Answered step by step

Verified Expert Solution

Question

1 Approved Answer

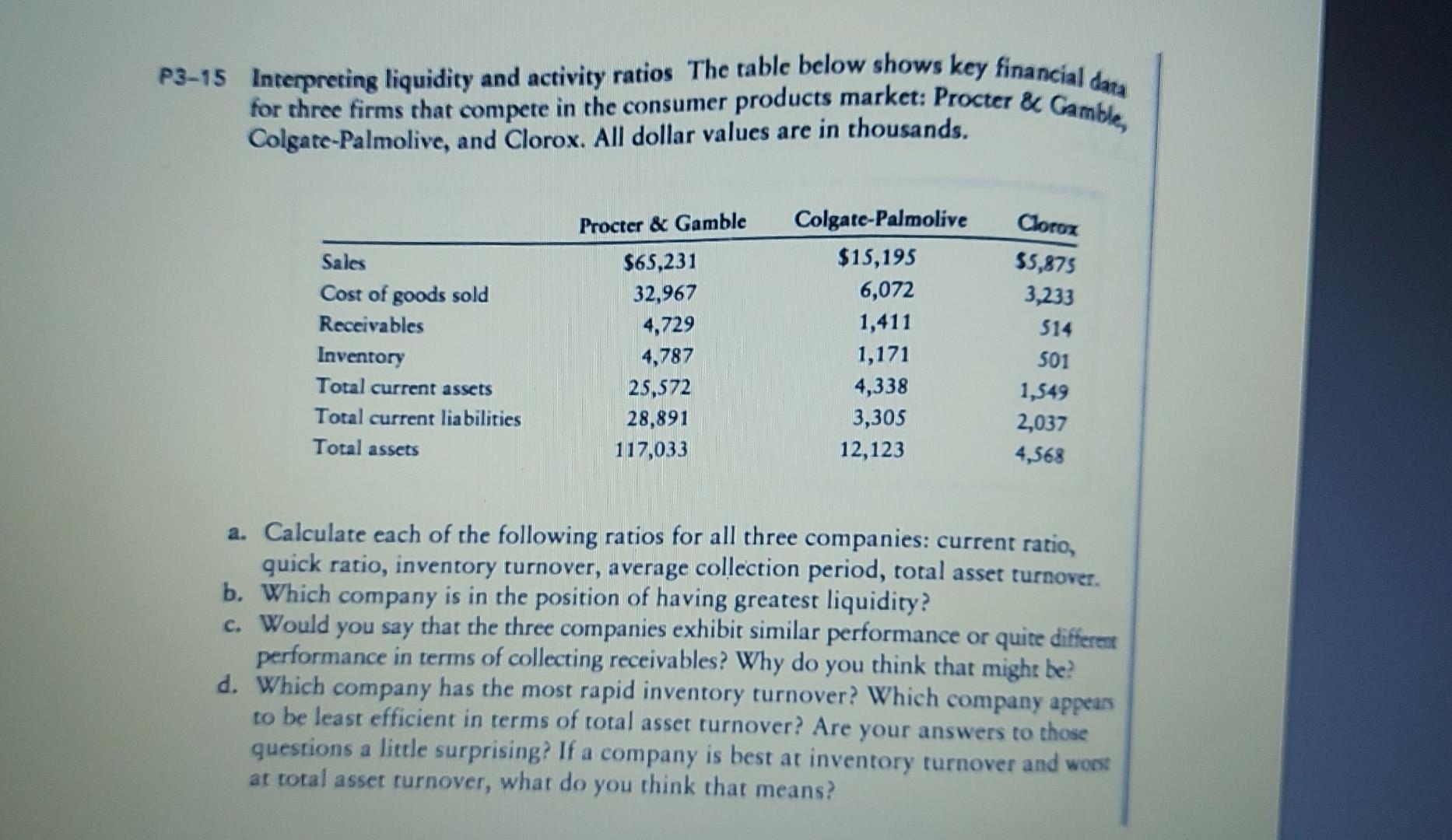

P3-15 Interpreting liquidity and activity ratios The table below shows key financial data for three firms that compete in the consumer products market: Procter &

P3-15 Interpreting liquidity and activity ratios The table below shows key financial data for three firms that compete in the consumer products market: Procter & Gamble, Colgate-Palmolive, and Clorox. All dollar values are in thousands. Sales Cost of goods sold Receivables Inventory Total current assets Total current liabilities Total assets Procter & Gamble $65,231 32,967 4,729 4,787 25,572 28,891 117,033 Colgate-Palmolive $15,195 6,072 1,411 1,171 4,338 3,305 12,123 Cloroz $5,875 3,233 514 501 1,549 2,037 4,568 a. Calculate each of the following ratios for all three companies: current ratio, quick ratio, inventory turnover, average collection period, total asset turnover. b. Which company is in the position of having greatest liquidity? c. Would you say that the three companies exhibit similar performance or quite different performance in terms of collecting receivables? Why do you think that might be? d. Which company has the most rapid inventory turnover? Which company appears to be least efficient in terms of total asset turnover? Are your answers to those questions a little surprising? If a company is best at inventory turnover and worst at total asset turnover, what do you think that means

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started