Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P21-1B Transactions P21-1B Wilbury Company manufactures a nutrient, Everlife, through two manufacturing processes: Blending and Packaging. All materials are entered at the beginning of each

P21-1B

P21-1B

Transactions

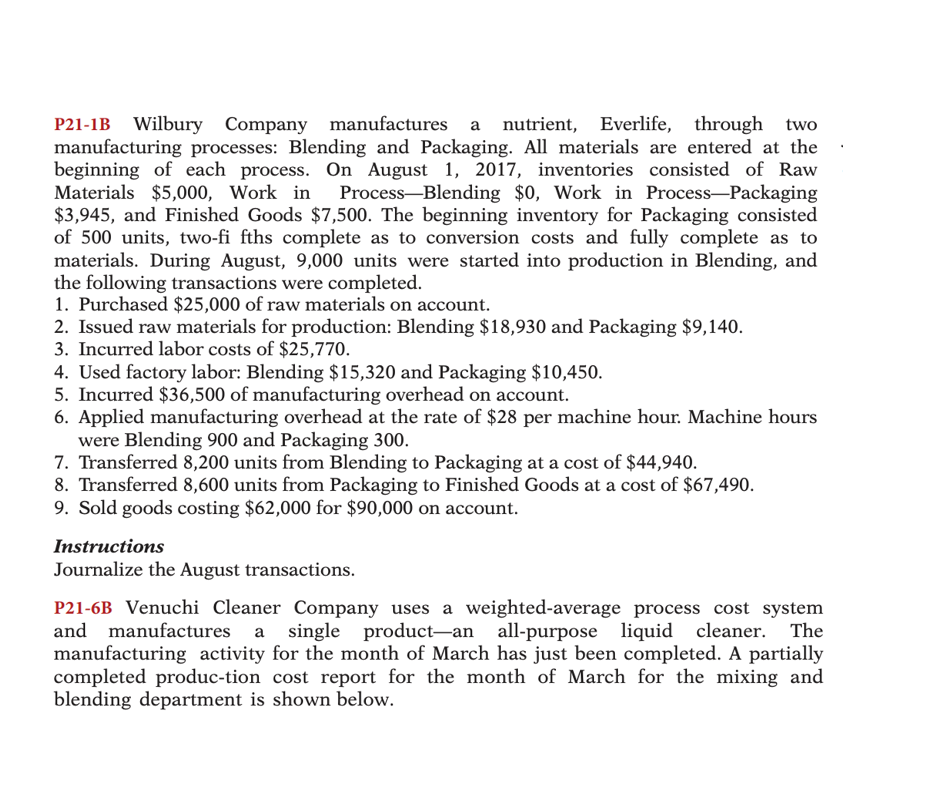

P21-1B Wilbury Company manufactures a nutrient, Everlife, through two manufacturing processes: Blending and Packaging. All materials are entered at the beginning of each process. On August 1, 2017, inventories consisted of Raw Materials $5,000, Work in Process-Blending $0, Work in Process-Packaging $3,945, and Finished Goods $7,500. The beginning inventory for Packaging consisted of 500 units, two-fi fths complete as to conversion costs and fully complete as to materials. During August, 9,000 units were started into production in Blending, and the following transactions were completed. 1. Purchased $25,000 of raw materials on account. 2. Issued raw materials for production: Blending $18,930 and Packaging $9,140. 3. Incurred labor costs of $25,770. 4. Used factory labor: Blending $15,320 and Packaging $10,450. 5. Incurred $36,500 of manufacturing overhead on account. 6. Applied manufacturing overhead at the rate of $28 per machine hour. Machine hours were Blending 900 and Packaging 300 . 7. Transferred 8,200 units from Blending to Packaging at a cost of $44,940. 8. Transferred 8,600 units from Packaging to Finished Goods at a cost of $67,490. 9. Sold goods costing $62,000 for $90,000 on account. Instructions Journalize the August transactions. P21-6B Venuchi Cleaner Company uses a weighted-average process cost system and manufactures a single product-an all-purpose liquid cleaner. The manufacturing activity for the month of March has just been completed. A partially completed produc-tion cost report for the month of March for the mixing and blending department is shown below. P21-1B Wilbury Company manufactures a nutrient, Everlife, through two manufacturing processes: Blending and Packaging. All materials are entered at the beginning of each process. On August 1, 2017, inventories consisted of Raw Materials $5,000, Work in Process-Blending $0, Work in Process-Packaging $3,945, and Finished Goods $7,500. The beginning inventory for Packaging consisted of 500 units, two-fi fths complete as to conversion costs and fully complete as to materials. During August, 9,000 units were started into production in Blending, and the following transactions were completed. 1. Purchased $25,000 of raw materials on account. 2. Issued raw materials for production: Blending $18,930 and Packaging $9,140. 3. Incurred labor costs of $25,770. 4. Used factory labor: Blending $15,320 and Packaging $10,450. 5. Incurred $36,500 of manufacturing overhead on account. 6. Applied manufacturing overhead at the rate of $28 per machine hour. Machine hours were Blending 900 and Packaging 300 . 7. Transferred 8,200 units from Blending to Packaging at a cost of $44,940. 8. Transferred 8,600 units from Packaging to Finished Goods at a cost of $67,490. 9. Sold goods costing $62,000 for $90,000 on account. Instructions Journalize the August transactions. P21-6B Venuchi Cleaner Company uses a weighted-average process cost system and manufactures a single product-an all-purpose liquid cleaner. The manufacturing activity for the month of March has just been completed. A partially completed produc-tion cost report for the month of March for the mixing and blending department is shown below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started