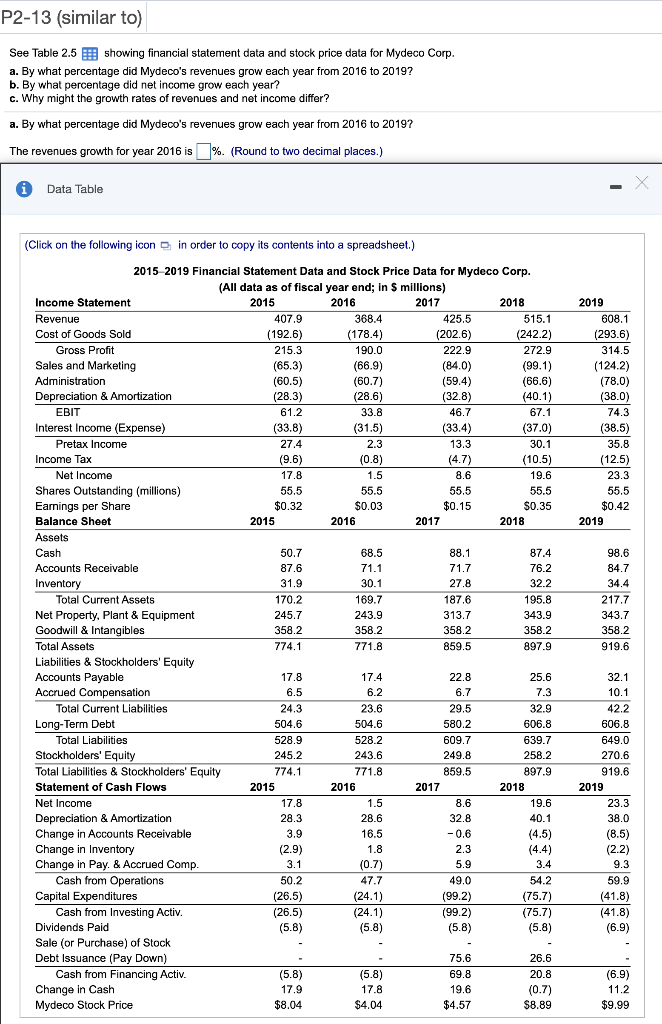

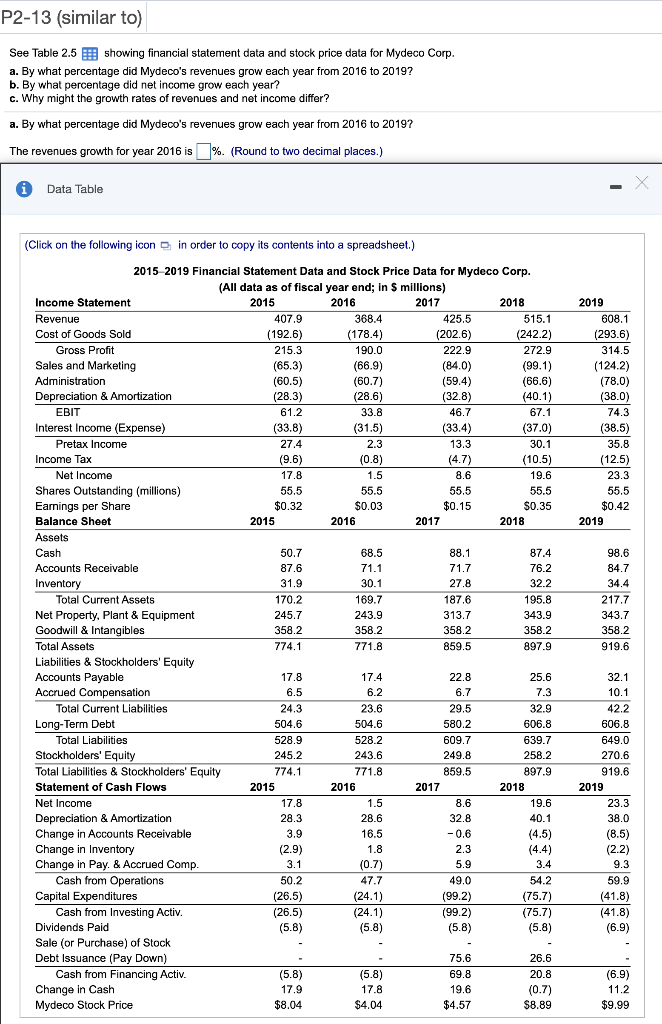

P2-13 (similar to) See Table 2.5 B showing financial statement data and stock price data for Mydeco Corp. a. By what percentage did Mydeco's revenues grow each year from 2016 to 2019? b. By what percentage did net income grow each year? c. Why might the growth rates of revenues and net income differ? a. By what percentage did Mydeco's revenues grow each year from 2016 to 2019? The revenues growth for year 2016 is %. (Round to two decimal places.) Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) 2019 608.1 (202.6) (293.6) 314.5 (124.2) (78.0) (38.0) 74.3 (38.5) 35.8 (12.5) 23.3 55.5 $0.42 2019 2015 2019 Financial Statement Data and Stock Price Data for Mydeco Corp. (All data as of fiscal year end; in s millions) Income Statement 2015 2016 2017 2018 Revenue 407.9 368.4 425.5 515.1 Cost of Goods Sold ( (192.6) (178.4) (242.2) Gross Profit 215,3 190.0 222.9 10.0 272.9 Sales and Marketing (65.3) (66.9) ie! 0.0! (84.0) (99.1) Administration (60.5) (60.7) (59.4) (66.6) Depreciation & Amortization (28.3) (28.6) (32.8) (40.1) EDIT EBIT 21 61.2 33.8 46.7 67.1 Interest Income (Expense) 100 (33.8) (31.5) (33.4) (37.0) Pretax Income 27.4 2.3 13.3 30.1 Income Tax (9.6) (0.8) (4.7) (10.5) Net Income 17.8 1.5 8.6 19.6 Shares Outstanding (millions) 55.5 55.5 55.5 55.5 Earnings per Share $0.32 $0.03 $0.15 $0.35 Balance Sheet 2015 2016 2017 2018 Assets Cash 50.7 68.5 88.1 87.4 Accounts Receivable 87.6 71.1 71.7 76.2 Inventory 31.9 30.1 27.8 32.2 Total Current Assets 170.2 169.7 187.6 195.8 Net Property, Plant & Equipment 245.7 243.9 313.7 343.9 Goodwill & Intangibles 358.2 358.2 358.2 358.2 Total Assets 774.1 771.8 859.5 897.9 Liabilities & Stockholders' Equity Accounts Payable 17.8 17.4 22.8 25.6 Accrued Compensation 6.5 6.2 6.7 7.3 Total Current Liabilities 24.3 23.6 29.5 32.9 Long-Term Debt 504.6 504.6 580.2 606.8 Total Liabilities 528.9 528.2 609.7 639.7 Stockholders' Equity 245 2 243.6 249.8 258.2 Total Liabilities & Stockholders' Equity 774.1 771.8 859.5 897.9 Statement of Cash Flows 2015 2016 2017 2018 98.6 84.7 34.4 217.7 343.7 358.2 919.6 32.1 10.1 42.2 606.8 649.0 270.6 919.6 2019 Net Income 17.8 1.5 8.6 19.6 23.3 28.6 40.1 28.3 3.9 32.8 -0.6 16.5 38.0 (8.5) (2.2) 9.3 (2.9) 1.8 (4.5) (4.4) 3.4 2.3 3.1 5.9 (0.7) 47.7 54.2 59.9 (41.8) Depreciation & Amortization Change in Accounts Receivable Change in Inventory Change in Pay. & Accrued Comp. Cash from Operations Capital Expenditures Cash from Investing Activ. Dividends Paid Sale (or Purchase) of Stock Debt Issuance (Pay Down) Cash from Financing Activ. Change in Cash Mydeco Stock Price 50.2 (26.5) (26.5) (5.8) (24.1) (24.1) (5.8) 49.0 (99.2) (99.2) (5.8) (75.7) (75.7) (5.8) (41.8) (6.9) 75.6 26.6 (5.8) 69.8 20.8 (5.8) 17.8 $4.04 (6.9) 11.2 17.9 19.6 (0.7) $8.89 $8.04 $4.57 $9.99