Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P12.4 (LO 1, 2, 3), AP Roya Company's production managers are the best in the business! They secure contracts with a number of suppliers to

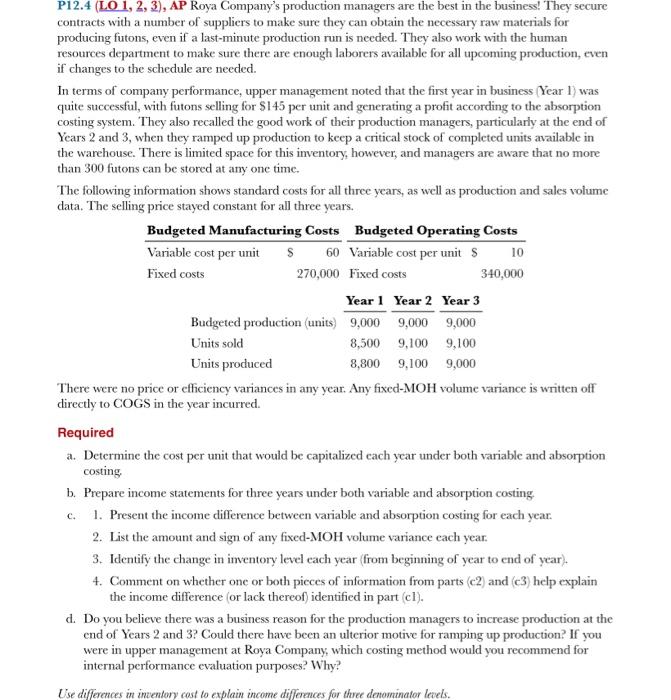

P12.4 (LO 1, 2, 3), AP Roya Company's production managers are the best in the business! They secure contracts with a number of suppliers to make sure they can obtain the necessary raw materials for producing futons, even if a last-minute production run is needed. They also work with the human resources department to make sure there are enough laborers available for all upcoming production, even if changes to the schedule are needed. In terms of company performance, upper management noted that the first year in business (Year 1) was quite successful, with futons selling for $145 per unit and generating a profit according to the absorption costing system. They also recalled the good work of their production managers, particularly at the end of Years 2 and 3, when they ramped up production to keep a critical stock of completed units available in the warehouse. There is limited space for this inventory, however, and managers are aware that no more than 300 futons can be stored at any one time. The following information shows standard costs for all three years, as well as production and sales volume data. The selling price stayed constant for all three years. Budgeted Manufacturing Costs Variable cost per unit $ 60 Fixed costs 270,000 Budgeted Operating Costs Variable cost per unit $ 10 Fixed costs Year 1 Year 2 Year 3 Budgeted production (units) 9,000 9,000 9,000 8,500 9,100 9,100 8,800 9,100 9,000 Units sold Units produced C. 340,000 There were no price or efficiency variances in any year. Any fixed-MOH volume variance is written off directly to COGS in the year incurred. Required a. Determine the cost per unit that would be capitalized each year under both variable and absorption costing. b. Prepare income statements for three years under both variable and absorption costing. 1. Present the income difference between variable and absorption costing for each year. 2. List the amount and sign of any fixed-MOH volume variance each year. 3. Identify the change in inventory level each year (from beginning of year to end of year). 4. Comment on whether one or both pieces of information from parts (c2) and (c3) help explain the income difference (or lack thereof) identified in part (cl). d. Do you believe there was a business reason for the production managers to increase production at the end of Years 2 and 3? Could there have been an ulterior motive for ramping up production? If you were in upper management at Roya Company, which costing method would you recommend for internal performance evaluation purposes? Why? Use differences in inventory cost to explain income differences for three denominator levels.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started