Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P14C-H2 The CEO of UML, Inc. wants to purchase a piece of special equipment for use in the company's environmental research project. The equipment

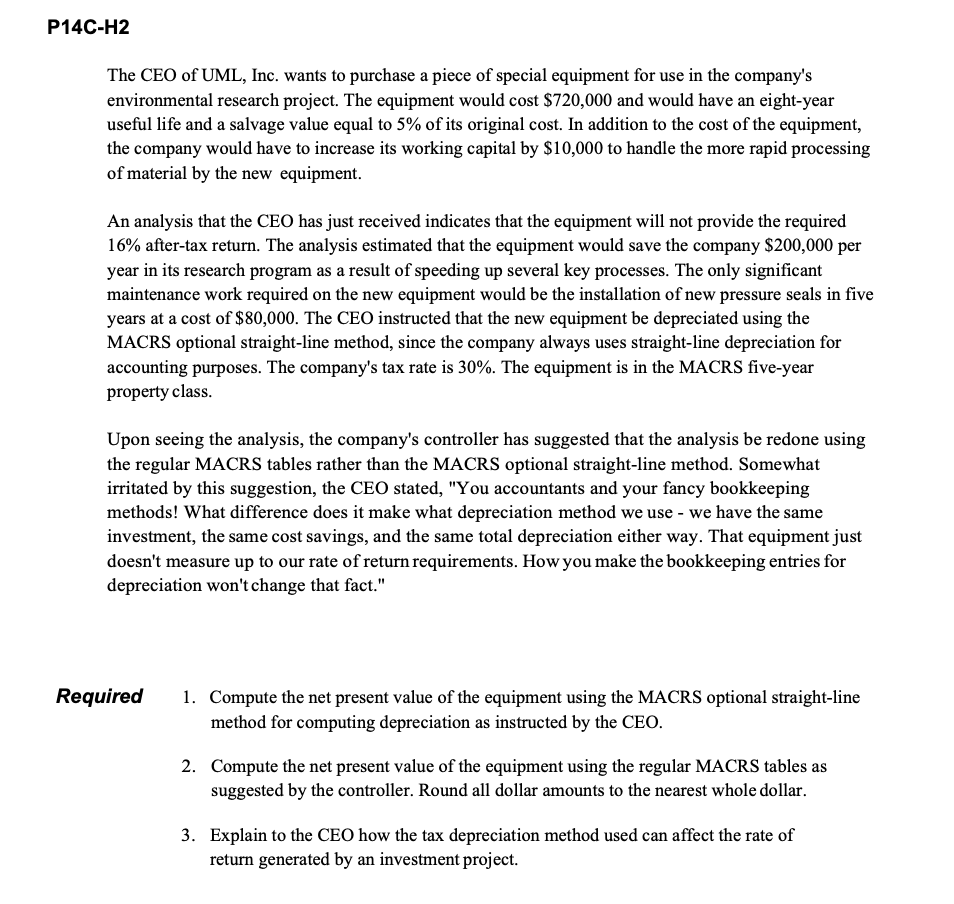

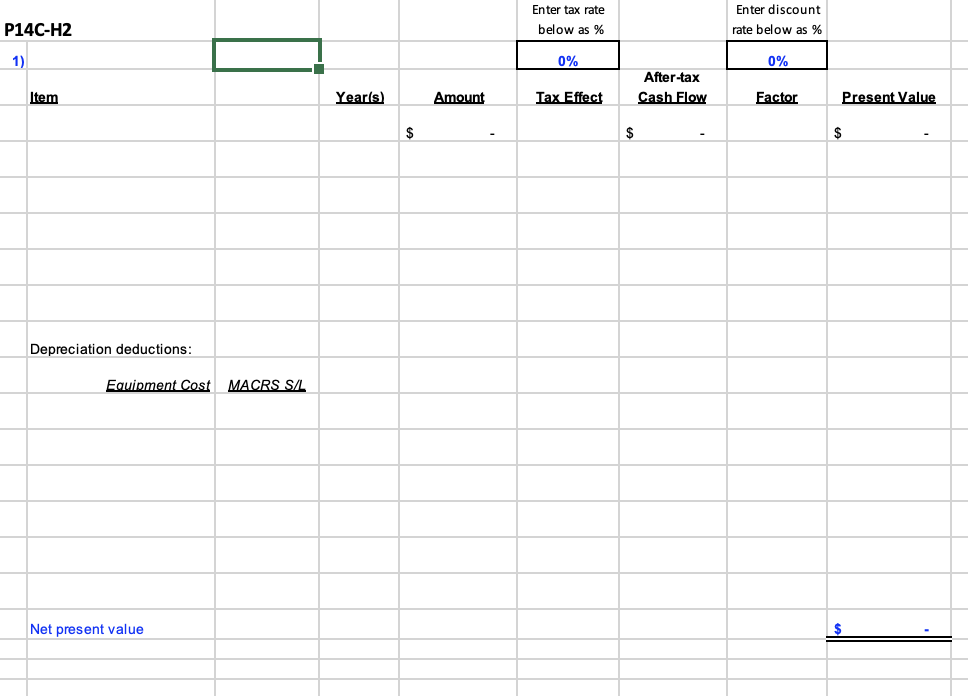

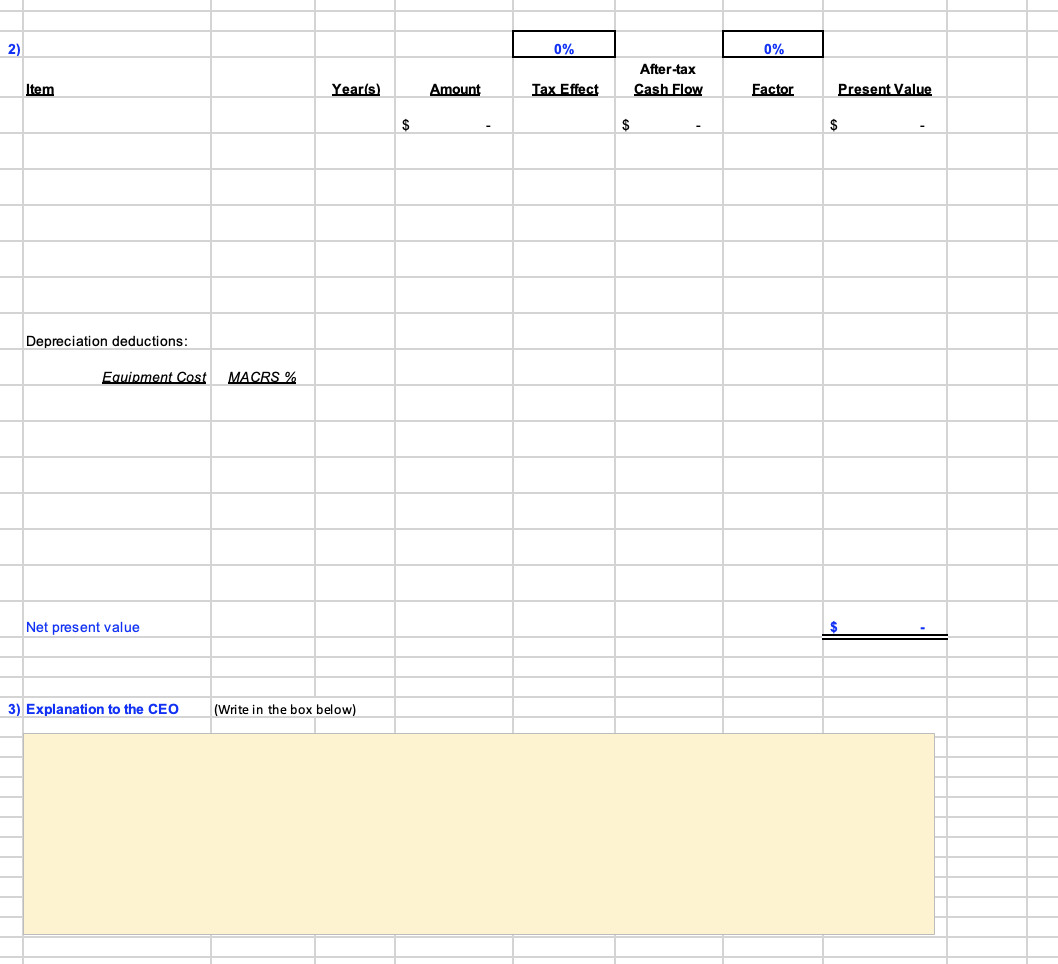

P14C-H2 The CEO of UML, Inc. wants to purchase a piece of special equipment for use in the company's environmental research project. The equipment would cost $720,000 and would have an eight-year useful life and a salvage value equal to 5% of its original cost. In addition to the cost of the equipment, the company would have to increase its working capital by $10,000 to handle the more rapid processing of material by the new equipment. An analysis that the CEO has just received indicates that the equipment will not provide the required 16% after-tax return. The analysis estimated that the equipment would save the company $200,000 per year in its research program as a result of speeding up several key processes. The only significant maintenance work required on the new equipment would be the installation of new pressure seals in five years at a cost of $80,000. The CEO instructed that the new equipment be depreciated using the MACRS optional straight-line method, since the company always uses straight-line depreciation for accounting purposes. The company's tax rate is 30%. The equipment is in the MACRS five-year property class. Upon seeing the analysis, the company's controller has suggested that the analysis be redone using the regular MACRS tables rather than the MACRS optional straight-line method. Somewhat irritated by this suggestion, the CEO stated, "You accountants and your fancy bookkeeping methods! What difference does it make what depreciation method we use - we have the same investment, the same cost savings, and the same total depreciation either way. That equipment just doesn't measure up to our rate of return requirements. How you make the bookkeeping entries for depreciation won't change that fact." Required 1. Compute the net present value of the equipment using the MACRS optional straight-line method for computing depreciation as instructed by the CEO. 2. Compute the net present value of the equipment using the regular MACRS tables as suggested by the controller. Round all dollar amounts to the nearest whole dollar. 3. Explain to the CEO how the tax depreciation method used can affect the rate of return generated by an investment project. P14C-H2 1) Enter tax rate below as % Enter discount rate below as % 0% 0% After-tax Item Year(s) Amount Tax Effect Cash Flow Factor Present Value $ $ - $ Depreciation deductions: Equipment Cost MACRS S/L Net present value 2) 0% 0% After-tax Item Year(s) Amount Tax Effect Cash Flow Factor $ $ - $ Depreciation deductions: Equipment Cost MACRS % Net present value 3) Explanation to the CEO (Write in the box below) Present Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started