Answered step by step

Verified Expert Solution

Question

1 Approved Answer

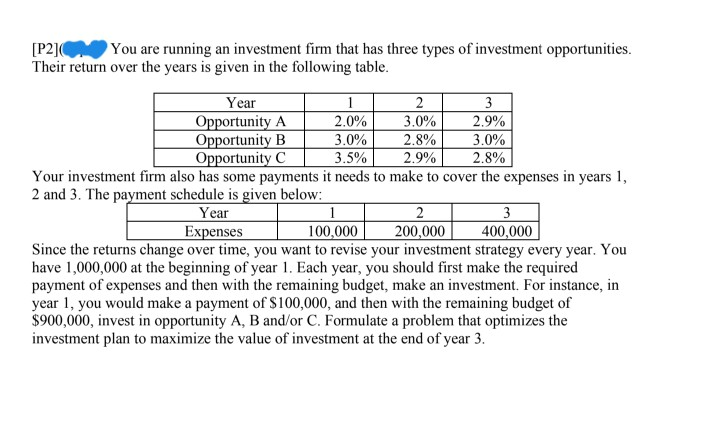

[P2] You are running an investment firm that has three types of investment opportunities. Their return over the years is given in the following table.

[P2] You are running an investment firm that has three types of investment opportunities. Their return over the years is given in the following table. DE Year 2 Opportunity A 2.0% 3.0% 2.9% Opportunity B 3.0% 2.8% 3.0% Opportunity C 3.5% 2.9% 2.8% Your investment firm also has some payments it needs to make to cover the expenses in years 1, 2 and 3. The payment schedule is given below: Year Expenses 100,000 200,000 400,000 Since the returns change over time, you want to revise your investment strategy every year. You have 1,000,000 at the beginning of year 1. Each year, you should first make the required payment of expenses and then with the remaining budget, make an investment. For instance, in year 1, you would make a payment of $100,000, and then with the remaining budget of $900,000, invest in opportunity A, B and/or C. Formulate a problem that optimizes the investment plan to maximize the value of investment at the end of year 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started