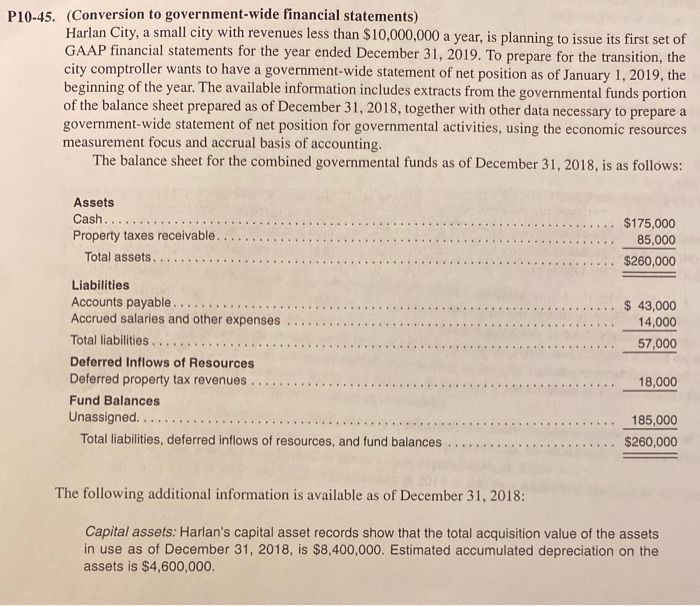

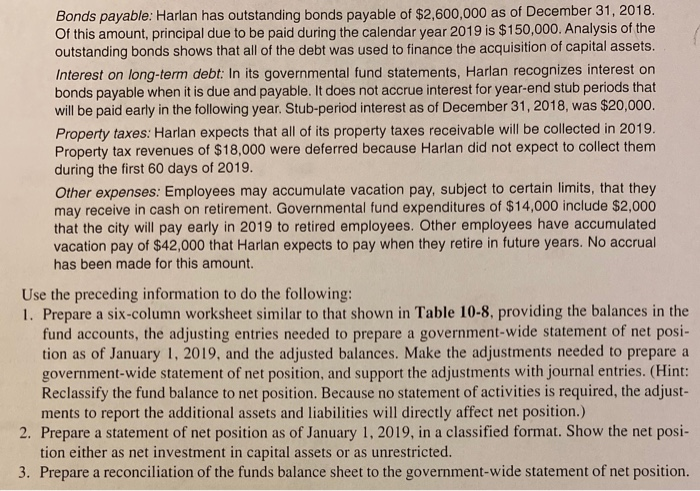

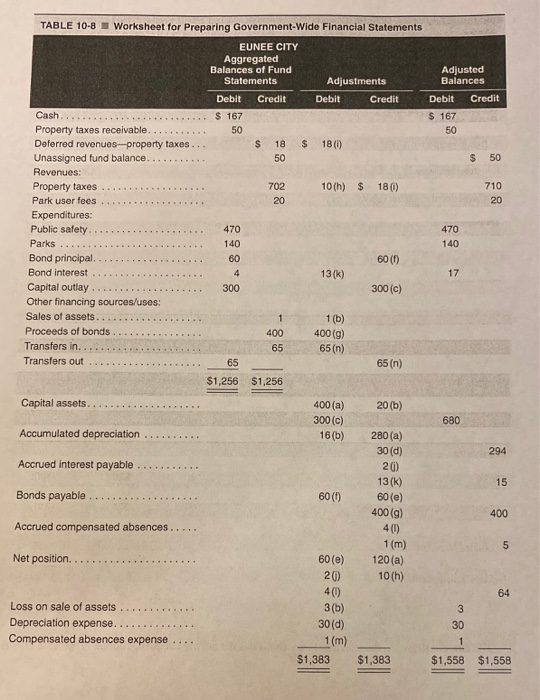

P10-45. (Conversion to government-wide financial statements) Harlan City, a small city with revenues less than $10,000,000 a year, is planning to issue its first set of GAAP financial statements for the year ended December 31, 2019. To prepare for the transition, the city comptroller wants to have a government-wide statement of net position as of January 1, 2019, the beginning of the year. The available information includes extracts from the governmental funds portion of the balance sheet prepared as of December 31, 2018, together with other data necessary to prepare a government-wide statement of net position for governmental activities, using the economic resources measurement focus and accrual basis of accounting. The balance sheet for the combined governmental funds as of December 31, 2018, is as follows: Assets Cash......... Property taxes receivable....... Total assets........... $175,000 85,000 $260,000 $ 43,000 14,000 57,000 Liabilities Accounts payable........ Accrued salaries and other expenses .. Total liabilities... Deferred Inflows of Resources Deferred property tax revenues Fund Balances Unassigned. ... Total liabilities, deferred inflows of resources, and fund balances .. 18,000 185,000 $260,000 The following additional information is available as of December 31, 2018: Capital assets: Harlan's capital asset records show that the total acquisition value of the assets in use as of December 31, 2018, is $8,400,000. Estimated accumulated depreciation on the assets is $4,600,000 Bonds payable: Harlan has outstanding bonds payable of $2,600,000 as of December 31, 2018. Of this amount, principal due to be paid during the calendar year 2019 is $150,000. Analysis of the outstanding bonds shows that all of the debt was used to finance the acquisition of capital assets. Interest on long-term debt: In its governmental fund statements, Harlan recognizes interest on bonds payable when it is due and payable. It does not accrue interest for year-end stub periods that will be paid early in the following year. Stub-period interest as of December 31, 2018, was $20,000. Property taxes: Harlan expects that all of its property taxes receivable will be collected in 2019. Property tax revenues of $18,000 were deferred because Harlan did not expect to collect them during the first 60 days of 2019. Other expenses: Employees may accumulate vacation pay, subject to certain limits, that they may receive in cash on retirement Governmental fund expenditures of $14,000 include $2,000 that the city will pay early in 2019 to retired employees. Other employees have accumulated vacation pay of $42,000 that Harlan expects to pay when they retire in future years. No accrual has been made for this amount Use the preceding information to do the following: 1. Prepare a six-column worksheet similar to that shown in Table 10-8. providing the balances in the fund accounts, the adjusting entries needed to prepare a government-wide statement of net posi- tion as of January 1, 2019, and the adjusted balances. Make the adjustments needed to prepare a government-wide statement of net position, and support the adjustments with journal entries. (Hint: Reclassify the fund balance to net position. Because no statement of activities is required, the adjust- ments to report the additional assets and liabilities will directly affect net position.) 2. Prepare a statement of net position as of January 1, 2019, in a classified format. Show the net posi- tion either as net investment in capital assets or as unrestricted. 3. Prepare a reconciliation of the funds balance sheet to the government-wide statement of net position. 50 TABLE 10-8 Worksheet for Preparing Government-Wide Financial Statements EUNEE CITY Aggregated Balances of Fund Adjusted Statements Adjustments Balances Debit Credit Debit Credit Debit Credit Cash... $ 167 $ 167 Property taxes receivable...... 50 50 Deferred revenues-property taxes... $ 18 $ 180 Unassigned fund balance $ 50 Revenues: Property taxes ....... 702 10(h) $ 180 Park user fees .... 20 Expenditures: Public safety..... Parks .... Bond principal........ 60 (0 Bond interest ........ 13(K) Capital outlay ....... .... 300 (c) Other financing sources/uses: Sales of assets....... 1(b) Proceeds of bonds ..... 400 400 (9) Transfers in....... . 65 65 (n) Transfers out ...... 65 (n) $1,256 $1,256 Capital assets... 20(b) 400(a) 300 (c) 16(b) 680 Accumulated depreciation .. 294 Accrued interest payable ... Bonds payable. 60(0) 280 (a) 30(d) 20 13(k) 60(e) 400(g) 4(0) 1 (m) 120 (a) 10(h) Accrued compensated absences... Net position. ... Loss on sale of assets ....... Depreciation expense....... Compensated absences expense .. 60(e) 20 40 3(b) 30(d) 1 (m) $1,383 30 $1,383 $1,558 $1,558