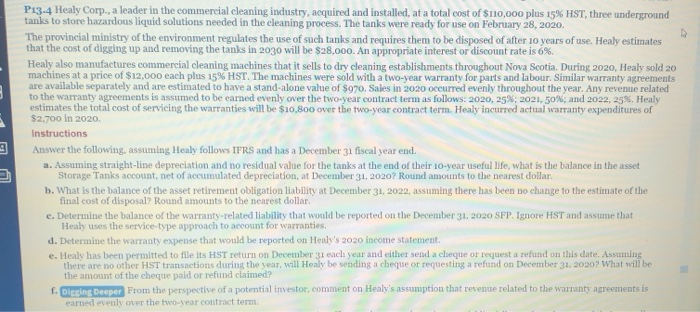

P13-4 Healy Corp., a leader in the commercial cleaning industry, acquired and installed, at a total cost of $110,000 plus 15% HST, three underground tanks to store hazardous liquid solutions needed in the cleaning process. The tanks were ready for use on February 28, 2020. The provincial ministry of the environment regulates the use of such tanks and requires them to be disposed of after 10 years of use. Healy estimates that the cost of digging up and removing the tanks in 2030 will be $28,000. An appropriate interest or discount rate is 6%. Healy also manufactures commercial cleaning machines that it sells to dry cleaning establishments throughout Nova Scotia. During 2020, Healy sold 20 machines at a price of $12,000 each plus 15% HST. The machines were sold with a two-year warranty for parts and labour. Similar warranty agreements are available separately and are estimated to have a stand-alone value of $970. Sales in 2020 occurred evenly throughout the year. Any revenue related to the warranty agreements is assumed to be earned evenly over the two-year contract term as follows: 2020, 25%; 2021, 50% and 2022, 25%. Healy estimates the total cost of servicing the warranties will be $10,800 over the two-year contract term. Healy incurred actual warranty expenditures of $2,700 in 2020. Instructions Answer the following, assuming Healy follows IFRS and has a December 31 fiscal year end. a. Assuming straight-line depreciation and no residual value for the tanks at the end of their 10-year useful life, what is the balance in the asset Storage Tanks account, net of accumulated depreciation, at December 31, 2020? Round amounts to the nearest dollar. b. What is the balance of the asset retirement obligation liability at December 31, 2022, assuming there has been no change to the estimate of the final cost of disposal? Round amounts to the nearest dollar. c. Determine the balance of the warranty-related liability that would be reported on the December 31, 2020 SFP. Ignore HST and assume that Healy uses the service-type approach to account for warranties, d. Determine the warranty expense that would be reported on Healy's 2020 income statement e. Healy has been permitted to file its HST return on December 31 each year and either send a cheque or request a refund on this date. Assuming there are no other HST transactions during the year, will Henly be sending a cheque or requesting a refund on December 31, 2020? What will be the amount of the cheque paid or refund claimed? f. Digging Deeper From the perspective of a potential investor, comment on Healy's assumption that revenue related to the warranty agreements is earned evenly over the two-year contract term P13-4 Healy Corp., a leader in the commercial cleaning industry, acquired and installed, at a total cost of $110,000 plus 15% HST, three underground tanks to store hazardous liquid solutions needed in the cleaning process. The tanks were ready for use on February 28, 2020. The provincial ministry of the environment regulates the use of such tanks and requires them to be disposed of after 10 years of use. Healy estimates that the cost of digging up and removing the tanks in 2030 will be $28,000. An appropriate interest or discount rate is 6%. Healy also manufactures commercial cleaning machines that it sells to dry cleaning establishments throughout Nova Scotia. During 2020, Healy sold 20 machines at a price of $12,000 each plus 15% HST. The machines were sold with a two-year warranty for parts and labour. Similar warranty agreements are available separately and are estimated to have a stand-alone value of $970. Sales in 2020 occurred evenly throughout the year. Any revenue related to the warranty agreements is assumed to be earned evenly over the two-year contract term as follows: 2020, 25%; 2021, 50% and 2022, 25%. Healy estimates the total cost of servicing the warranties will be $10,800 over the two-year contract term. Healy incurred actual warranty expenditures of $2,700 in 2020. Instructions Answer the following, assuming Healy follows IFRS and has a December 31 fiscal year end. a. Assuming straight-line depreciation and no residual value for the tanks at the end of their 10-year useful life, what is the balance in the asset Storage Tanks account, net of accumulated depreciation, at December 31, 2020? Round amounts to the nearest dollar. b. What is the balance of the asset retirement obligation liability at December 31, 2022, assuming there has been no change to the estimate of the final cost of disposal? Round amounts to the nearest dollar. c. Determine the balance of the warranty-related liability that would be reported on the December 31, 2020 SFP. Ignore HST and assume that Healy uses the service-type approach to account for warranties, d. Determine the warranty expense that would be reported on Healy's 2020 income statement e. Healy has been permitted to file its HST return on December 31 each year and either send a cheque or request a refund on this date. Assuming there are no other HST transactions during the year, will Henly be sending a cheque or requesting a refund on December 31, 2020? What will be the amount of the cheque paid or refund claimed? f. Digging Deeper From the perspective of a potential investor, comment on Healy's assumption that revenue related to the warranty agreements is earned evenly over the two-year contract term