Answered step by step

Verified Expert Solution

Question

1 Approved Answer

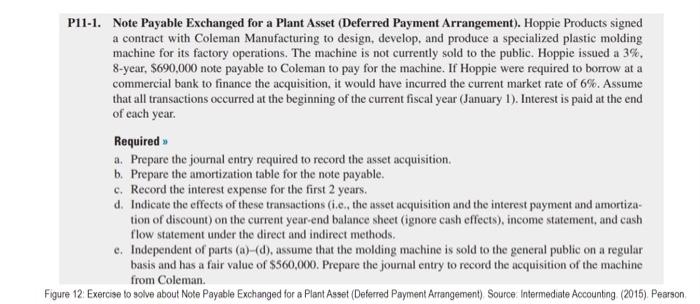

P11-1. Note Payable Exchanged for a Plant Asset (Deferred Payment Arrangement). Hoppie Products signed a contract with Coleman Manufacturing to design, develop, and produce a

P11-1. Note Payable Exchanged for a Plant Asset (Deferred Payment Arrangement). Hoppie Products signed a contract with Coleman Manufacturing to design, develop, and produce a specialized plastic molding machine for its factory operations. The machine is not currently sold to the public. Hoppie issued a 3%, 8-year, $690,000 note payable to Coleman to pay for the

machine. If Hoppie were required to borrow at a commercial bank to finance the acquisition, it would have incurred the current market rate of 6%. Assume that all transactions occurred at the beginning of the current fiscal year (January 1). Interest is paid at the end of each year.

Required

a. Prepare the journal entry required to record the asset acquisition.

b. Prepare the amortization table for the note payable.

c. Record the interest expense for the first 2 years.

d. Indicate the effects of these transactions (i.e., the asset acquisition and the interest payment and amortization of discount) on the current year-end balance sheet (ignore cash effects), income statement, and cash flow statement under the direct and indirect methods.

e. Independent of parts (a)-(d), assume that the molding machine is sold to the general public on a regular

basis and has a fair value of $560,000. Prepare the journal entry to record the acquisition of the machine from Coleman.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started