Answered step by step

Verified Expert Solution

Question

1 Approved Answer

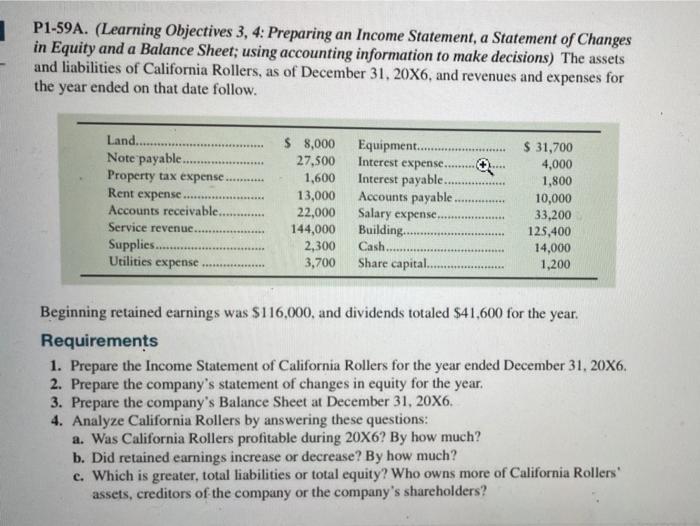

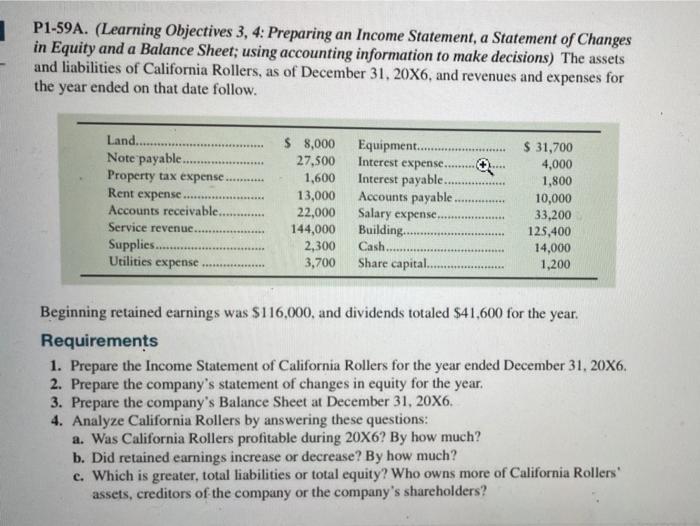

P1-59A. (Learning ovjectives 3, 4:Preparing an income statement, a statement of changes in equity and balance sheet; using accounting information to make decisions) The assets

P1-59A. (Learning ovjectives 3, 4:Preparing an income statement, a statement of changes in equity and balance sheet; using accounting information to make decisions) The assets and liabilities of California Rollers, as of December 31, 20X6, and revenues and expenses for the year ended on that date follow.

P1-59A. (Learning Objectives 3, 4: Preparing an Income Statement, a Statement of Changes in Equity and a Balance Sheet; using accounting information to make decisions) The assets and liabilities of California Rollers, as of December 31, 20X6, and revenues and expenses for the year ended on that date follow. Land. Note payable. Property tax expense Rent expense Accounts receivable, Service revenue. Supplies.. Utilities expense $ 8,000 27,500 1,600 13,000 22,000 144,000 2,300 3,700 Equipment......... Interest expense Interest payable. Accounts payable Salary expense. Building... Cash Share capital...... $ 31,700 4,000 1,800 10,000 33,200 125,400 14,000 1,200 Beginning retained earnings was $116,000, and dividends totaled $41,600 for the year. Requirements 1. Prepare the Income Statement of California Rollers for the year ended December 31, 20X6. 2. Prepare the company's statement of changes in equity for the year. 3. Prepare the company's Balance Sheet at December 31, 20X6. 4. Analyze California Rollers by answering these questions: a. Was California Rollers profitable during 20X6? By how much? b. Did retained earnings increase or decrease? By how much? e. Which is greater, total liabilities or total equity? Who owns more of California Rollers assets, creditors of the company or the company's shareholders

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started