Answered step by step

Verified Expert Solution

Question

1 Approved Answer

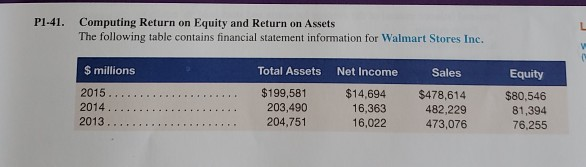

P1-41. Computing Return on Equity and Return on Assets The following table contains financial statement information for Walmart Stores Inc. V $ millions Total Assets

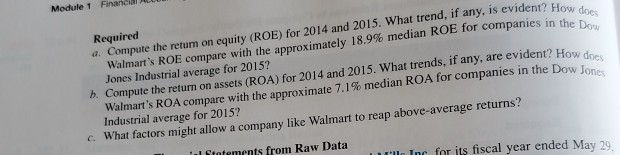

P1-41. Computing Return on Equity and Return on Assets The following table contains financial statement information for Walmart Stores Inc. V $ millions Total Assets Net Income Sales 2015 2014 2013 $199,581 203,490 204,751 $14,694 16,363 16,022 $478,614 482.229 473,076 Equity $80,546 81,394 76,255 a. Compute the return on equity (ROE) for 2014 and 2015. What trend, if any, is evident? How does Walmart's ROE compare with the approximately 18.9% median ROE for companies in the Dow Financial Module 1 Required Jones Industrial average for 2015? b. Compute the return on assets (ROA) for 2014 and 2015. What trends, if any, are evident? How does Walmart's ROA compare with the approximate 7.1% median ROA for companies in the Dow Jone Industrial average for 2015? c. What factors might allow a company like Walmart to reap above-average returns? Ial Statements from Raw Data Inc for its fiscal year ended May 29

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started