Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P18.13 Chen Corporation reported income before income tax for the year ended December 31,2023 , of $1,645,000. In preparing the 2023 financial statements, the accountant

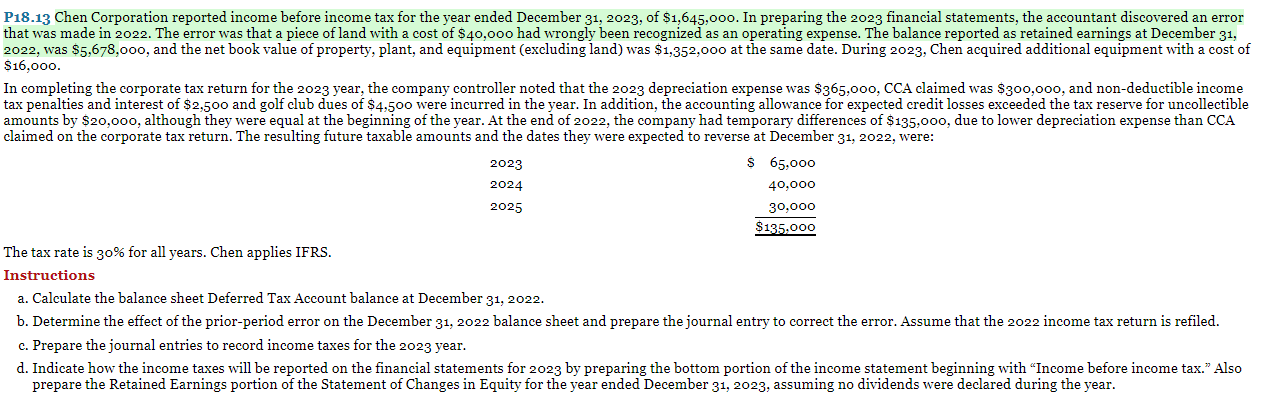

P18.13 Chen Corporation reported income before income tax for the year ended December 31,2023 , of $1,645,000. In preparing the 2023 financial statements, the accountant discovered an error that was made in 2022. The error was that a piece of land with a cost of $40,000 had wrongly been recognized as an operating expense. The balance reported as retained earnings at December 31 , 2022 , was $5,678,000, and the net book value of property, plant, and equipment (excluding land) was $1,352,000 at the same date. During 2023 , Chen acquired additional equipment with a cost of $16,000. In completing the corporate tax return for the 2023 year, the company controller noted that the 2023 depreciation expense was $365,000, CCA claimed was $300,000, and non-deductible income tax penalties and interest of $2,500 and golf club dues of $4,500 were incurred in the year. In addition, the accounting allowance for expected credit losses exceeded the tax reserve for uncollectible amounts by $20,000, although they were equal at the beginning of the year. At the end of 2022 , the company had temporary differences of $135,000, due to lower depreciation expense than CCA claimed on the corporate tax return. The resulting future taxable amounts and the dates they were expected to reverse at December 31,2022 , were: The tax rate is 30% for all years. Chen applies IFRS. Instructions a. Calculate the balance sheet Deferred Tax Account balance at December 31, 2022. b. Determine the effect of the prior-period error on the December 31, 2022 balance sheet and prepare the journal entry to correct the error. Assume that the 2022 income tax return is refiled. c. Prepare the journal entries to record income taxes for the 2023 year. d. Indicate how the income taxes will be reported on the financial statements for 2023 by preparing the bottom portion of the income statement beginning with "Income before income tax." Also prepare the Retained Earnings portion of the Statement of Changes in Equity for the year ended December 31,2023 , assuming no dividends were declared during the year

P18.13 Chen Corporation reported income before income tax for the year ended December 31,2023 , of $1,645,000. In preparing the 2023 financial statements, the accountant discovered an error that was made in 2022. The error was that a piece of land with a cost of $40,000 had wrongly been recognized as an operating expense. The balance reported as retained earnings at December 31 , 2022 , was $5,678,000, and the net book value of property, plant, and equipment (excluding land) was $1,352,000 at the same date. During 2023 , Chen acquired additional equipment with a cost of $16,000. In completing the corporate tax return for the 2023 year, the company controller noted that the 2023 depreciation expense was $365,000, CCA claimed was $300,000, and non-deductible income tax penalties and interest of $2,500 and golf club dues of $4,500 were incurred in the year. In addition, the accounting allowance for expected credit losses exceeded the tax reserve for uncollectible amounts by $20,000, although they were equal at the beginning of the year. At the end of 2022 , the company had temporary differences of $135,000, due to lower depreciation expense than CCA claimed on the corporate tax return. The resulting future taxable amounts and the dates they were expected to reverse at December 31,2022 , were: The tax rate is 30% for all years. Chen applies IFRS. Instructions a. Calculate the balance sheet Deferred Tax Account balance at December 31, 2022. b. Determine the effect of the prior-period error on the December 31, 2022 balance sheet and prepare the journal entry to correct the error. Assume that the 2022 income tax return is refiled. c. Prepare the journal entries to record income taxes for the 2023 year. d. Indicate how the income taxes will be reported on the financial statements for 2023 by preparing the bottom portion of the income statement beginning with "Income before income tax." Also prepare the Retained Earnings portion of the Statement of Changes in Equity for the year ended December 31,2023 , assuming no dividends were declared during the year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started