Answered step by step

Verified Expert Solution

Question

1 Approved Answer

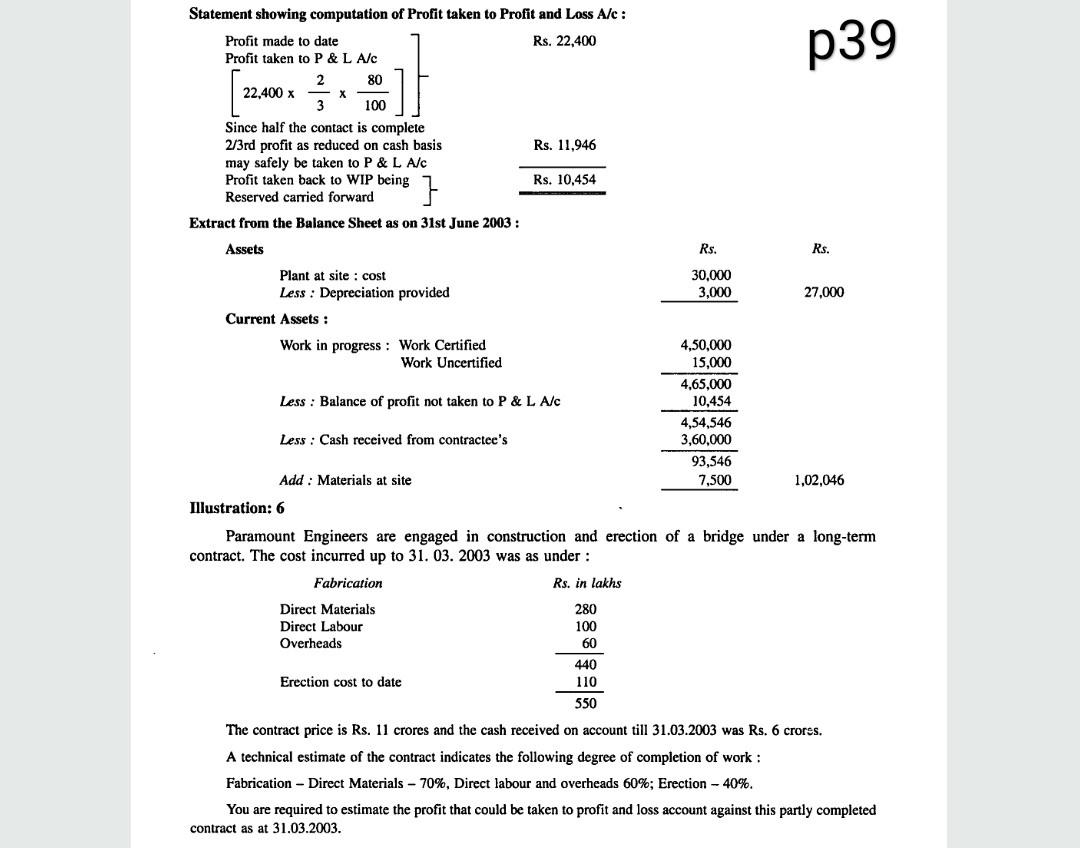

p39 Statement showing computation of Profit taken to Profit and Loss Alc: Profit made to date Rs. 22,400 Profit taken to P & L A/C

p39 Statement showing computation of Profit taken to Profit and Loss Alc: Profit made to date Rs. 22,400 Profit taken to P & L A/C 2 80 22.400 x -X 3 100 Since half the contact is complete 2/3rd profit as reduced on cash basis Rs. 11,946 may safely be taken to P & L Alc Profit taken back to WIP being Rs. 10.454 Reserved carried forward } Extract from the Balance Sheet as on 31st June 2003: Rs. Rs. 30,000 3,000 27,000 Assets Plant at site : cost Less : Depreciation provided Current Assets : Work in progress : Work Certified Work Uncertified Less : Balance of profit not taken to P & L A/C 4,50.000 15,000 4.65,000 10,454 4,54,546 3,60,000 93,546 7,500 Less : Cash received from contractee's Add : Materials at site 1,02,046 Illustration: 6 Paramount Engineers are engaged in construction and erection of a bridge under a long-term contract. The cost incurred up to 31. 03. 2003 was as under: Fabrication Rs. in lakhs Direct Materials Direct Labour Overheads 280 100 60 440 110 550 Erection cost to date The contract price is Rs. 11 crores and the cash received on account till 31.03.2003 was Rs. 6 crorss. A technical estimate of the contract indicates the following degree of completion of work: Fabrication - Direct Materials - 70%, Direct labour and overheads 60%; Erection - 40%. You are required to estimate the profit that could be taken to profit and loss account against this partly completed contract as at 31.03.2003

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started