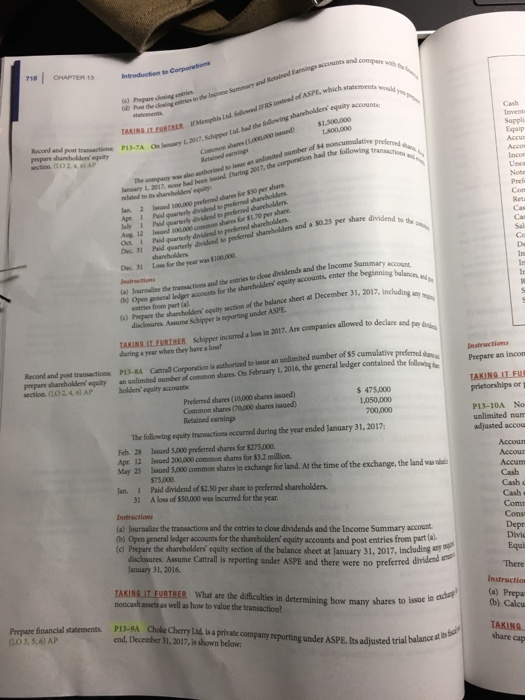

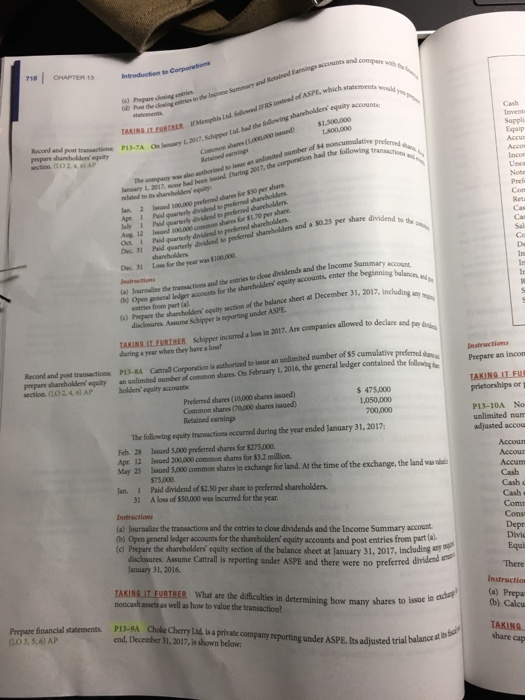

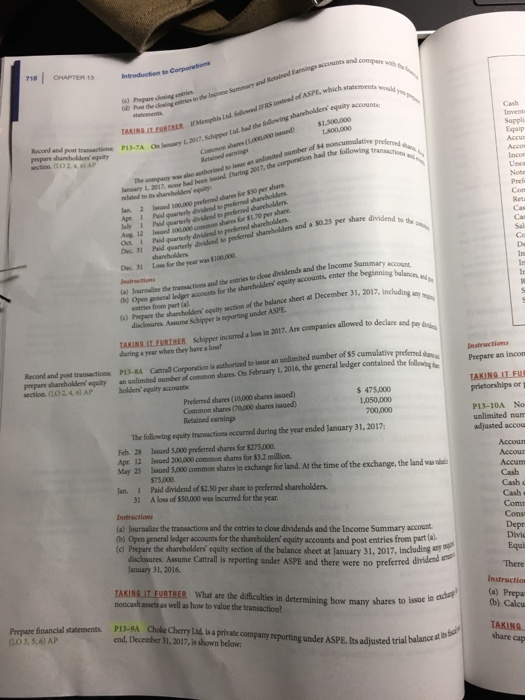

p13-9A

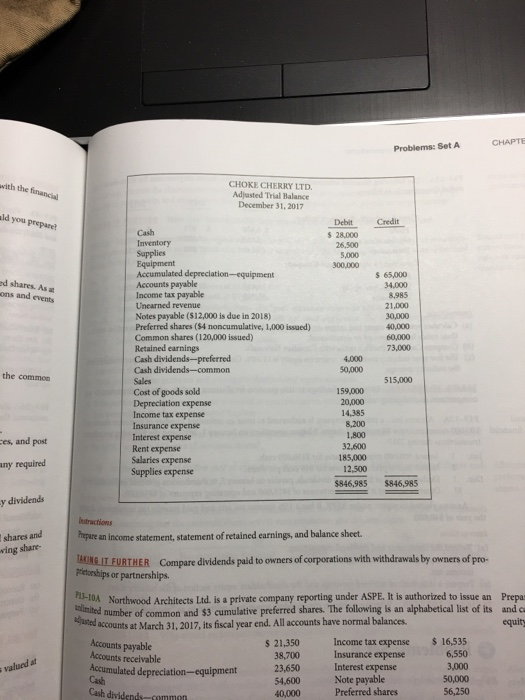

18 CHAPTER 13 E, which statementa would you ) Prepare cloning estries Cash prmpare shareholden equity section. (to 24 AP had the f was als lansary 1, 2017, none had related to its shareholders equity for 550 per Reta guarterly dvidend to prederred sharebolders and a $0.25 per share d Loss for the year was $108,000 dividend to the Aug 12 Issond Oet 1 Peid quarterly dividend to Co Dex. 31 (a) Journalise the transactions and the entries to close b) Open grocral lalger accounts fe the sharchalder' eguity (c) Prepare the shareholders' equity section o beginning bulencn accounts, enter the tramactions and the entries to dose dividends and the Income disclosures Assume Schipper is seporting under ASPE. TAKING IT EURTHER Schipper incurred a loss in 2017. Are companies allowed to declare and daring a year when they have a loss Record and post tranactions PI-&A Cetrail Corporhoared to isue an ualimined mumber of S5 cumolative ger contained Recond and post transactions PI3-SA section (LO2 4 6) AP the follewing oPrepare an incon TAKING IT FU prictorships or equity an unlimied aumber of common shares. On February 1, 2016, the general led bolders' equity accounts Preferred shares (10,000 shares isued) 475,000 1,050,000 Common shares (70,000 shares issued) Retained earnings P13-10A No unlimited num adjusted accou The following equity transactioes occurred during the year ended January 31, 2017 Feb. 28 Isued 5,000 preferred shares for $275,000. Apr. 12 Issued 200,000 common shares for $3,2 million May 25 Issued 5,000 common shates in exchange for land. At the time of the exchange, the land ws a Accum lan. 1 Paid dividend of $2.50 per share to peeferred shareholders 31 A loss of $50,000 was incurred for the year Instructions (a) lournalize the transactions and the entries to close dividends and the Income Summary account (c) Prepare the shareholders' equity section of the balance sheet at January 31, 2017, inchuding ary Cash e Cash a Com Cons Depr Divic b) Open general ledger accounts for the shareholden' equity accounts and post entries from part (a. disclosures. Assume Cattallis reporting under ASPE and there were no preferred dividd 31, 2016 There TAKING IT FURTHER What are the dificulties in determining how many shares to issue ta noncash assets as well as how to value the transaction a(a) Prepa (b) Calcu Goancial suatements. P13-9A Choke Chery Lid is a private company reporting under ASPE. Its adjusted trial balance LO 3, 5,6) AP end December 31, 2017, is shown below share cap Problems Set ACHAPT CHOKE CHERRY LTD. Adjasted Trial Balance December 31, 2017 with the you prepare Debit Credit s 28,000 26,500 5,000 Equipment Accumulated depreciation-equipment Accounts payable Income tax payable Unearned revenue Notes payable ($12,000 is due in 2018) Preferred shares ($4 noncumulative, 1,000 issaed) Common shares (120,000 issued) Retained earnings Cash dividends-preferred 65,000 ed shares. As a ons and events 8,985 21,000 0,000 40,000 4000 73,000 the common 515,000 Cost of goods sold Depreciation expense Income tax expense Insurance expense Interest expense Rent expense Salaries expense Supplies expense 159,000 20,000 14,385 8,200 1,800 32,600 185,000 12,500 es, and post ny required $846,985 $846,985 y dividends mpure an income statement, statement of retained earnings, and balance sheet. TAMIT FURTHER Compare dividends paid toowners ofcorporations with withdrawals by owners ofpro- -10A Northwood Architects Ltd. is a private company reporting under ASPE. It is authorized to issue an shares and ving sharePTE or partnerships. Prepo ditmited number of common and $3 cumulative preferred shares. The following is an alphabetical list of its and c accounts at March 31, 2017, its fiscal year end. All accounts have normal balances Accounts payable s21,350 38,700 23,650 54,600 Income tax expense16,535 Insurance expense Interest expense Note payable 6,550 3,000 Accounts receivable ccumulated depreclation-equipment Cash dividends-commn valued at Preferred shares 56,250