Answered step by step

Verified Expert Solution

Question

1 Approved Answer

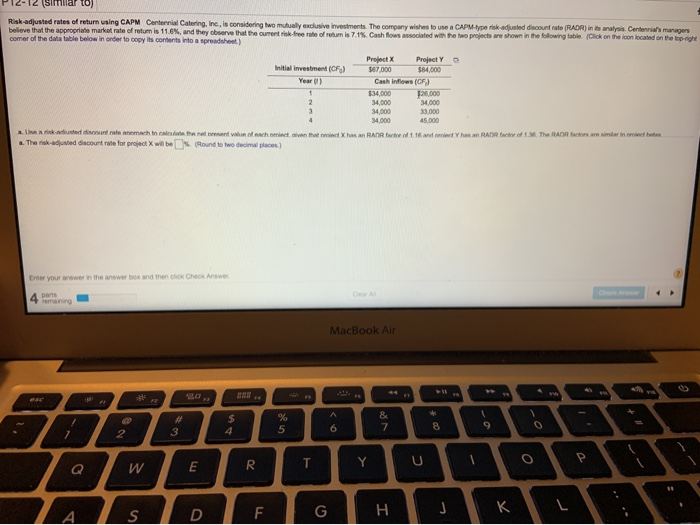

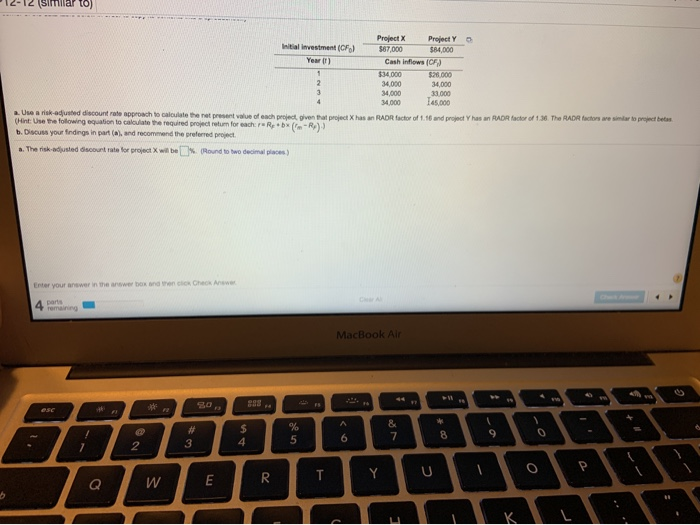

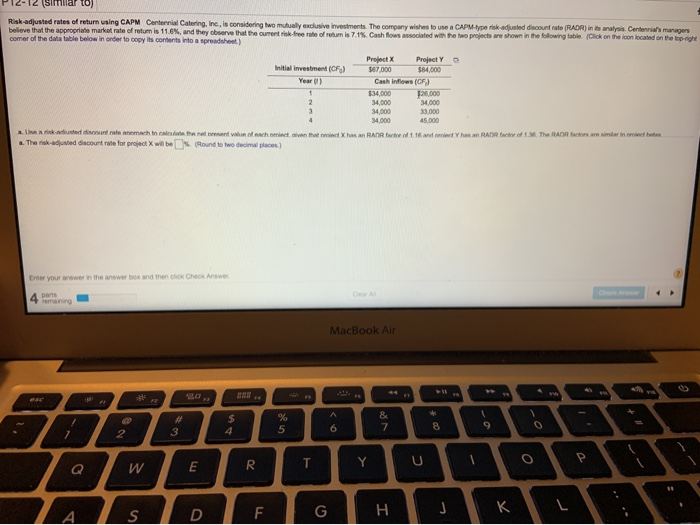

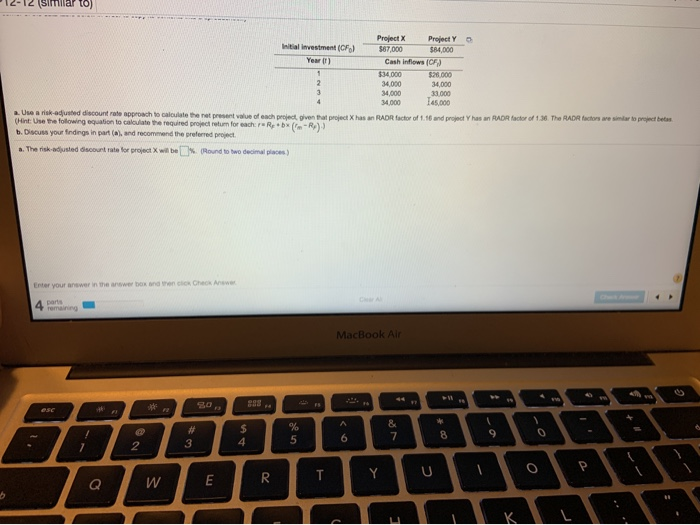

P12-12 (Siinlar to) Risk-adjusted rates of return using CAPM Centennial Catering, Inc., is considering two mutually exclusive investments. The company wishes to use a CAPM-typerok

P12-12 (Siinlar to) Risk-adjusted rates of return using CAPM Centennial Catering, Inc., is considering two mutually exclusive investments. The company wishes to use a CAPM-typerok adjusted discount rate (RADR) in s analysis. Certe 's managers believe that the appropriate market rate of retum is 11.6%, and they observe that the current role of robum is 7.1% Cash Bows associated with the two projects are shown in the following table Click on the iconlocated on the top righe comer of the datatable below in order to copy its contents into a spreadsheet) Project Project Y Initial Investment (CF) 7000 SB4.000 Cashindows (CF) $34.000 120000 34,000 34.000 34.000 30.000 na a. Ther discutat in discount rate for project will be RADR foto 16 a nity e het Round to two decimal places Enter your time an 4 part MacBook Air TASDFGHJK 12-12 (Similar to) Project X Project Y 5 Initial investment (CF) $67.000 $64,000 Cash inflows (CF) $34000 $28.000 34000 34.000 33 000 34.000 165.000 a.Use a risk-adjusted discount rate approach to calculate the represent value of each p art oven that proiect Xhas an ADR tartow of and protect has an ADR (Hint: Use the following equation to calculate the required project return for each R -R )) b. Discuss your findings in part(a) and recommend the preferred project The risk adjusted discount rate for project will be Round to two decimal places) of 1.36. The RADR factors are to project betes Enter your answer to 4 ore MacBook Air

P12-12 (Siinlar to) Risk-adjusted rates of return using CAPM Centennial Catering, Inc., is considering two mutually exclusive investments. The company wishes to use a CAPM-typerok adjusted discount rate (RADR) in s analysis. Certe 's managers believe that the appropriate market rate of retum is 11.6%, and they observe that the current role of robum is 7.1% Cash Bows associated with the two projects are shown in the following table Click on the iconlocated on the top righe comer of the datatable below in order to copy its contents into a spreadsheet) Project Project Y Initial Investment (CF) 7000 SB4.000 Cashindows (CF) $34.000 120000 34,000 34.000 34.000 30.000 na a. Ther discutat in discount rate for project will be RADR foto 16 a nity e het Round to two decimal places Enter your time an 4 part MacBook Air TASDFGHJK 12-12 (Similar to) Project X Project Y 5 Initial investment (CF) $67.000 $64,000 Cash inflows (CF) $34000 $28.000 34000 34.000 33 000 34.000 165.000 a.Use a risk-adjusted discount rate approach to calculate the represent value of each p art oven that proiect Xhas an ADR tartow of and protect has an ADR (Hint: Use the following equation to calculate the required project return for each R -R )) b. Discuss your findings in part(a) and recommend the preferred project The risk adjusted discount rate for project will be Round to two decimal places) of 1.36. The RADR factors are to project betes Enter your answer to 4 ore MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started