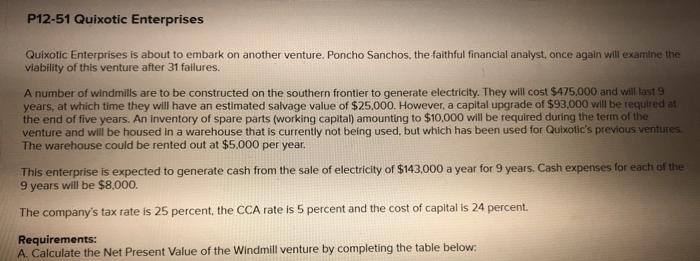

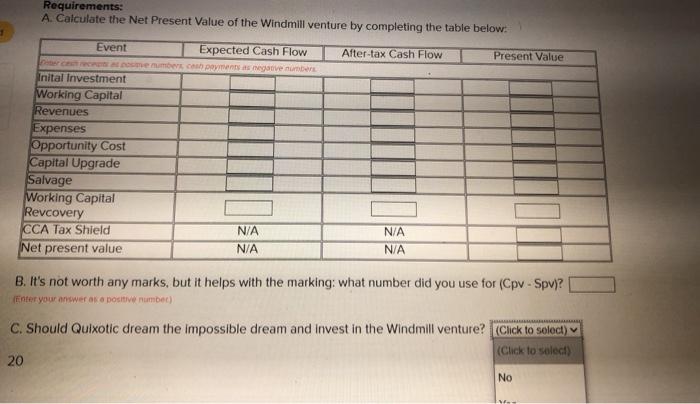

P12-51 Quixotic Enterprises Quixotic Enterprises is about to embark on another venture. Poncho Sanchos, the faithful financial analyst, once again will examine the viability of this venture after 31 failures. A number of windmills are to be constructed on the southern frontier to generate electricity. They will cost $475,000 and will last 9 years, at which time they will have an estimated salvage value of $25,000. However, a capital upgrade of $93,000 will be required at the end of five years. An inventory of spare parts (working capital amounting to $10,000 will be required during the term of the venture and will be housed in a warehouse that is currently not being used, but which has been used for Qulxotic's previous ventures The warehouse could be rented out at $5,000 per year. This enterprise is expected to generate cash from the sale of electricity of $143,000 a year for 9 years, Cash expenses for each of the 9 years will be $8,000. The company's tax rate is 25 percent, the CCA rate is 5 percent and the cost of capital is 24 percent. Requirements: A. Calculate the Net Present Value of the Windmill venture by completing the table below: Requirements: A. Calculate the Net Present Value of the Windmill venture by completing the table below: Event Expected Cash Flow After-tax Cash Flow Present Value Come mam posegovember Inital Investment Working Capital Revenues Expenses Opportunity Cost Capital Upgrade Salvage Working Capital Revcovery CCA Tax Shield N/A N/A Net present value N/A N/A B. It's not worth any marks, but it helps with the marking: what number did you use for (Cpv - Spv)? Enter your answer as a positive numbet) C. Should Quixotic dream the impossible dream and invest in the Windmill venture? (Click to select) (Click to select) 20 No P12-51 Quixotic Enterprises Quixotic Enterprises is about to embark on another venture. Poncho Sanchos, the faithful financial analyst, once again will examine the viability of this venture after 31 failures. A number of windmills are to be constructed on the southern frontier to generate electricity. They will cost $475,000 and will last 9 years, at which time they will have an estimated salvage value of $25,000. However, a capital upgrade of $93,000 will be required at the end of five years. An inventory of spare parts (working capital amounting to $10,000 will be required during the term of the venture and will be housed in a warehouse that is currently not being used, but which has been used for Qulxotic's previous ventures The warehouse could be rented out at $5,000 per year. This enterprise is expected to generate cash from the sale of electricity of $143,000 a year for 9 years, Cash expenses for each of the 9 years will be $8,000. The company's tax rate is 25 percent, the CCA rate is 5 percent and the cost of capital is 24 percent. Requirements: A. Calculate the Net Present Value of the Windmill venture by completing the table below: Requirements: A. Calculate the Net Present Value of the Windmill venture by completing the table below: Event Expected Cash Flow After-tax Cash Flow Present Value Come mam posegovember Inital Investment Working Capital Revenues Expenses Opportunity Cost Capital Upgrade Salvage Working Capital Revcovery CCA Tax Shield N/A N/A Net present value N/A N/A B. It's not worth any marks, but it helps with the marking: what number did you use for (Cpv - Spv)? Enter your answer as a positive numbet) C. Should Quixotic dream the impossible dream and invest in the Windmill venture? (Click to select) (Click to select) 20 No