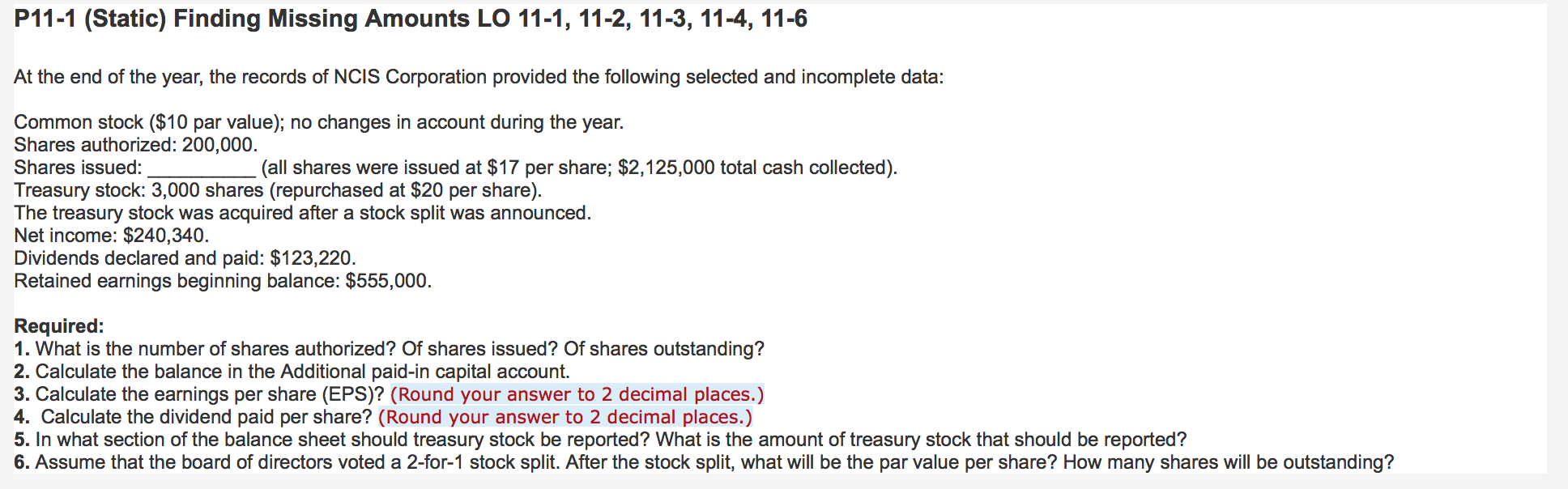

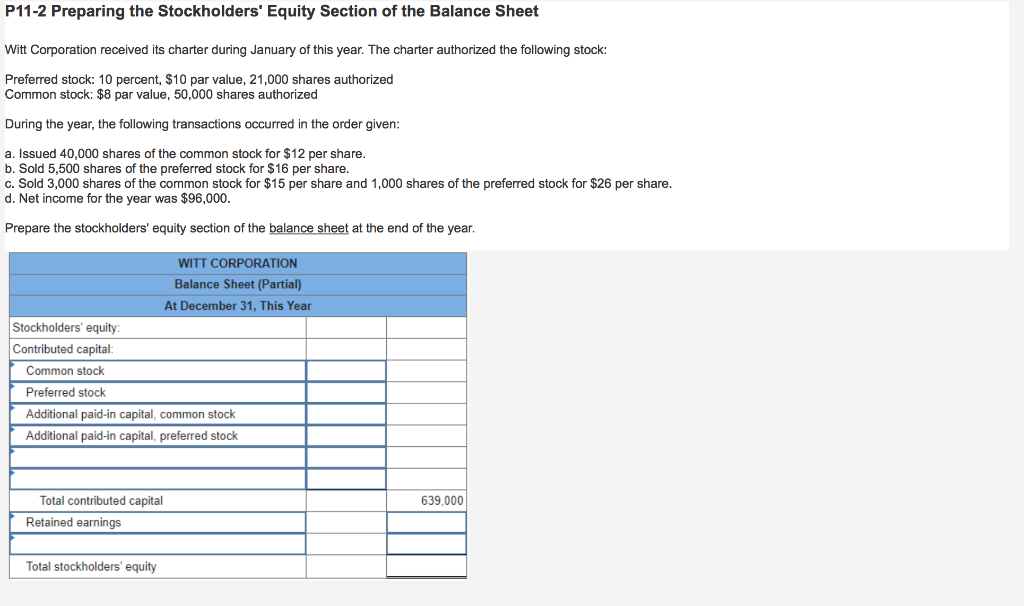

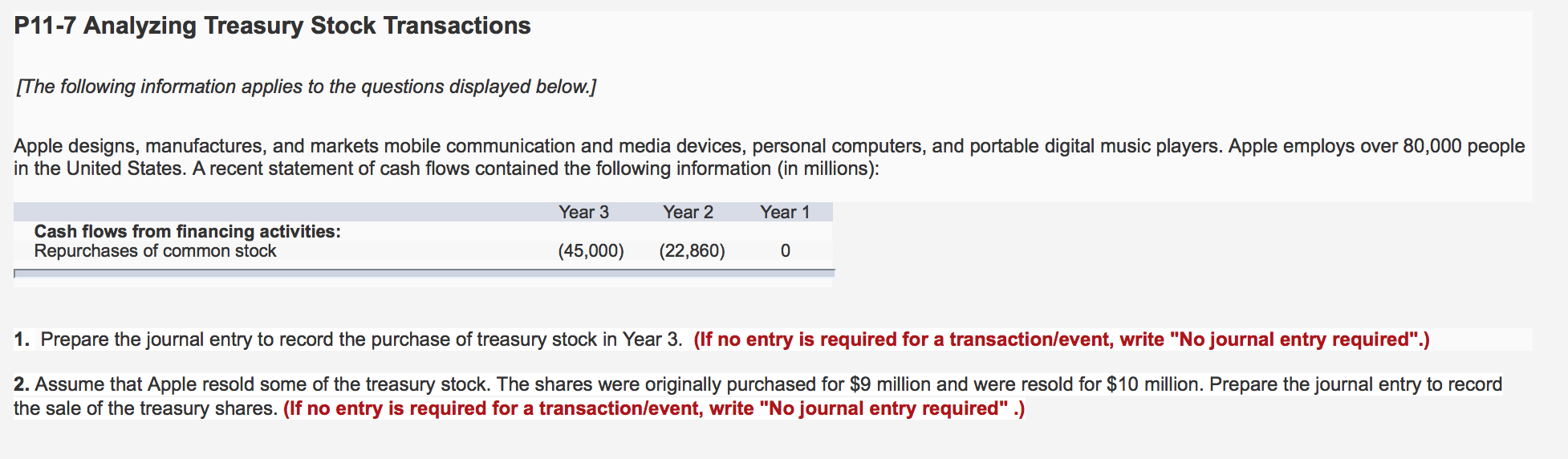

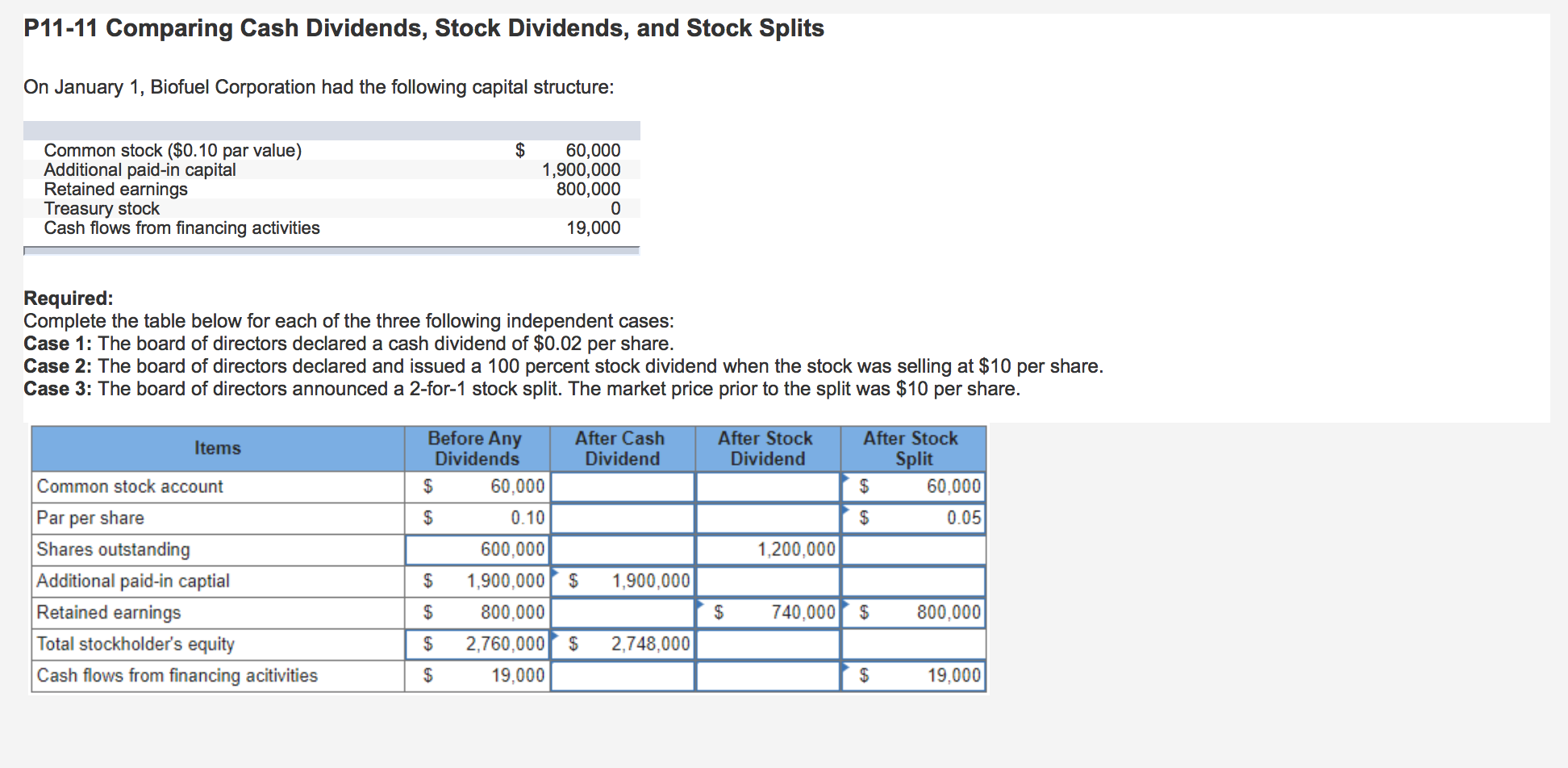

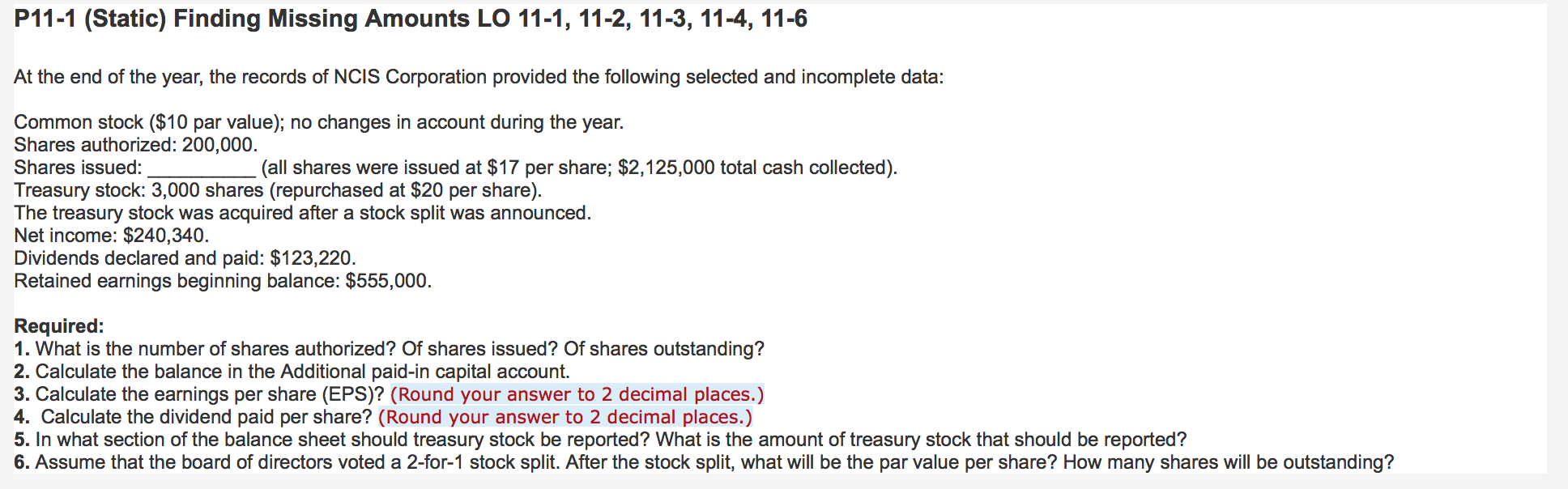

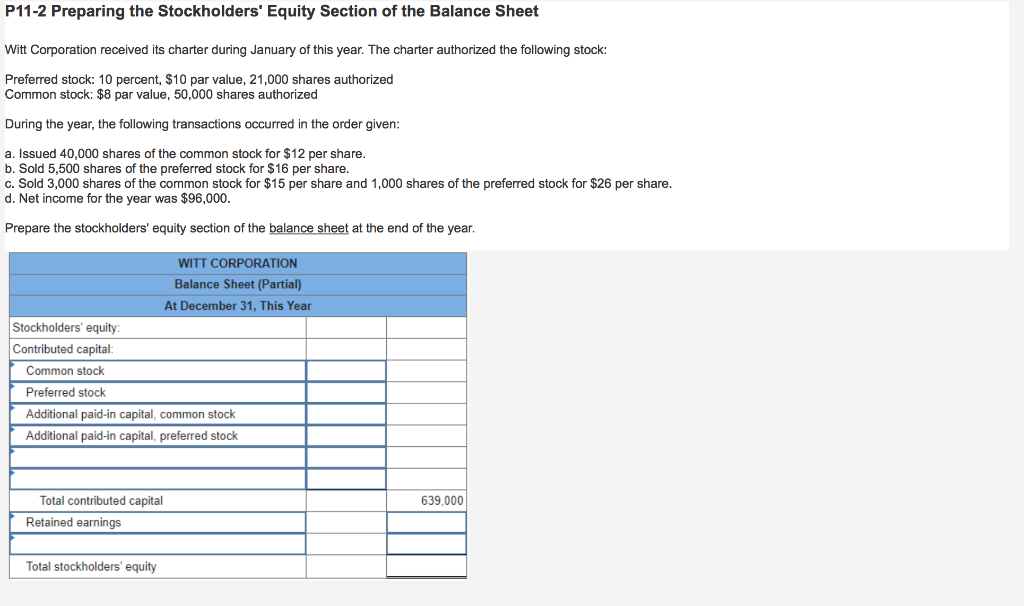

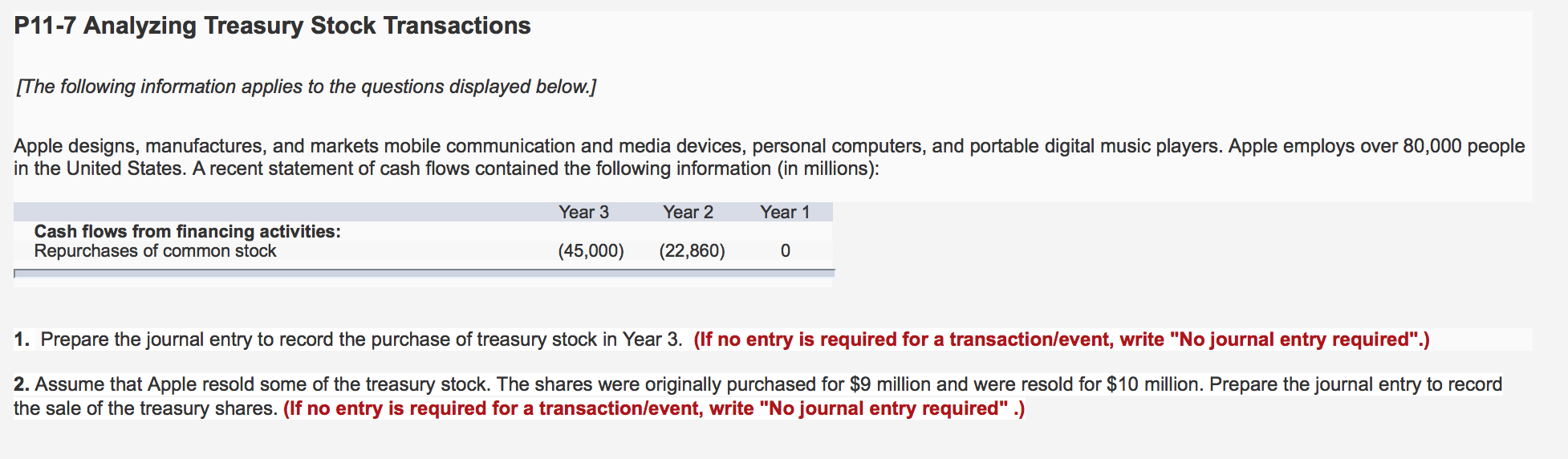

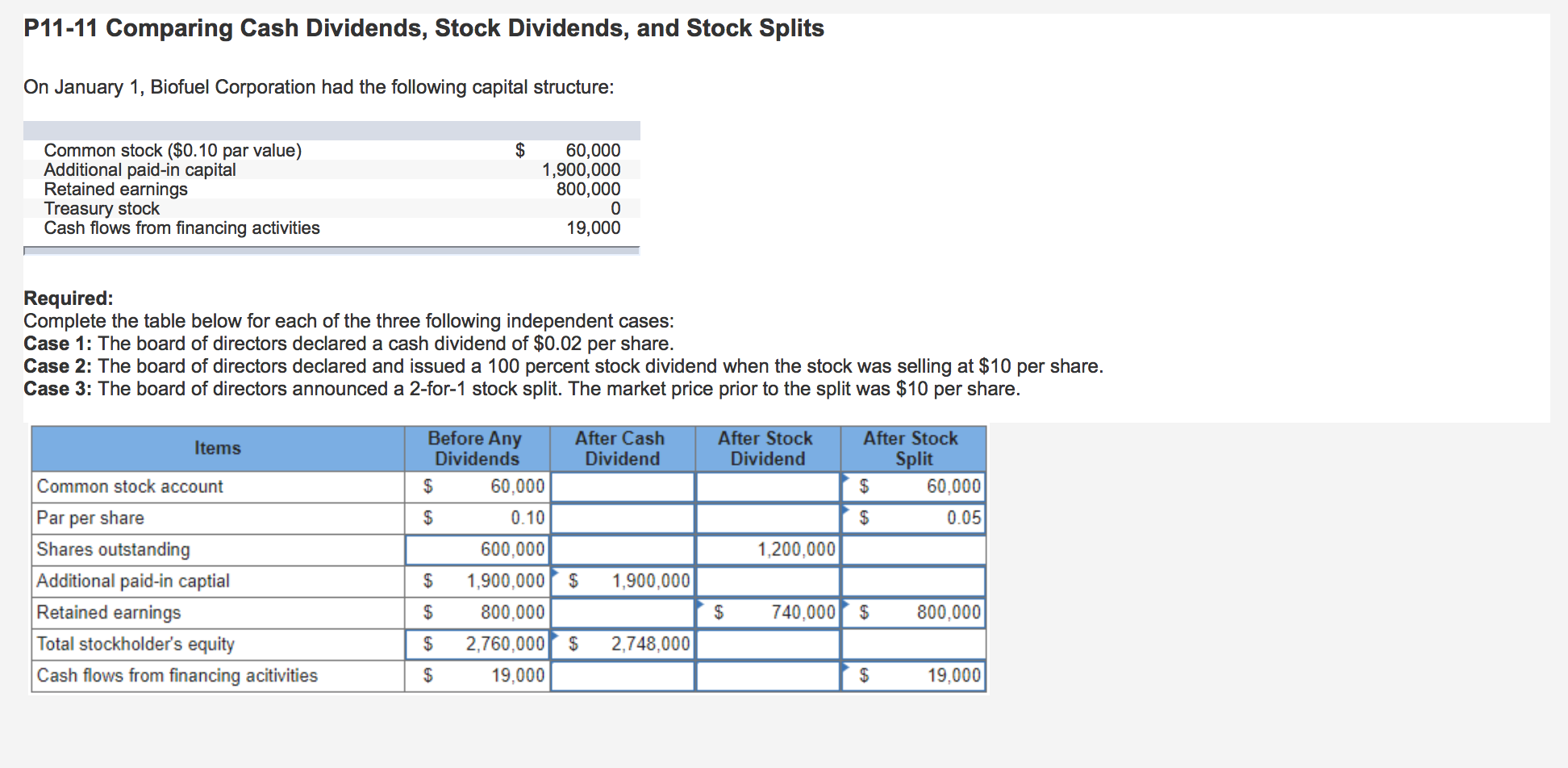

P11-1 (Static) Finding Missing Amounts LO 11-1, 11-2, 11-3, 11-4, 11-6 At the end of the year, the records of NCIS Corporation provided the following selected and incomplete data: Common stock ($10 par value); no changes in account during the year. Shares authorized: 200,000. Shares issued: (all shares were issued at $17 per share; $2,125,000 total cash collected). Treasury stock: 3,000 shares (repurchased at $20 per share). The treasury stock was acquired after a stock split was announced. Net income: $240,340. Dividends declared and paid: $123,220. Retained earnings beginning balance: $555.000. Required: 1. What is the number of shares authorized? Of shares issued? Of shares outstanding? 2. Calculate the balance in the Additional paid-in capital account. ate the earnings per share (EPS)? (Round your answer to 2 decimal places.) 4. Calculate the dividend paid per share? (Round your answer to 2 decimal places.) 5. In what section of the balance sheet should treasury stock be reported? What is the amount of treasury stock that should be reported? 6. Assume that the board of directors voted a 2-for-1 stock split. After the stock split, what will be the par value per share? How many shares will be outstanding? P11-2 Preparing the Stockholders' Equity Section of the Balance Sheet Witt Corporation received its charter during January of this year. The charter authorized the following stock: Preferred stock: 10 percent, $10 par value, 21,000 shares authorized Common stock: $8 par value, 50,000 shares authorized During the year, the following transactions occurred in the order given: a. Issued 40,000 shares of the common stock for $12 per share. b. Sold 5,500 shares of the preferred stock for $16 per share. c. Sold 3,000 shares of the common stock for $15 per share and 1,000 shares of the preferred stock for $26 per share. d. Net income for the year was $96.000. Prepare the stockholders' equity section of the balance sheet at the end of the year. WITT CORPORATION Balance Sheet (Partial) At December 31, This Year Stockholders' equity: Contributed capital: Common stock Preferred stock Additional paid-in capital, common stock Additional paid-in capital, preferred stock 639,000 Total contributed capital Retained earnings Total stockholders' equity P11-7 Analyzing Treasury Stock Transactions [The following information applies to the questions displayed below.) Apple designs, manufactures, and markets mobile communication and media devices, personal computers, and portable digital music players. Apple employs over 80,000 people in the United States. A recent statement of cash flows contained the following information (in millions): Year 3 Year 2 Year 1 Cash flows from financing activities: Repurchases of common stock (45,000) (22,860) 0 1. Prepare the journal entry to record the purchase of treasury stock in Year 3. (If no entry is required for a transaction/event, write "No journal entry required".) 2. Assume that Apple resold some of the treasury stock. The shares were originally purchased for $9 million and were resold for $10 million. Prepare the journal entry to record the sale of the treasury shares. (If no entry is required for a transaction/event, write "No journal entry required" .) P11-11 Comparing Cash Dividends, Stock Dividends, and Stock Splits On January 1, Biofuel Corporation had the following capital structure: $ Common stock ($0.10 par value) Additional paid-in capital Retained earnings Treasury stock Cash flows from financing activities 60,000 1,900,000 800,000 19,000 Required: Complete the table below for each of the three following independent cases: Case 1: The board of directors declared a cash dividend of $0.02 per share. Case 2: The board of directors declared and issued a 100 percent stock dividend when the stock was selling at $10 per share. Case 3: The board of directors announced a 2-for-1 stock split. The market price prior to the split was $10 per share. Items After Stock Dividend 60.000 After Stock Split $ 60,000 $ 0.05 Before Any After Cash Dividends Dividend 60,000 $ 0.10 600,000 $ 1,900,000 $ 1,900,000 $ 800,000 $ 2,760,000$ 2,748,000 $ 19,000 Common stock account Par per share Shares outstanding Additional paid-in captial Retained earnings Total stockholder's equity Cash flows from financing acitivities 1,200,000 $ 740,000 $ 800,000 $ 19,000