Answered step by step

Verified Expert Solution

Question

1 Approved Answer

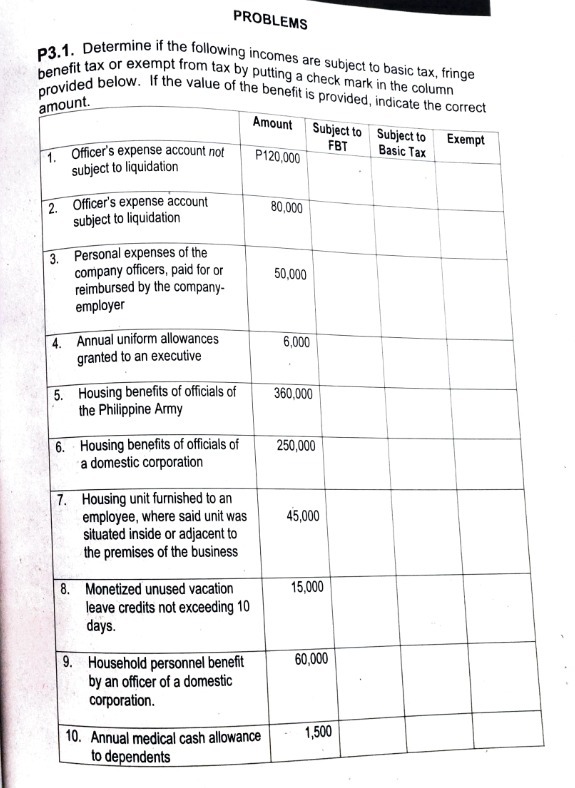

P3.1. Determine if the following incomes are subject to basic tax, fringe benefit tax or exempt from tax by putting a check mark in

P3.1. Determine if the following incomes are subject to basic tax, fringe benefit tax or exempt from tax by putting a check mark in the column provided below. If the value of the benefit is provided, indicate the correct amount. 1. Officer's expense account not subject to liquidation 2. Officer's expense account subject to liquidation 3. Personal expenses of the company officers, paid for or reimbursed by the company- employer PROBLEMS 4. Annual uniform allowances granted to an executive 5. Housing benefits of officials of the Philippine Army 6. Housing benefits of officials of a domestic corporation 7. Housing unit furnished to an employee, where said unit was situated inside or adjacent to the premises of the business 8. Monetized unused vacation leave credits not exceeding 10 days. 9. Household personnel benefit by an officer of a domestic corporation. Amount P120,000 10. Annual medical cash allowance to dependents 80,000 50,000 6,000 Subject to FBT 360,000 250,000 45,000 15,000 60,000 1,500 Subject to Basic Tax Exempt

Step by Step Solution

★★★★★

3.36 Rating (134 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started