Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P4-2 Name: _____________________________ Requirement 1 JACKSON HOLDING COMPANY Income Statements (partial) For the years ended December 31 2018 2017 Income from continuing operations, before taxes

| P4-2 | Name: _____________________________ | ||

| Requirement 1 | |||

| JACKSON HOLDING COMPANY | |||

| Income Statements (partial) | |||

| For the years ended December 31 | |||

| 2018 | 2017 | ||

| Income from continuing operations, before taxes ^ | $ 2,200,000 | ||

| Income tax expense | |||

| Income from continuing operations | |||

| Discontinued operations: | |||

| Income (loss) from discontinued component | |||

| (including gain on disposal of in 2018) | |||

| Income tax benefit (expense) | |||

| Income(loss) on discontinued operations | |||

| Net Income | |||

| ^Income from continuing operations, before taxes | |||

| Operating income with component included | 2,600,000 | ||

| Less: Income from discontinued operations | (400,000) | ||

| Income from continuing operatons before taxes | 2,200,000 |

| |

| Requirement 2: | |

| 2018 | |

| Income from continuing operations, before taxes ^ | |

| Income tax expense | |

| Income from continuing operations | |

| Discontinued operations: | |

| Income (loss) from discontinued component | |

| Income tax benefit (expense) | |

| Income(loss) on discontinued operations | |

| Net Income | |

| Requirement 3 | |

| 2018 | |

| Income from continuing operations, before taxes ^ | |

| Income tax expense | |

| Income from continuing operations | |

| Discontinued operations: | |

| Income (loss) from discontinued component | |

| (including impariment loss of ) | |

| Income tax benefit (expense) | |

| Income(loss) on discontinued operations | |

| Net Income |

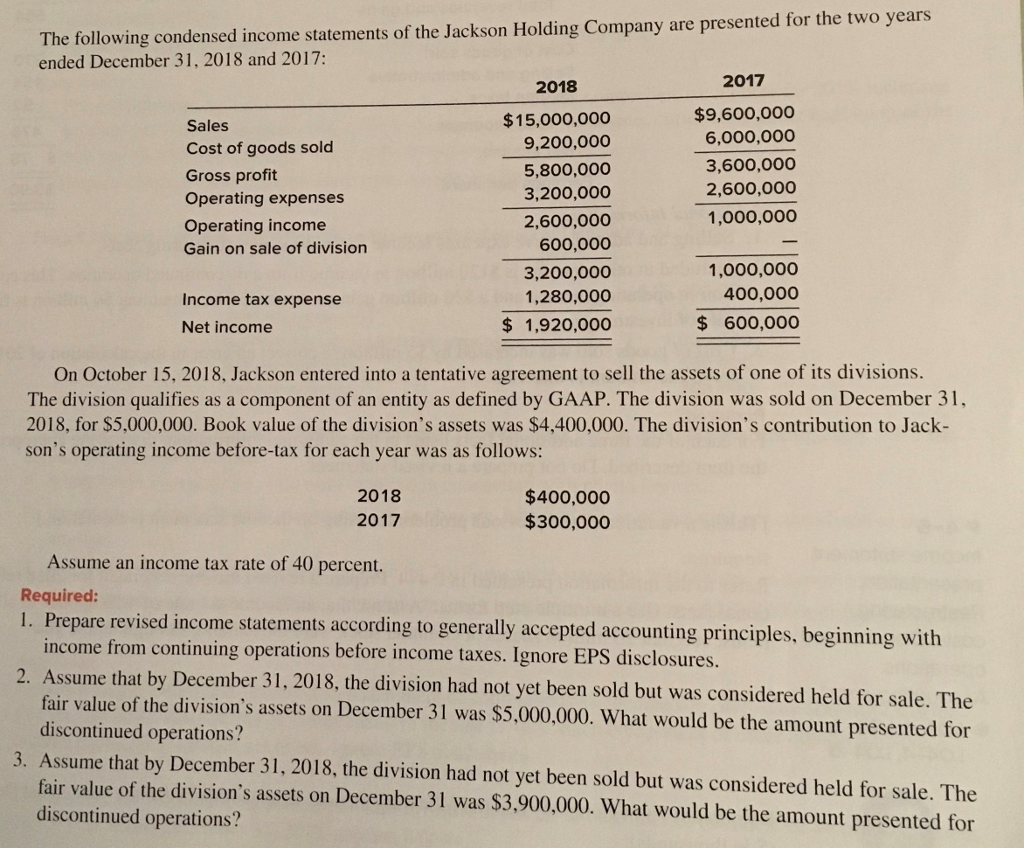

on Holding Company are presented for the two years The following condensed income statements of the Jacks ended December 31, 2018 and 2017: 2017 $9,600,000 6,000,000 3,600,000 2,600,00o 1,000,000 2018 Sales Cost of goods sold Gross profit Operating expenses Operating income Gain on sale of division $15,000,000 9,200,000 5,800,00o 3,200,000 2,600,000 600,000 3,200,000 1,280,000 $ 1,920,00o 1,000,000 400,000 Income tax expense Net income $ 600,000 On October 15, 2018, Jackson entered into a tentative agreement to sell the assets of one of its divisions. The division qualifies as a component of an entity as defined by GAAP. The division was sold on December 31, 2018, for $5,000,000. Book value of the division's assets was $4,400,000. The division's contribution to Jack- son's operating income before-tax for each year was as follows: 2018 2017 $400,000 $300,000 Assume an income tax rate of 40 percent Required 1. Prepare revised income statements a ccording to generally accepted accounting principles, beginning with income from continuing operations before income taxes. Ignore EPS disclosures. 2. Assume that by December 31, 2018, the division had not yet been sold but was considered held for sale. The fair value of the division's assets on December 31 was $5,000,000. What would be the amount presented for discontinued operations? 3. Assume that by December 31, 2018, the division had not yet been sold but was considered held for sale. The fair value of the division's assets on December 31 was $3,900,000. What would be the amount presented for discontinued operations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started