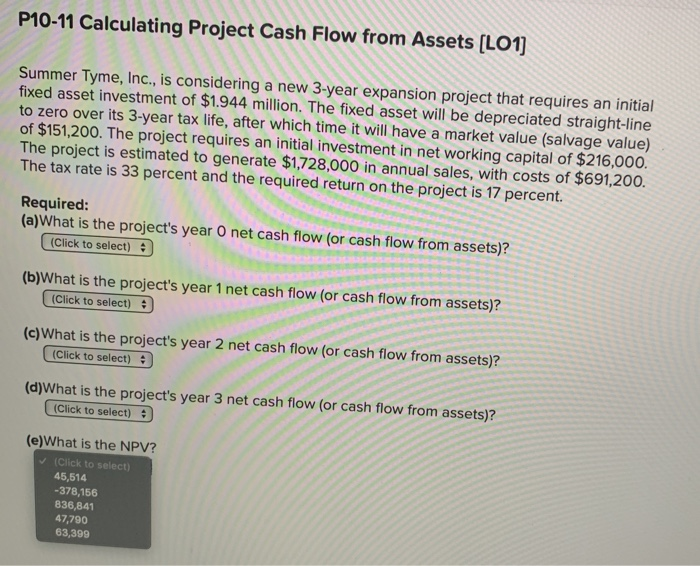

P10-11 Calculating Project Cash Flow from Assets (L01) Summer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $1.944 million. The fixed asset will be depreciated straight-line to zero over its 3-year tax life, after which time it will have a market value (salvage value) of $151,200. The project requires an initial investment in net working capital of $216,000. The project is estimated to generate $1,728,000 in annual sales, with costs of $691,200. The tax rate is 33 percent and the required return on the project is 17 percent. Required: (a)What is the project's year 0 net cash flow (or cash flow from assets)? (Click to select) -2,160,000 ( -2,376,000 ect's year 1 net cash flow (or cash flow from assets)? -2,268,000 -2,052,000 -1,944,000 (Cynan is the project's year 2 net cash flow (or cash flow from assets)? (Click to select) (d)What is the project's year 3 net cash flow (or cash flow from assets)? (Click to select) (e)What is the NPV? (Click to select) P10-11 Calculating Project Cash Flow from Assets (L01) Summer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $1.944 million. The fixed asset will be depreciated straight-line to zero over its 3-year tax life, after which time it will have a market value (salvage value) of $151,200. The project requires an initial investment in net working capital of $216,000. The project is estimated to generate $1,728,000 in annual sales, with costs of $691,200. The tax rate is 33 percent and the required return on the project is 17 percent. Required: (a)What is the project's year O net cash flow (or cash flow from assets)? (Click to select) (b)What is the project's year 1 net cash flow (or cash flow from assets)? (Click to select) 863,071 999,346 ct's year 2 net cash flow (or cash flow from assets)? 908,496 953,921 817,646 (ajatiste project's year 3 net cash flow cash flow from assets)? (Click to select) (e)What is the NPV? (Click to select) P10-11 Calculating Project Cash Flow from Assets [LO1) D Summer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $1.944 million. The fixed asset will be depreciated straight-line to zero over its 3-year tax life, after which time it will have a market value (salvage value) of $151,200. The project requires an initial investment in net working capital of $216,000. The project is estimated to generate $1,728,000 in annual sales, with costs of $691,200. The tax rate is 33 percent and the required return on the project is 17 percent. Required: (a)What is the project's year 0 net cash flow (or cash flow from assets)? (Click to select) 9 (b)What is the project's year 1 net cash flow (or cash flow from assets)? (Click to select) ) (c)What is the project's year 2 net cash flow (or cash flow from assets)? (Click to select) 953,921 817,646 ct's year 3 net cash flow (or cash flow from assets)? 999,346 863,071 908,496 (ejat is merv? (Click to select) 2 alculations Saved P10-11 Calculating Project Cash Flow from Assets [LO1] Summer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $1.944 million. The fixed asset will be depreciated straight-line to zero over its 3-year tax life, after which time it will have a market value (salvage value) of $151,200. The project requires an initial investment in net working capital of $216,000. The project is estimated to generate $1,728,000 in annual sales, with costs of $691,200. The tax rate is 33 percent and the required return on the project is 17 percent. Required: (a)What is the project's year 0 net cash flow (or cash flow from assets)? (Click to select) (b)What is the project's year 1 net cash flow (or cash flow from assets)? (Click to select) :) (c)What is the project's year 2 net cash flow (or cash flow from assets)? (Click to select) (d) What is the project's year 3 net cash flow (or cash flow from assets)? Click to select) 1,103,220 1,287,090 1,225,800 1,348,380 1,164,510 P10-11 Calculating Project Cash Flow from Assets (L01) Summer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $1.944 million. The fixed asset will be depreciated straight-line to zero over its 3-year tax life, after which time it will have a market value (salvage value) of $151,200. The project requires an initial investment in net working capital of $216,000. The project is estimated to generate $1,728,000 in annual sales, with costs of $691,200. The tax rate is 33 percent and the required return on the project is 17 percent. Required: (a)What is the project's year 0 net cash flow (or cash flow from assets)? (Click to select) (b)What is the project's year 1 net cash flow (or cash flow from assets)? (Click to select) (c) What is the project's year 2 net cash flow (or cash flow from assets)? (Click to select) (d)What is the project's year 3 net cash flow (or cash flow from assets)? (Click to select) = (e)What is the NPV? (Click to select) 45,514 -378,156 B36,841 47,790 63,399