Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P12.8 Pizza Restaurant provides a delivery service and is considering pur- chasing a new compact vehicle or leasing it. Purchase price would be $13,500

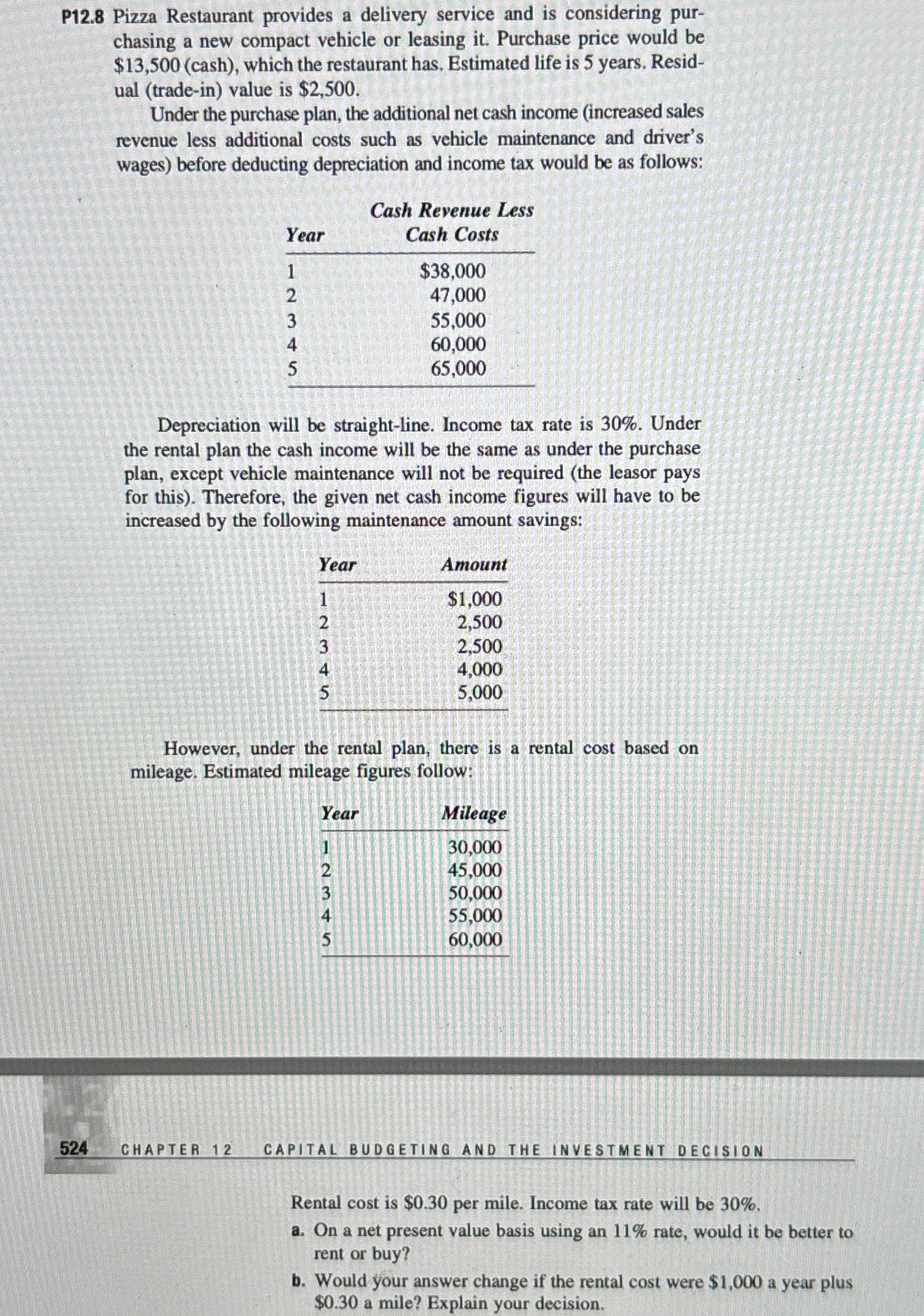

P12.8 Pizza Restaurant provides a delivery service and is considering pur- chasing a new compact vehicle or leasing it. Purchase price would be $13,500 (cash), which the restaurant has. Estimated life is 5 years. Resid- ual (trade-in) value is $2,500. Under the purchase plan, the additional net cash income (increased sales revenue less additional costs such as vehicle maintenance and driver's wages) before deducting depreciation and income tax would be as follows: Year Cash Revenue Less Cash Costs 12345 $38,000 47,000 55,000 60,000 65,000 Depreciation will be straight-line. Income tax rate is 30%. Under the rental plan the cash income will be the same as under the purchase plan, except vehicle maintenance will not be required (the leasor pays for this). Therefore, the given net cash income figures will have to be increased by the following maintenance amount savings: Year 12345 Amount $1,000 2,500 2,500 4,000 5,000 However, under the rental plan, there is a rental cost based on mileage. Estimated mileage figures follow: 524 CHAPTER 12 Year 12345 Mileage 30,000 45,000 50,000 55,000 60,000 CAPITAL BUDGETING AND THE INVESTMENT DECISION Rental cost is $0.30 per mile. Income tax rate will be 30%. a. On a net present value basis using an 11% rate, would it be better to rent or buy? b. Would your answer change if the rental cost were $1,000 a year plus $0.30 a mile? Explain your decision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets calculate the net present value NPV for both the purchase and lease options Purchase Optio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d65291a5d6_967459.pdf

180 KBs PDF File

663d65291a5d6_967459.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started