Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P3-11 Liquidity management Bauman Company's total current assets, total current liabili- ties, and inventory for each of the past 4 years follow: Item 2016 2017

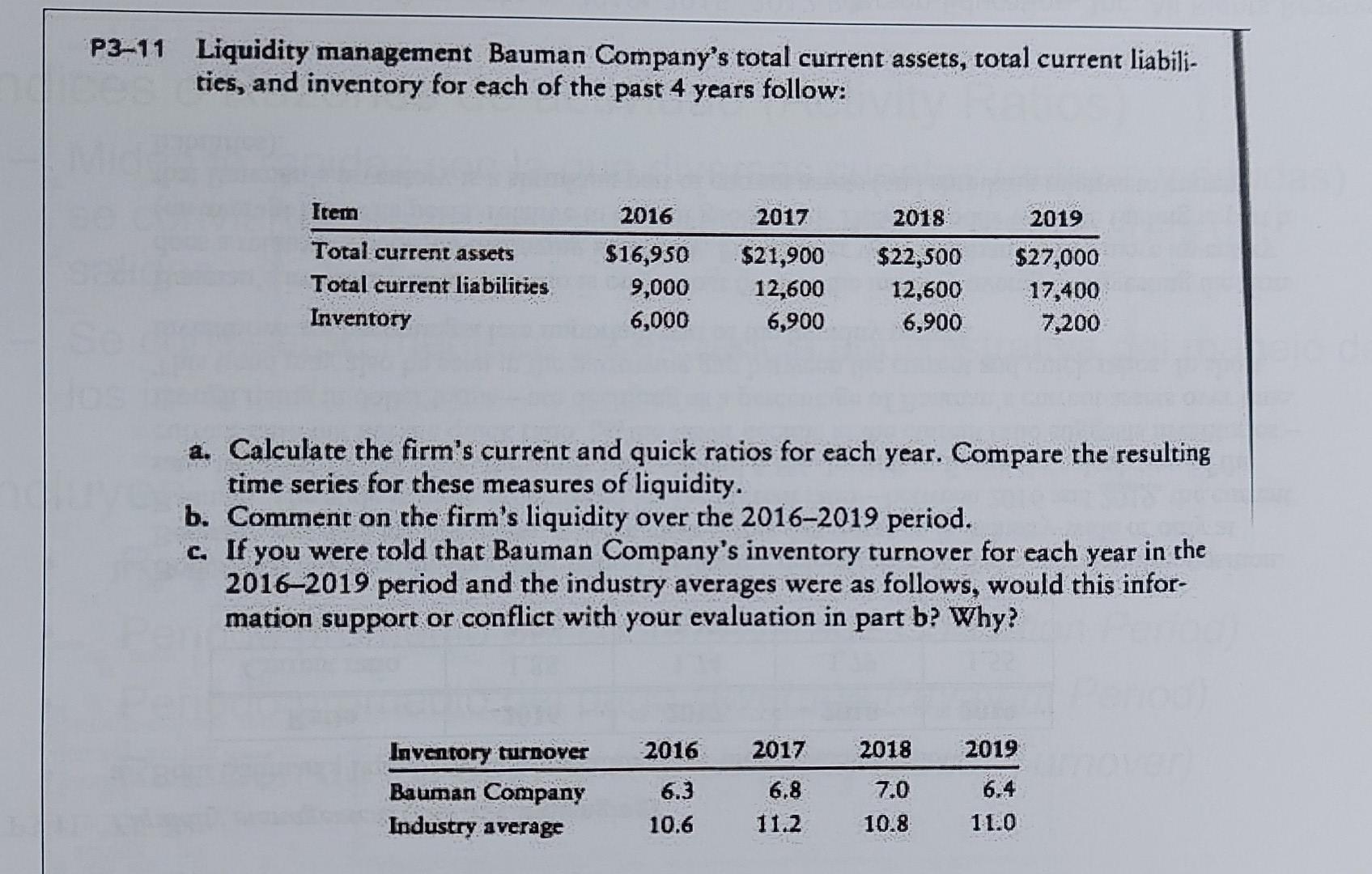

P3-11 Liquidity management Bauman Company's total current assets, total current liabili- ties, and inventory for each of the past 4 years follow: Item 2016 2017 2018 2019 Total current assets Total current liabilities Inventory $16,950 9,000 6,000 $21,900 12,600 6,900 $22,500 12,600 6,900 $27,000 17,400 7,200 Calculate the firm's current and quick ratios for each year. Compare the resulting time series for these measures of liquidity. b. Comment on the firm's liquidity over the 2016-2019 period. c. If you were told that Bauman Company's inventory turnover for each year in the 2016-2019 period and the industry averages were as follows, would this infor mation support or conflict with your evaluation in part b? Why? 2016 2017 2018 2019 Inventory turnover Bauman Company Industry average 6.3 10.6 6,8 11.2 7.0 10.8 6.4 11.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started