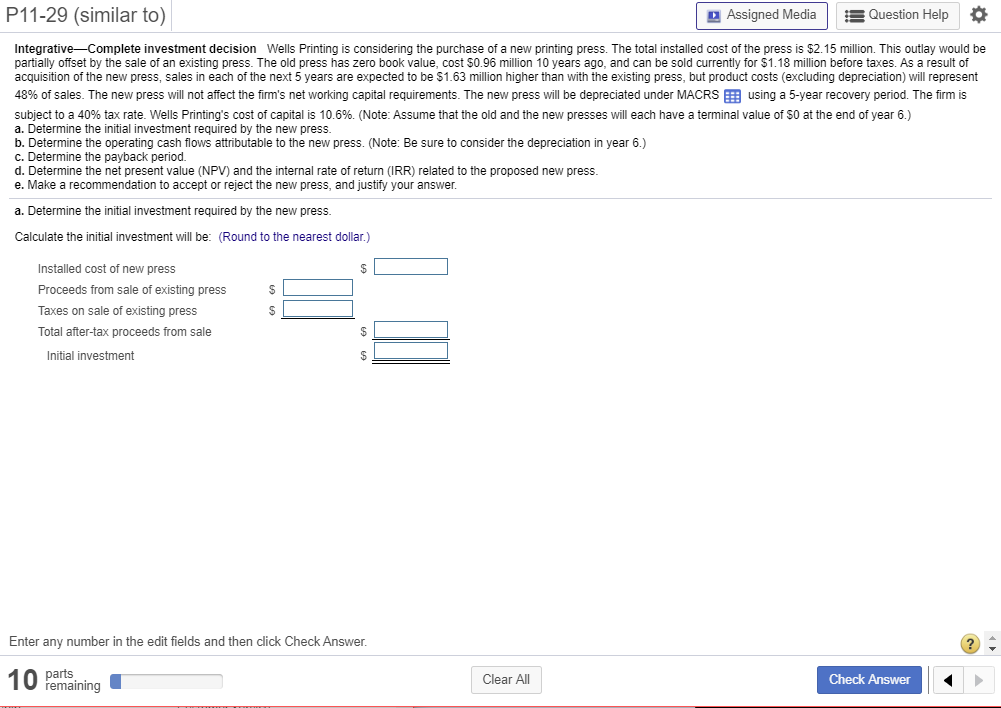

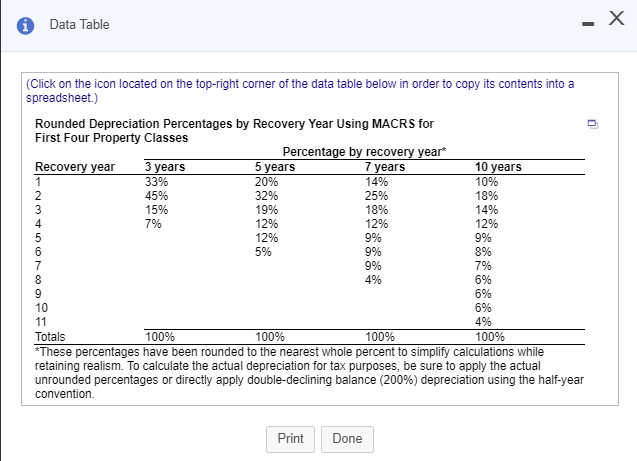

P11-29 (similar to) Assigned Medias Question Help Integrative Complete investment decision Wells Printing is considering the purchase of a new printing press. The total installed cost of the press is $2.15 million. This outlay would be partially offset by the sale of an existing press. The old press has zero book value, cost $0.96 million 10 years ago, and can be sold currently for $1.18 million before taxes. As a result of acquisition of the new press, sales in each of the next 5 years are expected to be $1.63 million higher than with the existing press, but product costs (excluding depreciation) will represent 48% of sales. The new press will not affect the firm's net working capital requirements. The new press will be depreciated under MACRS E using a 5-year recovery period. The firm is subject to a 40% tax rate. Wells Printing's cost of capital is 10.6%. (Note: Assume that the old and the new presses will each have a terminal value of $0 at the end of year 6.) a. Determine the initial investment required by the new press b. Determine the operating cash flows attributable to the new press. (Note: Be sure to consider the depreciation in year 6.) c. Determine the payback period. d. Determine the net present value (NPV) and the internal rate of return (IRR) related to the proposed new press. e. Make a recommendation to accept or reject the new press, and justify your answer. a. Determine the initial investment required by the new press. Calculate the initial investment will be: (Round to the nearest dollar.) Installed cost of new press Proceeds from sale of existing press Taxes on sale of existing press Total after-tax proceeds from sale Initial investment Enter any number in the edit fields and then click Check Answer. 10 remaining Clear All Check Answer X Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year* Recovery year 3 years 5 years 7 years 33% 20% 14% 45% 32% 25% 15% 19% 18% 12% 12% 12% 9% 10 years 10% 18% 14% 12% 7% 9% 5% 8% 7% 6% 6% 6% 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention Print Done