Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P2. Inventory (2) P2.1. In what way do different inventory estimation methods affect cash flow? P.2.2. How does the choice of different inventory methods

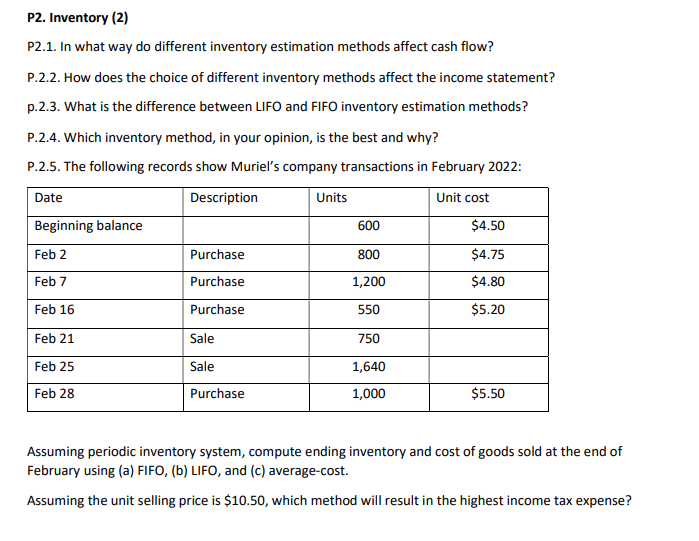

P2. Inventory (2) P2.1. In what way do different inventory estimation methods affect cash flow? P.2.2. How does the choice of different inventory methods affect the income statement? p.2.3. What is the difference between LIFO and FIFO inventory estimation methods? P.2.4. Which inventory method, in your opinion, is the best and why? P.2.5. The following records show Muriel's company transactions in February 2022: Date Description Units Unit cost Beginning balance 600 $4.50 Feb 2 Purchase 800 $4.75 Feb 7 Purchase 1,200 $4.80 Feb 16 Purchase 550 $5.20 Feb 21 Sale 750 Feb 25 Sale 1,640 Feb 28 Purchase 1,000 $5.50 Assuming periodic inventory system, compute ending inventory and cost of goods sold at the end of February using (a) FIFO, (b) LIFO, and (c) average-cost. Assuming the unit selling price is $10.50, which method will result in the highest income tax expense?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started