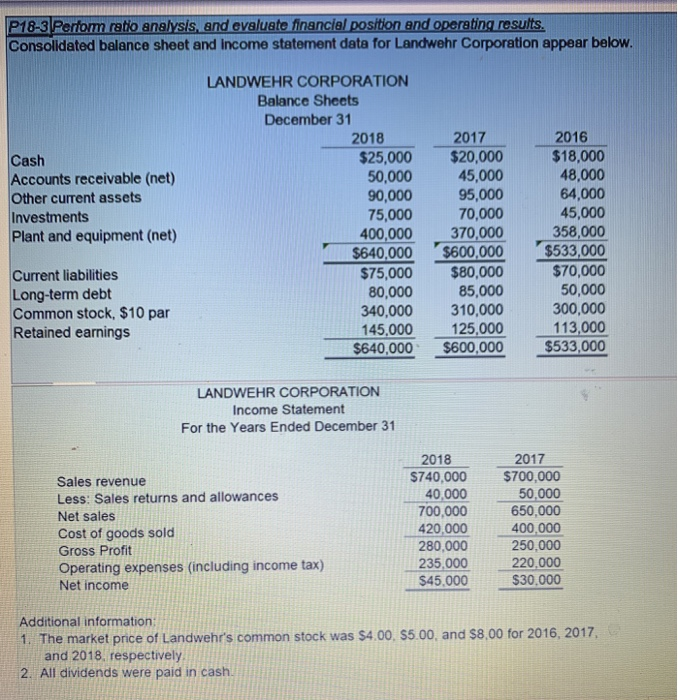

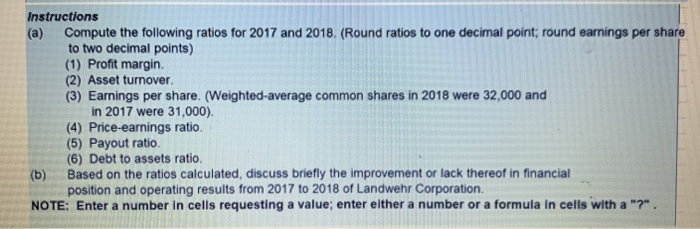

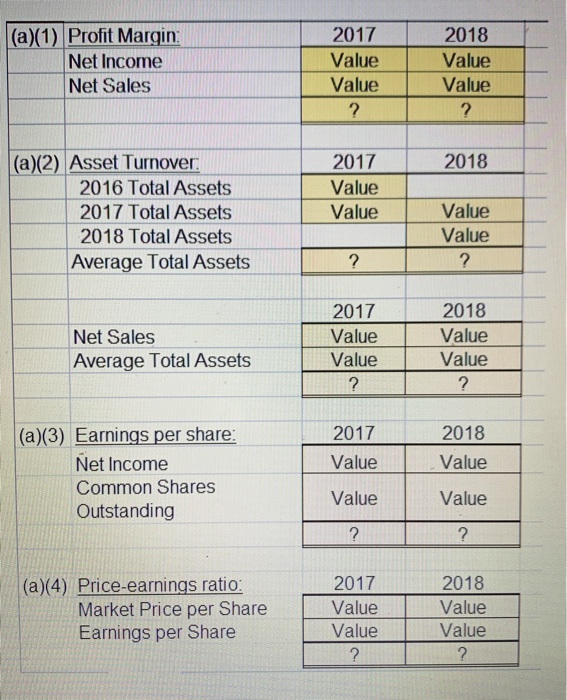

P18-3 Perform ratio analysis, and evaluate financial position and operating results Consolidated balance sheet and income statement data for Landwehr Corporation appear below. Cash Accounts receivable (net) Other current assets Investments Plant and equipment (net) LANDWEHR CORPORATION Balance Sheets December 31 2018 $25,000 50,000 90,000 75,000 400,000 $640,000 $75,000 80,000 340,000 145,000 $640,000 2017 $20,000 45,000 95.000 70,000 370,000 $600,000 $80,000 85,000 310,000 125,000 $600,000 2016 $18,000 48,000 64,000 45,000 358,000 $533,000 $70,000 50.000 300,000 113,000 $533,000 Current liabilities Long-term debt Common stock, $10 par Retained earnings LANDWEHR CORPORATION Income Statement For the Years Ended December 31 2017 Sales revenue Less: Sales returns and allowances Net sales Cost of goods sold Gross Profit Operating expenses (including income tax) Net income 2018 $740,000 40,000 700.000 420,000 280,000 235,000 $45.000 $700,000 50,000 650,000 400,000 250,000 220.000 $30.000 Additional information: 1. The market price of Landwehr's common stock was $4.00, S5.00, and $8.00 for 2016, 2017, and 2018 respectively 2. All dividends were paid in cash. Instructions (a) Compute the following ratios for 2017 and 2018. (Round ratios to one decimal point; round earnings per share to two decimal points) (1) Profit margin. (2) Asset turnover. (3) Earnings per share. (Weighted average common shares in 2018 were 32,000 and in 2017 were 31,000). (4) Price-earnings ratio. (5) Payout ratio. . (6) Debt to assets ratio. Based on the ratios calculated, discuss briefly the improvement or lack thereof in financial position and operating results from 2017 to 2018 of Landwehr Corporation. NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". (b) (a)(1) Profit Margin: Net Income Net Sales 2017 Value Value ? 2018 Value Value ? 2018 (a)(2) Asset Turnover: 2016 Total Assets 2017 Total Assets 2018 Total Assets Average Total Assets 2017 Value Value Value Value ? Net Sales Average Total Assets 2017 Value Value ? 2018 Value Value ? 2017 Value 2018 Value (a)(3) Earnings per share: Net Income Common Shares Outstanding Value Value ? (a)(4) Price-earnings ratio: Market Price per Share Earnings per Share 2017 Value Value ? 2018 Value Value ? (a)(5) Payout ratio: Cash Dividends Net income 2017 Value Value 2018 Value Value ? 2 (a)(6) Debt to assets ratio: Debt Assets 2017 Value Value ? 2018 Value Value b) Response