Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P16-1B Required: Prepare the cash flows from operating activities section only of the company's 2015 statement of cash flows using the indirect method. Assignment Questions

"P16-1B Required: Prepare the cash flows from operating activities section only of the company's 2015 statement of cash flows using the indirect method."

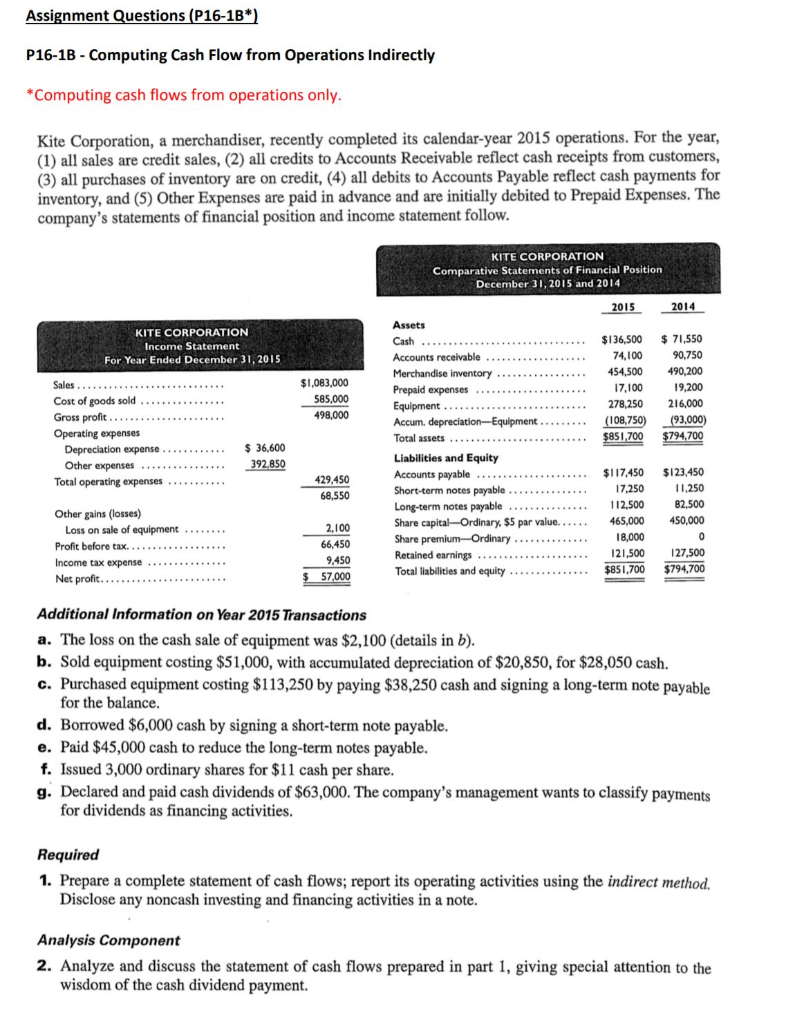

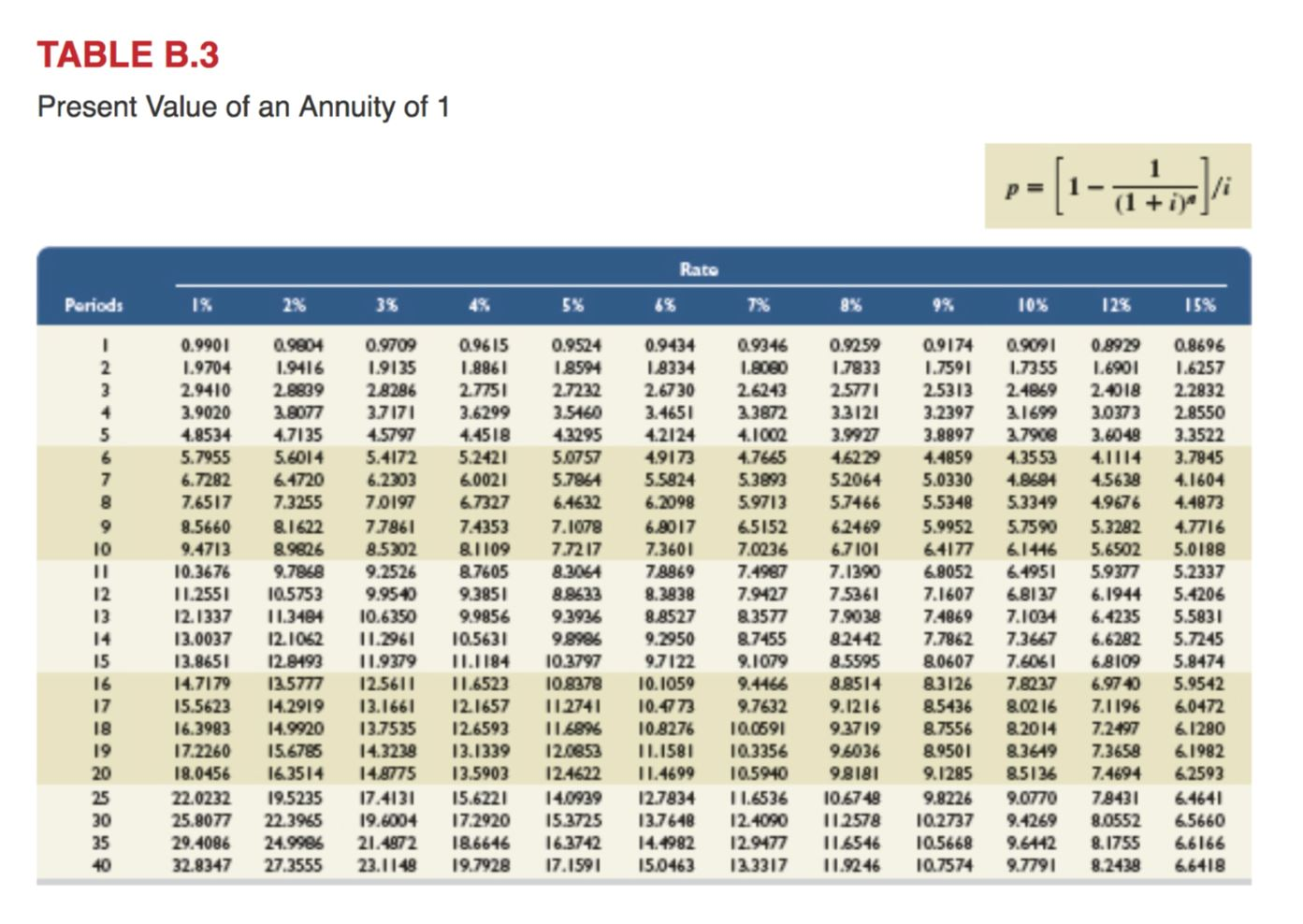

Assignment Questions (P16-1B*) P16-1B - Computing Cash Flow from Operations Indirectly *Computing cash flows from operations only. Kite Corporation, a merchandiser, recently completed its calendar-year 2015 operations. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. The company's statements of financial position and income statement follow. KITE CORPORATION Comparative Statements of Financial Position December 31, 2015 and 2014 2015 2014 KITE CORPORATION Income Statement For Year Ended December 31, 2015 $1,083,000 585,000 498,000 Sales .... Cost of goods sold ................ Gross profit ......... .... Operating expenses Depreciation expense ............ Other expenses ............... Total operating expenses ........... $136,500 74,100 454,500 17,100 278,250 (108,750) $851,700 $ 71,550 90,750 490,200 19,200 216,000 (93,000) $794,700 $ 36,600 392,850 Assets Cash Accounts receivable Merchandise inventory ........... Prepaid expenses ............ Equipment ........... Accum. depreciation Equipment ....... Total assets ...... Liabilities and Equity Accounts payable ..................... Short-term notes payable ............... Long-term notes payable ............... Share capital-Ordinary $5 par value...... Share premium-Ordinary ..... ....... Retained earnings ..................... Total liabilities and equity ............. 429,450 68,550 $117,450 17,250 112,500 465,000 18,000 121,500 $851,700 $123,450 11.250 82,500 450,000 Other gains (losses) Loss on sale of equipment ........ Profit before tax..... . Income tax expense .............. Net profit.............. 2,100 66,450 9.450 57,000 127,500 $794,700 $ Additional Information on Year 2015 Transactions a. The loss on the cash sale of equipment was $2,100 (details in b). b. Sold equipment costing $51,000, with accumulated depreciation of $20,850, for $28,050 cash. c. Purchased equipment costing $113,250 by paying $38,250 cash and signing a long-term note payable for the balance. d. Borrowed $6,000 cash by signing a short-term note payable. e. Paid $45,000 cash to reduce the long-term notes payable. f. Issued 3,000 ordinary shares for $11 cash per share. g. Declared and paid cash dividends of $63,000. The company's management wants to classify payments for dividends as financing activities. Required 1. Prepare a complete statement of cash flows; report its operating activities using the indirect method. Disclose any noncash investing and financing activities in a note. Analysis Component 2. Analyze and discuss the statement of cash flows prepared in part 1, giving special attention to the wisdom of the cash dividend payment. TABLE B.3 Present Value of an Annuity of 1 --[i-otojai Rato 6% Periods 1% 2% 3% 4% 5% 7% 8% 9% 10% 12% 15% 6.4632 0.9901 1.9704 2.9410 3.9020 4.8534 5.7955 6.7282 7.6517 8.5660 9.4713 10.3676 11.2551 12. 1337 13.0037 13.8651 14.7179 15.5623 16.3983 17.2260 18.0456 22.0232 25.8077 29.4086 32.8347 0.9804 1.9416 2.8839 2.8077 4.7135 5.6014 64720 7.3255 81622 89826 9.7868 10.5753 11.3484 12.1062 12.9493 12.5777 14.2919 14.9920 156785 16.3514 19.5235 22.3965 24.9986 27.3555 0.9709 0.9615 0.9524 1.9135 1.8861 18594 2.8286 2.7751 2.7222 3.7171 3.6299 3.5460 4.5797 4.4518 4.3295 5.41725.2421 5.0757 6.2303 6.0021 5.7961 70197 67327 7.7861 7.4353 7.1078 8.5302 81109 7.7217 9.2526 87605 8.3064 9.9540 9.3851 8.9633 10.6350 9.9856 93926 11.2961 10.5631 99986 11.9379 11.1184 10.3797 12.5611 11.6523 10.8378 13.1661 12.1657 11 2741 13.7535 12.6593 11699% 14.3239 13.1339 12.0653 148775 13.5903124622 17.4131 15.6221 14.0939 19.6004 17.2920 15.3725 21.4872 18.6646 16.3742 23.1149 19.7928 17.1591 0.9434 09346 18334 1.8060 2.67 30 2.6243 3.4651 2.3872 4.2124 4.1002 49173 4.7665 5.5824 5.3893 6.2098 59713 6.2017 6.5152 7.3601 7.0236 78869 7.4987 8.29387 9427 8.8527 8.3577 9.2950 8.7455 97122 9.1079 10.1059 9.4466 10.473 9.7632 10.8276 11.1581 10.3356 11.4699 10.5940 12.7834 11.6536 13.7648 12.4090 14.4982 12.9477 15.0463 12.3317 0.9259 1.7833 2.5771 3.3121 3.9927 46229 52064 5.7466 62469 6.7101 7.1390 7.5361 7.9038 8.2442 8.5595 8.8514 9.12.16 9.3719 9.6036 98181 10.6748 11.2578 116546 11.9246 09174 09091 0.8929 0.8696 1.75911.7355 6901 1.6257 2.5313 2.4869 2.4018 2.2832 3.2397 3.1699 3.0373 2.8550 3.8897 3.7908 3.6048 3.3522 4.48594.3553 4.1114 3.7845 5.0330 4.8694 4.5638 4.1604 5.5348 5334949676 4.4873 5.995257590 5.3282 4.7716 64177 61446 5.65025.0188 6.8052 64951 5.9377 5.2337 7.1607 6.8137 6.1944 5.4206 7.4869 7.1034 5.5831 7.7862 7.3667 6.6282 5.7245 80607 7.6061 68109 5.8474 8.3126 7.8237 6.9740 5.9542 8.5436 8.02.16 7.1196 60472 8.7556 8.2014 7.249761280 8.9501 8.3649 61982 9.1285 85136 7.4694 6.2593 9.8226 9.0770 79431 64641 10.2737 9.42698.055265660 10.5668 9.6442 8.1755 6.6166 10.7574977918.2438 66418

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started