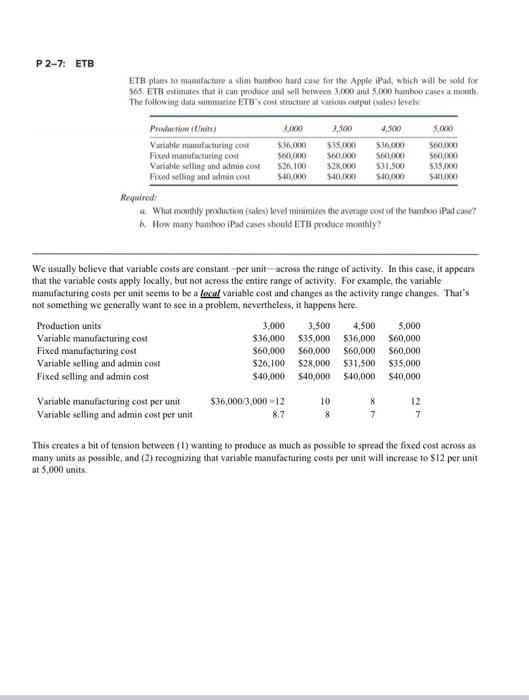

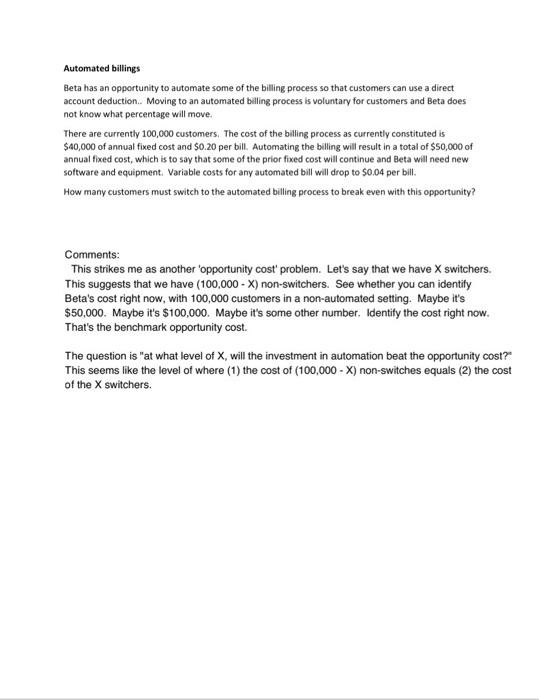

P2-15: American Cinema American Cinema shows first-run movies. It pays the company distributing the movies a fixed fee of S1.000 per week plus a percentage of the grow box office receipts. In the fint two weeks a movie is released the theater pays the fixed fee of $1.000 per week plus 90 percent of gross box office receipes to the distributor . If the theater keeps the movie for weeks 3 and 4, the theater puys the dir tributor $1.000 per week plus 80 percent of its gross box office receipts received during those two weeks. American Cinema charges $6.50 per ticket for all movies, including those shown for two weeks and those shown for four weeks. American Cinema must decide what movies to show and for how many weeks to show cach movie (either two weeks only or four week) before the movie is released. For most movies, the madience demand is higher in the first two weeks than in the next two week American Cinema is evaluating two similar comedies. The first onc. Paris la for Lovers, is scheduled for release on October 1. The second comedy, I Do, is scheduled for release on October 14. American Cinema has decided to rent Paris Is for Lovers but must decide whether to run it for four weeks or to run it for two weeks and then replace it with I Do. Based on all the information about the stars in the movie.production costs, and prerelease publicity, matapement expects the two movies will have the same denuand in the fint two weeks and will have the same (lower) demand in weeks 3 and 4. Required: 4. The only movie being released on October 14 is I De How should management so about deciding whether to rent Paris for four weeks or to rent it for two weeks and then replace it with I Do? In other words, provide American Cinema management with a decision-making rule to use in choosing between renting Paris for four weeks or just two weeks, American Cinemas tax rate is zero. Be sure to justify your advice with clearly described analysis. # How does your answer in puro change if American Cinema's income tax rate as 30 percent? American Cinema's average movie patron purchases oda.popcom, and candy that yields profits of S2 after supplies and labor. How does profit on these concession items affect your answer to part alt(Ignote tuxes) Comments: This seems to me as though we are deciding what to do in weeks 3 and 4. The choice seems to be stay or switch. There's a level of expected ticket sales for "Paris" in weeks 3 and 4, and a level of expected ticket sales for "I Do in those weeks. The question might be phrased "what level of expected ticket sales for Paris gives the same profit as might be expected for Do?" This makes it a kind of an opportunity cost question -- at what level of ticket sales for I Do, does I Do beat the opportunity cost of staying with Paris? P 2-7: ETB ETB plans to manufacture a slim bamboo hard case for the Apple iPod, which will be sold for $65. ETB estimates that it can produce and sell between 3,000 and 5,000 bomboo cases a month The following data summarize ETB's cost structure at various output (sales) levels 30.500 5.000 Production (Unity) 3.000 Variable manufacturing out SMO SI5.000 $36.00 $60,000 Fixed manufacturing cost $60,000 S60,000 S000 $60,000 Variable selling and admin cost $26.100 $28,000 $31.500 $35.000 Fixed selling and admin cost SH0.000 540,000 $40,000 $40,000 Required: 4. What monthly production (sales) level minimizes the average cost of the bamboo iPad case? an How many hamboo iPad cases should ETB produce monthly We usually believe that variable costs are constant per unit across the range of activity. In this case, it appears that the variable costs apply locally, but not across the entire range of activity. For example, the variable manufacturing costs per unit seems to be a local variable cost and changes as the activity range changes. That's not something we generally want to see in a problem, nevertheless, it happens here. Production units 3.000 3.500 4,500 5,000 Variable manufacturing cost $36.000 $35,000 $36,000 $60,000 Fixed manufacturing cost $60,000 $60,000 $60,000 $60,000 Variable selling and admin cost $26.100 $28,000 $31,500 S35,000 Fixed selling and admin cost $40,000 $40,000 $40,000 S40,000 Variable manufacturing cost per unit $36,000/3,000 -12 Variable selling and admin cost per unit 8.7 8 7 7 10 8 12 This creates a bit of tension between (1) wanting to produce as much as possible to spread the fixed cost across as many units as possible, and (2) recognizing that variable manufacturing costs per unit will increase to S12 per unit at 5.000 units. Automated billings Beta has an opportunity to automate some of the billing process so that customers can use a direct account deduction. Moving to an automated billing process is voluntary for customers and Beta does not know what percentage will move. There are currently 100,000 customers. The cost of the billing process as currently constituted is $40,000 of annual fixed cost and $0.20 per bill. Automating the billing will result in a total of $50,000 of annual fixed cost, which is to say that some of the prior fixed cost will continue and Beta will need new software and equipment. Variable costs for any automated bill will drop to $0.04 per bill. How many customers must switch to the automated billing process to break even with this opportunity? Comments: This strikes me as another opportunity cost' problem. Let's say that we have X switchers. This suggests that we have (100,000 - X) non-switchers. See whether you can identify Beta's cost right now, with 100,000 customers in a non-automated setting. Maybe it's $50,000. Maybe it's $100,000. Maybe it's some other number. Identify the cost right now. That's the benchmark opportunity cost. The question is "at what level of X, will the investment in automation beat the opportunity cost? This seems like the level of where (1) the cost of (100,000 - X) non-switches equals (2) the cost of the X switchers. P2-15: American Cinema American Cinema shows first-run movies. It pays the company distributing the movies a fixed fee of S1.000 per week plus a percentage of the grow box office receipts. In the fint two weeks a movie is released the theater pays the fixed fee of $1.000 per week plus 90 percent of gross box office receipes to the distributor . If the theater keeps the movie for weeks 3 and 4, the theater puys the dir tributor $1.000 per week plus 80 percent of its gross box office receipts received during those two weeks. American Cinema charges $6.50 per ticket for all movies, including those shown for two weeks and those shown for four weeks. American Cinema must decide what movies to show and for how many weeks to show cach movie (either two weeks only or four week) before the movie is released. For most movies, the madience demand is higher in the first two weeks than in the next two week American Cinema is evaluating two similar comedies. The first onc. Paris la for Lovers, is scheduled for release on October 1. The second comedy, I Do, is scheduled for release on October 14. American Cinema has decided to rent Paris Is for Lovers but must decide whether to run it for four weeks or to run it for two weeks and then replace it with I Do. Based on all the information about the stars in the movie.production costs, and prerelease publicity, matapement expects the two movies will have the same denuand in the fint two weeks and will have the same (lower) demand in weeks 3 and 4. Required: 4. The only movie being released on October 14 is I De How should management so about deciding whether to rent Paris for four weeks or to rent it for two weeks and then replace it with I Do? In other words, provide American Cinema management with a decision-making rule to use in choosing between renting Paris for four weeks or just two weeks, American Cinemas tax rate is zero. Be sure to justify your advice with clearly described analysis. # How does your answer in puro change if American Cinema's income tax rate as 30 percent? American Cinema's average movie patron purchases oda.popcom, and candy that yields profits of S2 after supplies and labor. How does profit on these concession items affect your answer to part alt(Ignote tuxes) Comments: This seems to me as though we are deciding what to do in weeks 3 and 4. The choice seems to be stay or switch. There's a level of expected ticket sales for "Paris" in weeks 3 and 4, and a level of expected ticket sales for "I Do in those weeks. The question might be phrased "what level of expected ticket sales for Paris gives the same profit as might be expected for Do?" This makes it a kind of an opportunity cost question -- at what level of ticket sales for I Do, does I Do beat the opportunity cost of staying with Paris? P 2-7: ETB ETB plans to manufacture a slim bamboo hard case for the Apple iPod, which will be sold for $65. ETB estimates that it can produce and sell between 3,000 and 5,000 bomboo cases a month The following data summarize ETB's cost structure at various output (sales) levels 30.500 5.000 Production (Unity) 3.000 Variable manufacturing out SMO SI5.000 $36.00 $60,000 Fixed manufacturing cost $60,000 S60,000 S000 $60,000 Variable selling and admin cost $26.100 $28,000 $31.500 $35.000 Fixed selling and admin cost SH0.000 540,000 $40,000 $40,000 Required: 4. What monthly production (sales) level minimizes the average cost of the bamboo iPad case? an How many hamboo iPad cases should ETB produce monthly We usually believe that variable costs are constant per unit across the range of activity. In this case, it appears that the variable costs apply locally, but not across the entire range of activity. For example, the variable manufacturing costs per unit seems to be a local variable cost and changes as the activity range changes. That's not something we generally want to see in a problem, nevertheless, it happens here. Production units 3.000 3.500 4,500 5,000 Variable manufacturing cost $36.000 $35,000 $36,000 $60,000 Fixed manufacturing cost $60,000 $60,000 $60,000 $60,000 Variable selling and admin cost $26.100 $28,000 $31,500 S35,000 Fixed selling and admin cost $40,000 $40,000 $40,000 S40,000 Variable manufacturing cost per unit $36,000/3,000 -12 Variable selling and admin cost per unit 8.7 8 7 7 10 8 12 This creates a bit of tension between (1) wanting to produce as much as possible to spread the fixed cost across as many units as possible, and (2) recognizing that variable manufacturing costs per unit will increase to S12 per unit at 5.000 units. Automated billings Beta has an opportunity to automate some of the billing process so that customers can use a direct account deduction. Moving to an automated billing process is voluntary for customers and Beta does not know what percentage will move. There are currently 100,000 customers. The cost of the billing process as currently constituted is $40,000 of annual fixed cost and $0.20 per bill. Automating the billing will result in a total of $50,000 of annual fixed cost, which is to say that some of the prior fixed cost will continue and Beta will need new software and equipment. Variable costs for any automated bill will drop to $0.04 per bill. How many customers must switch to the automated billing process to break even with this opportunity? Comments: This strikes me as another opportunity cost' problem. Let's say that we have X switchers. This suggests that we have (100,000 - X) non-switchers. See whether you can identify Beta's cost right now, with 100,000 customers in a non-automated setting. Maybe it's $50,000. Maybe it's $100,000. Maybe it's some other number. Identify the cost right now. That's the benchmark opportunity cost. The question is "at what level of X, will the investment in automation beat the opportunity cost? This seems like the level of where (1) the cost of (100,000 - X) non-switches equals (2) the cost of the X switchers