Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P16-98 Recording entries for an installment note payable Cat Company purchased a machine with a fair value of $250,000 on January 1 with a

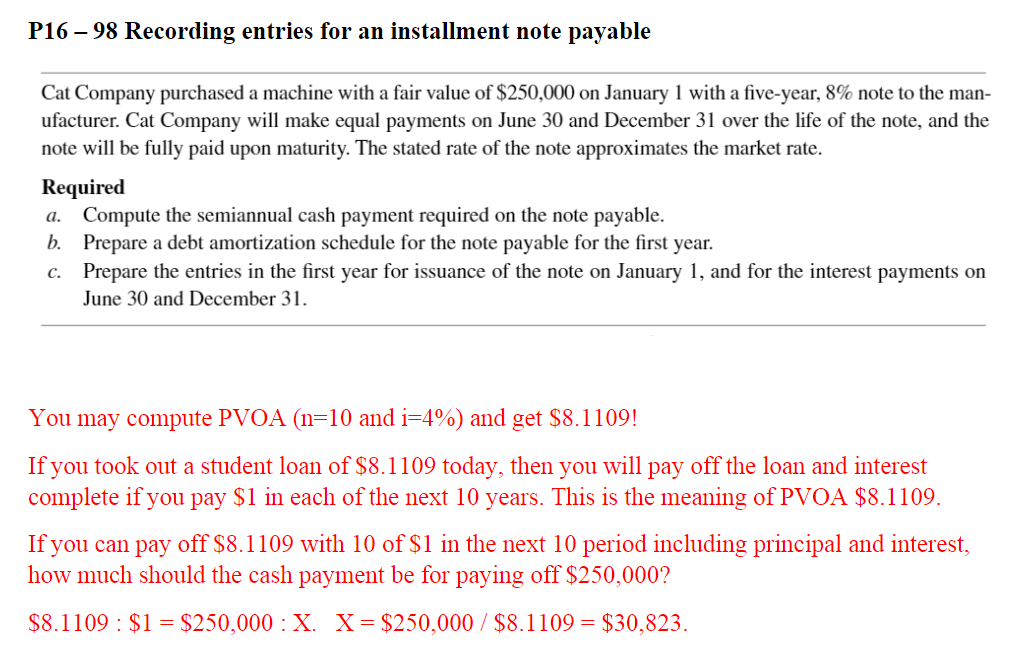

P16-98 Recording entries for an installment note payable Cat Company purchased a machine with a fair value of $250,000 on January 1 with a five-year, 8% note to the man- ufacturer. Cat Company will make equal payments on June 30 and December 31 over the life of the note, and the note will be fully paid upon maturity. The stated rate of the note approximates the market rate. Required a. Compute the semiannual cash payment required on the note payable. b. Prepare a debt amortization schedule for the note payable for the first year. C. Prepare the entries in the first year for issuance of the note on January 1, and for the interest payments on June 30 and December 31. You may compute PVOA (n=10 and i=4%) and get $8.1109! If you took out a student loan of $8.1109 today, then you will pay off the loan and interest complete if you pay $1 in each of the next 10 years. This is the meaning of PVOA $8.1109. If you can pay off $8.1109 with 10 of $1 in the next 10 period including principal and interest, how much should the cash payment be for paying off $250,000? $8.1109: $1 = $250,000: X. X= $250,000 / $8.1109 = $30,823.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image displays a homework problem P16 98 from an accounting textbook about recording entries for an installment note payable You are required to c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started