Answered step by step

Verified Expert Solution

Question

1 Approved Answer

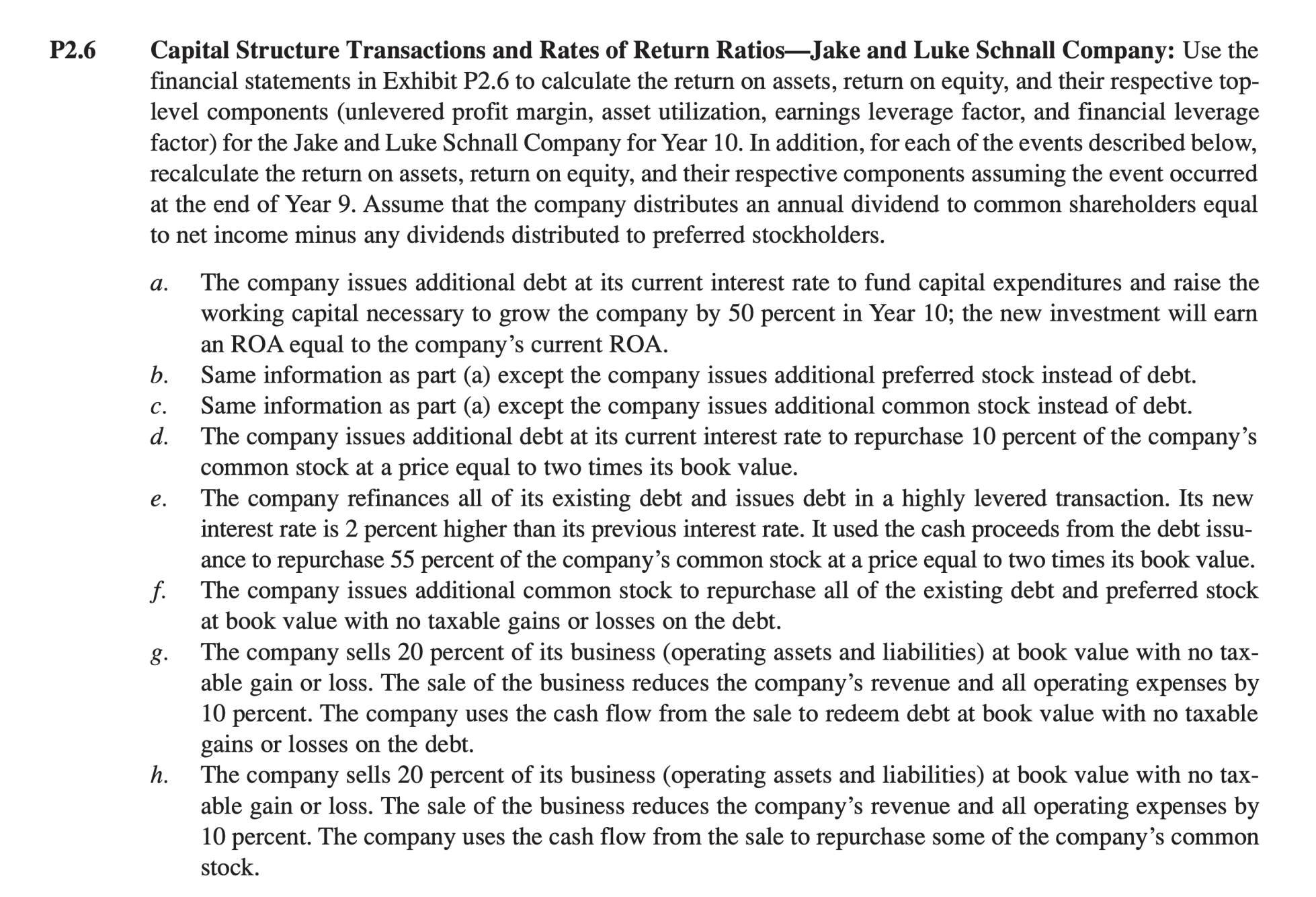

P2.6 Capital Structure Transactions and Rates of Return RatiosJake and Luke Schnall Company: Use the financial statements in Exhibit P2.6 to calculate the return

P2.6 Capital Structure Transactions and Rates of Return RatiosJake and Luke Schnall Company: Use the financial statements in Exhibit P2.6 to calculate the return on assets, return on equity, and their respective top- level components (unlevered profit margin, asset utilization, earnings leverage factor, and financial leverage factor) for the Jake and Luke Schnall Company for Year 10. In addition, for each of the events described below, recalculate the return on assets, return on equity, and their respective components assuming the event occurred at the end of Year 9. Assume that the company distributes an annual dividend to common shareholders equal to net income minus any dividends distributed to preferred stockholders. a. b. C. d. e. f. g. h. The company issues additional debt at its current interest rate to fund capital expenditures and raise the working capital necessary to grow the company by 50 percent in Year 10; the new investment will earn an ROA equal to the company's current ROA. Same information as part (a) except the company issues additional preferred stock instead of debt. Same information as part (a) except the company issues additional common stock instead of debt. The company issues additional debt at its current interest rate to repurchase 10 percent of the company's common stock at a price equal to two times its book value. The company refinances all of its existing debt and issues debt in a highly levered transaction. Its new interest rate is 2 percent higher than its previous interest rate. It used the cash proceeds from the debt issu- ance to repurchase 55 percent of the company's common stock at a price equal to two times its book value. The company issues additional common stock to repurchase all of the existing debt and preferred stock at book value with no taxable gains or losses on the debt. The company sells 20 percent of its business (operating assets and liabilities) at book value with no tax- able gain or loss. The sale of the business reduces the company's revenue and all operating expenses by 10 percent. The company uses the cash flow from the sale to redeem debt at book value with no taxable gains or losses on the debt. The company sells 20 percent of its business (operating assets and liabilities) at book value with no tax- able gain or loss. The sale of the business reduces the company's revenue and all operating expenses by 10 percent. The company uses the cash flow from the sale to repurchase some of the company's common stock.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started