Answered step by step

Verified Expert Solution

Question

1 Approved Answer

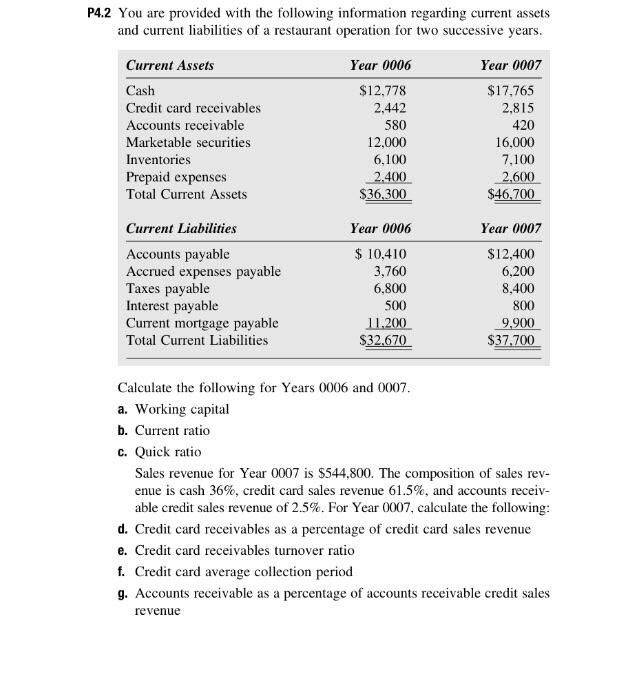

P4.2 You are provided with the following information regarding current assets and current liabilities of a restaurant operation for two successive years. Current Assets

P4.2 You are provided with the following information regarding current assets and current liabilities of a restaurant operation for two successive years. Current Assets Year 0006 Year 0007 Cash $12,778 $17,765 2,442 2,815 Credit card receivables Accounts receivable 580 420 12,000 16,000 Marketable securities Inventories 6,100 7,100 Prepaid expenses 2.400 2,600 Total Current Assets $36,300 $46,700 Current Liabilities Year 0006 Year 0007 Accounts payable $ 10,410 $12,400 Accrued expenses payable 3,760 6,200 Taxes payable 6,800 8,400 Interest payable 500 800 Current mortgage payable 11.200 9,900 Total Current Liabilities $32,670 $37,700 Calculate the following for Years 0006 and 0007. a. Working capital b. Current ratio c. Quick ratio Sales revenue for Year 0007 is $544,800. The composition of sales rev- enue is cash 36%, credit card sales revenue 61.5%, and accounts receiv- able credit sales revenue of 2.5%. For Year 0007, calculate the following: d. Credit card receivables as a percentage of credit card sales revenue e. Credit card receivables turnover ratio f. Credit card average collection period g. Accounts receivable as a percentage of accounts receivable credit sales revenue h. Accounts receivable turnover ratio i. Accounts receivable average collection period j. Cost of sales was $212,472; calculate cost of sales as a percentage of sales revenue k. Comment on what these ratios tell you about the restaurant.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Working capital Current assets Current liabilities Year 006 36300 32670 3630 Year 007 46700 37700 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started