Answered step by step

Verified Expert Solution

Question

1 Approved Answer

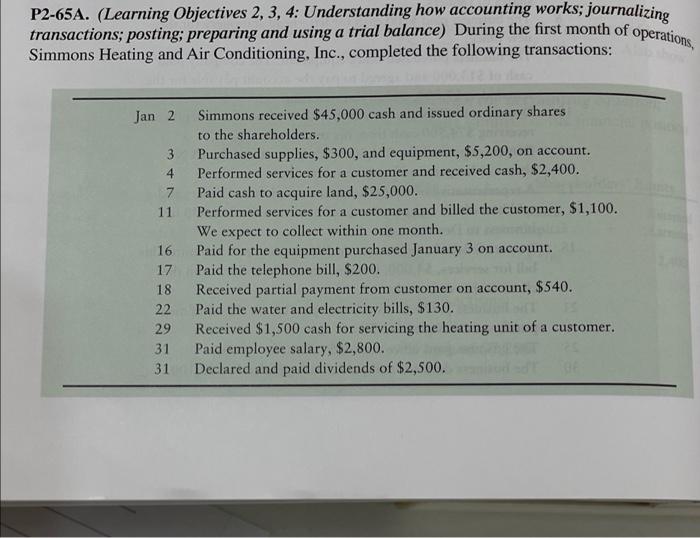

P2-65A. (Learning Objectives 2, 3, 4: Understanding how accounting works; journalizing transactions; posting; preparing and using a trial balance) During the first month of operations,

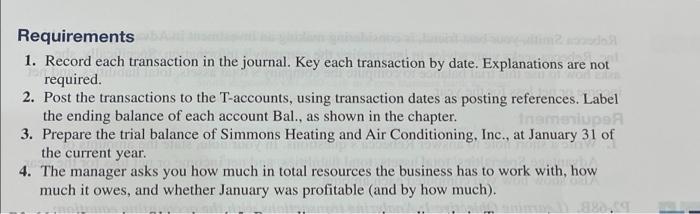

P2-65A. (Learning Objectives 2, 3, 4: Understanding how accounting works; journalizing transactions; posting; preparing and using a trial balance) During the first month of operations, Simmons Heating and Air Conditioning, Inc., completed the following transactions: Jan 2 3 4 7 11 16 17 18 22 29 31 31 Simmons received $45,000 cash and issued ordinary shares to the shareholders. Purchased supplies, $300, and equipment, $5,200, on account. Performed services for a customer and received cash, $2,400. Paid cash to acquire land, $25,000. Performed services for a customer and billed the customer, $1,100. We expect to collect within one month. Paid for the equipment purchased January 3 on account. Paid the telephone bill, $200. Received partial payment from customer on account, $540. Paid the water and electricity bills, $130. Received $1,500 cash for servicing the heating unit of a customer. Paid employee salary, $2,800. Declared and paid dividends of $2,500. Requirements s 1. Record each transaction in the journal. Key each transaction by date. Explanations are not required. Inameniupe 2. Post the transactions to the T-accounts, using transaction dates as posting references. Label the ending balance of each account Bal., as shown in the chapter. 3. Prepare the trial balance of Simmons Heating and Air Conditioning, Inc., at January 31 of the current year. 4. The manager asks you how much in total resources the business has to work with, how much it owes, and whether January was profitable (and by how much)

P2-65A. (Learning Objectives 2, 3, 4: Understanding how accounting works; journalizing transactions; posting; preparing and using a trial balance) During the first month of operations, Simmons Heating and Air Conditioning, Inc., completed the following transactions: Jan 2 3 4 7 11 16 17 18 22 29 31 31 Simmons received $45,000 cash and issued ordinary shares to the shareholders. Purchased supplies, $300, and equipment, $5,200, on account. Performed services for a customer and received cash, $2,400. Paid cash to acquire land, $25,000. Performed services for a customer and billed the customer, $1,100. We expect to collect within one month. Paid for the equipment purchased January 3 on account. Paid the telephone bill, $200. Received partial payment from customer on account, $540. Paid the water and electricity bills, $130. Received $1,500 cash for servicing the heating unit of a customer. Paid employee salary, $2,800. Declared and paid dividends of $2,500. Requirements s 1. Record each transaction in the journal. Key each transaction by date. Explanations are not required. Inameniupe 2. Post the transactions to the T-accounts, using transaction dates as posting references. Label the ending balance of each account Bal., as shown in the chapter. 3. Prepare the trial balance of Simmons Heating and Air Conditioning, Inc., at January 31 of the current year. 4. The manager asks you how much in total resources the business has to work with, how much it owes, and whether January was profitable (and by how much) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started