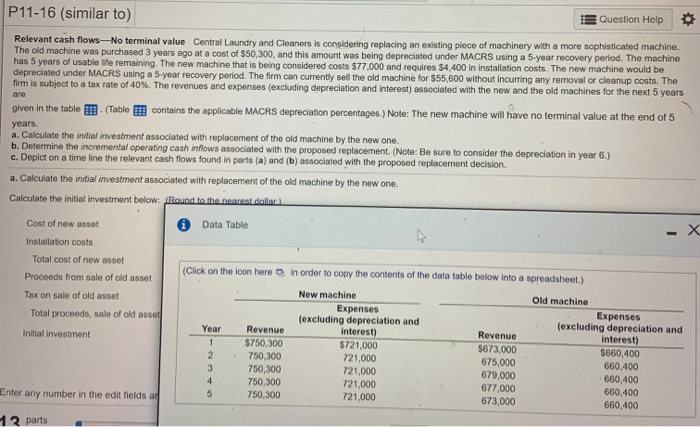

P11-16 (similar to) Question Help Relevant cash flows-No terminal value Central Laundry and Cleaners is considering replacing an existing place of machinery with a more sophisticated machine The old machine was purchased 3 years ago at a cost of $50,300, and this amount was being depreciated under MACRS using a 5-year recovery period. The machine has 5 years of usable life remaining. The new machine that is being considered costs $77,000 and requires $4.400 in installation costs. The new machine would be depreciated under MACRS using a 5-year recovery period. The firm can currently sell the old machine for $55,600 without incurring any removal or cleanup costs. The firm is subject to a tax rate of 40%. The revenues and expenses (excluding depreciation and interest) associated with the new and the old machines for the next 5 years are Diven in the table (Table contains the applicable MACRS depreciation percentages) Note: The new machine will have no terminal value at the end of 5 years. a. Calculate the initial investment associated with replacement of the old machine by the new one. b. Determine the incremental operating cash inflows associated with the proposed replacement. (Note: Be sure to consider the depreciation in year 6.) c. Depict on a timeline the relevant cash flows found in parts (a) and (b) associated with the proposed replacement decision a. Calculate the initial investment associated with replacement of the old machine by the new one. Calculate the initial investment below: Round to the cat dollar Data Table Cost of new asset Installation costs Total cost of new asset Proceeds from sale of old asset Tax on sale of old asset Total proceeds, sale of old asset (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year Initial investment New machine Expenses (excluding depreciation and Interest) $721,000 721,000 721,000 721,000 721,000 Revenue $750,300 750,300 750,300 750,300 750,300 2 Old machine Expenses (excluding depreciation and interest) 5660,400 660.400 660,400 660,400 660,400 Revenue $673,000 675,000 679,000 677.000 673,000 Enter any number in the edit fields ad A parts