Answered step by step

Verified Expert Solution

Question

1 Approved Answer

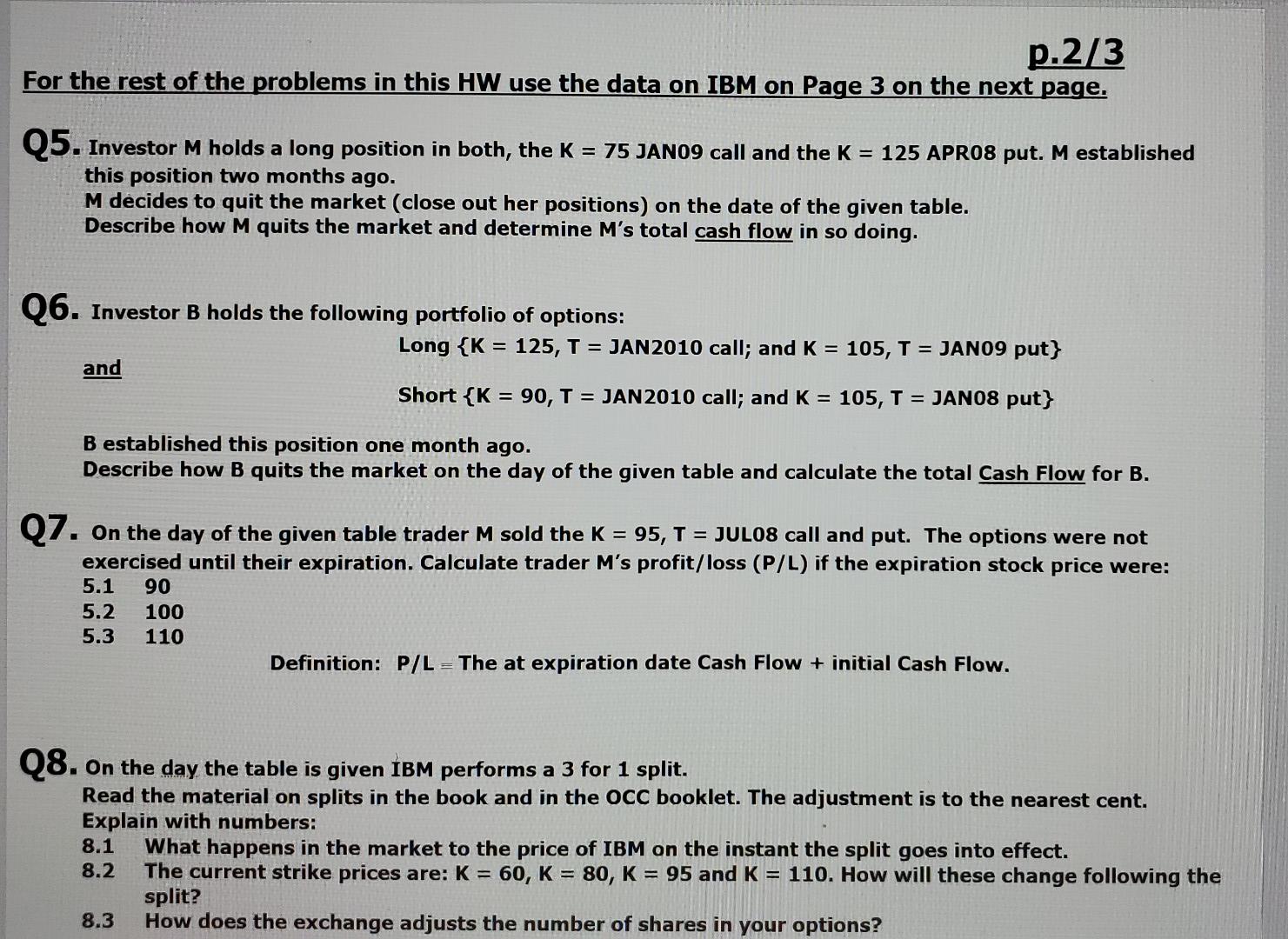

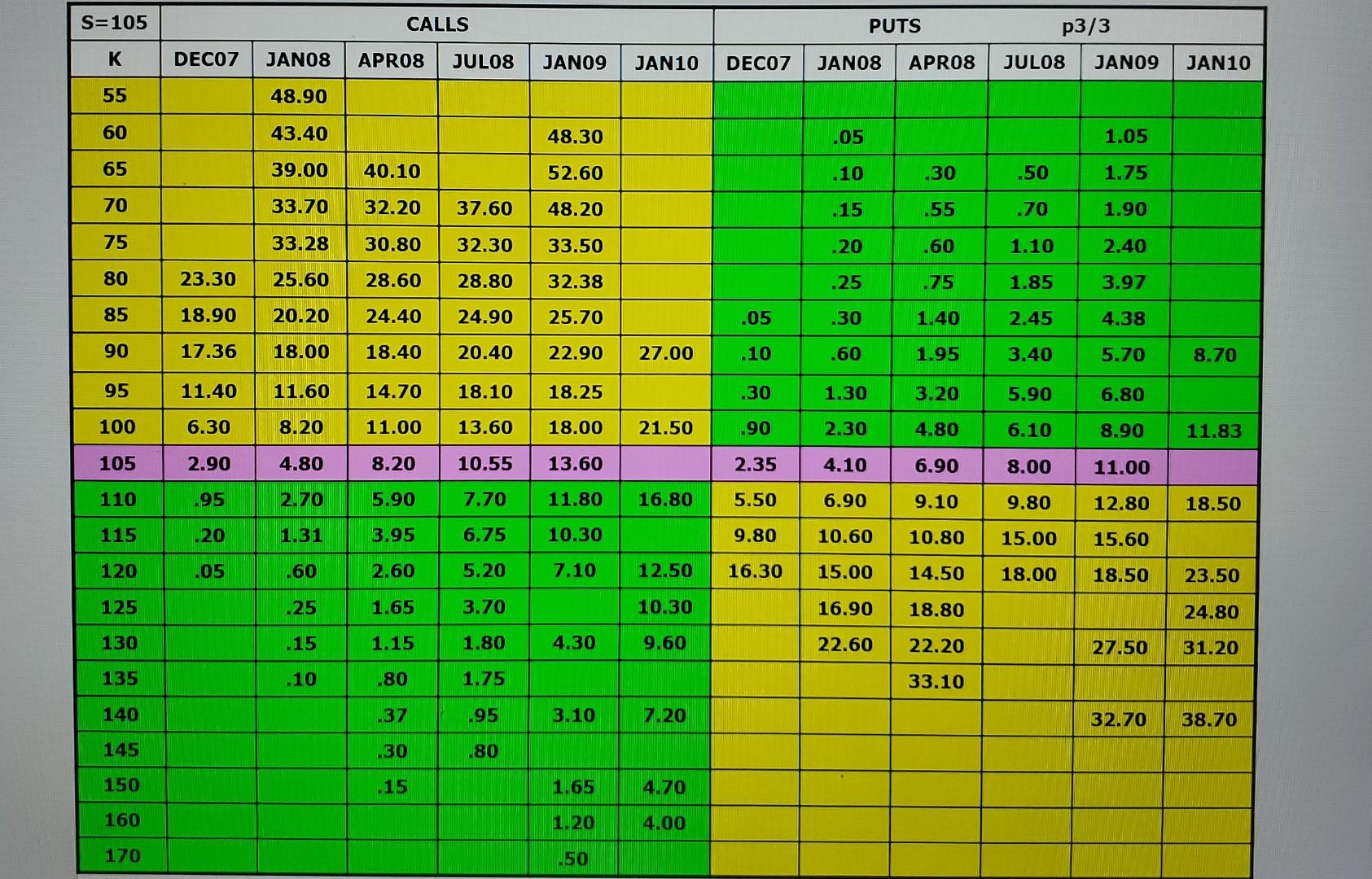

p.2/3 For the rest of the problems in this HW use the data on IBM on Page 3 on the next page. Q5. Investor M

p.2/3 For the rest of the problems in this HW use the data on IBM on Page 3 on the next page. Q5. Investor M holds a long position in both, the K = 75 JANO9 call and the K = 125 APRO8 put. M established this position two months ago. M decides to quit the market (close out her positions) on the date of the given table. Describe how M quits the market and determine M's total cash flow in so doing. Q6. Investor B holds the following portfolio of options: Long {K = 125, T = JAN2010 call; and K = 105, T = JANO9 put} and Short {K = 90, T = JAN2010 call; and K = 105, T = JAN08 put} = B established this position one month ago. Describe how B quits the market on the day of the given table and calculate the total Cash Flow for B. Q7. On the day of the given table trader M sold the K = 95, T = JULO8 call and put. The options were not exercised until their expiration. Calculate trader M's profit/loss (P/L) if the expiration stock price were: 5.1 5.2 5.3 90 100 110 Definition: P/L = The at expiration date Cash Flow + initial Cash Flow. Q8. On the day the table is given IBM performs a 3 for 1 split. Read the material on splits in the book and in the OCC booklet. The adjustment is to the nearest cent. Explain with numbers: 8.1 What happens in the market to the price of IBM on the instant the split goes into effect. 8.2 The current strike prices are: K= 60, K = 80, K = 95 and K = 110. How will these change following the split? 8.3 How does the exchange adjusts the number of shares in your options? S=105 CALLS PUTS p3/3 K DECO7 JAN08 APR08 JUL08 JANO9 JAN10 DECO7 JAN08 APR08 JULO8 JAN09 JAN10 55 48.90 60 43.40 48.30 .05 1.05 65 39.00 40.10 52.60 .10 .30 .50 1.75 70 33.70 32.20 37.60 48.20 .15 .55 .70 1.90 75 33.28 30.80 32.30 33.50 .20 .60 1.10 2.40 80 23.30 25.60 28.60 28.80 32.38 .25 .75 1.85 3.97 85 18.90 20.20 24.40 24.90 25.70 .05 .30 1.40 2.45 4.38 90 17.36 18.00 18.40 20.40 22.90 27.00 .10 .60 1.95 3.40 5.70 8.70 95 11.40 11.60 14.70 18.10 18.25 .30 1.30 3.20 5.90 6.80 100 6.30 8.20 11.00 13.60 18.00 21.50 .90 2.30 4.80 6.10 8.90 11.83 105 2.90 4.80 8.20 10.55 13.60 2.35 4.10 6.90 8.00 11.00 110 .95 2.70 5.90 7.70 11.80 16.80 5.50 6.90 9.10 9.80 12.80 18.50 115 .20 1.31 3.95 6.75 10.30 9.80 10.60 10.80 15.00 15.60 120 .05 -60 2.60 5.20 7.10 12.50 16.30 15.00 14.50 18.00 18.50 23.50 125 25 1.65 3.70 10.30 16.90 18.80 24.80 130 -15 1.15 1.80 4.30 9.60 22.60 22.20 27.50 31.20 135 .10 .80 1.75 33.10 140 37 .95 3.10 720 32.70 38.70 145 30 80 150 .15 1.65 4.70 160 1.20 4.00 170 .50 On NOV 30 2007 you longed the following IBM options: p.2/3 For the rest of the problems in this HW use the data on IBM on Page 3 on the next page. Q5. Investor M holds a long position in both, the K = 75 JANO9 call and the K = 125 APRO8 put. M established this position two months ago. M decides to quit the market (close out her positions) on the date of the given table. Describe how M quits the market and determine M's total cash flow in so doing. Q6. Investor B holds the following portfolio of options: Long {K = 125, T = JAN2010 call; and K = 105, T = JANO9 put} and Short {K = 90, T = JAN2010 call; and K = 105, T = JAN08 put} = B established this position one month ago. Describe how B quits the market on the day of the given table and calculate the total Cash Flow for B. Q7. On the day of the given table trader M sold the K = 95, T = JULO8 call and put. The options were not exercised until their expiration. Calculate trader M's profit/loss (P/L) if the expiration stock price were: 5.1 5.2 5.3 90 100 110 Definition: P/L = The at expiration date Cash Flow + initial Cash Flow. Q8. On the day the table is given IBM performs a 3 for 1 split. Read the material on splits in the book and in the OCC booklet. The adjustment is to the nearest cent. Explain with numbers: 8.1 What happens in the market to the price of IBM on the instant the split goes into effect. 8.2 The current strike prices are: K= 60, K = 80, K = 95 and K = 110. How will these change following the split? 8.3 How does the exchange adjusts the number of shares in your options? S=105 CALLS PUTS p3/3 K DECO7 JAN08 APR08 JUL08 JANO9 JAN10 DECO7 JAN08 APR08 JULO8 JAN09 JAN10 55 48.90 60 43.40 48.30 .05 1.05 65 39.00 40.10 52.60 .10 .30 .50 1.75 70 33.70 32.20 37.60 48.20 .15 .55 .70 1.90 75 33.28 30.80 32.30 33.50 .20 .60 1.10 2.40 80 23.30 25.60 28.60 28.80 32.38 .25 .75 1.85 3.97 85 18.90 20.20 24.40 24.90 25.70 .05 .30 1.40 2.45 4.38 90 17.36 18.00 18.40 20.40 22.90 27.00 .10 .60 1.95 3.40 5.70 8.70 95 11.40 11.60 14.70 18.10 18.25 .30 1.30 3.20 5.90 6.80 100 6.30 8.20 11.00 13.60 18.00 21.50 .90 2.30 4.80 6.10 8.90 11.83 105 2.90 4.80 8.20 10.55 13.60 2.35 4.10 6.90 8.00 11.00 110 .95 2.70 5.90 7.70 11.80 16.80 5.50 6.90 9.10 9.80 12.80 18.50 115 .20 1.31 3.95 6.75 10.30 9.80 10.60 10.80 15.00 15.60 120 .05 -60 2.60 5.20 7.10 12.50 16.30 15.00 14.50 18.00 18.50 23.50 125 25 1.65 3.70 10.30 16.90 18.80 24.80 130 -15 1.15 1.80 4.30 9.60 22.60 22.20 27.50 31.20 135 .10 .80 1.75 33.10 140 37 .95 3.10 720 32.70 38.70 145 30 80 150 .15 1.65 4.70 160 1.20 4.00 170 .50 On NOV 30 2007 you longed the following IBM options

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started