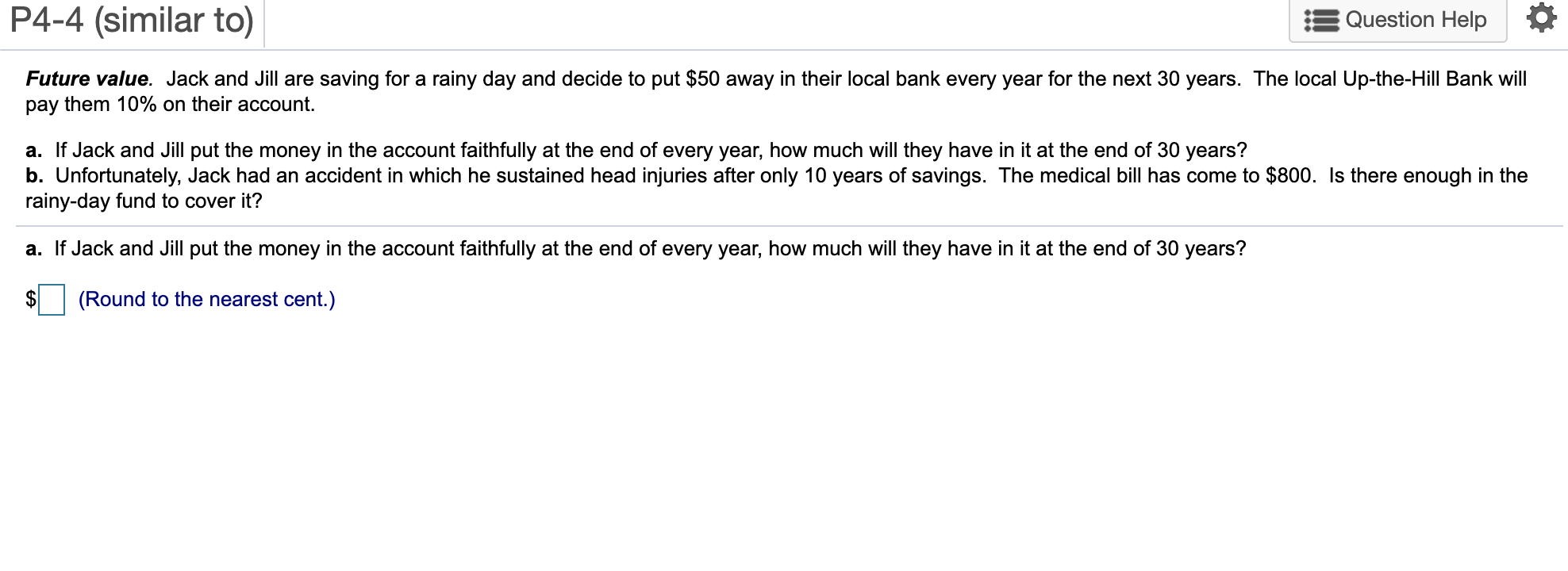

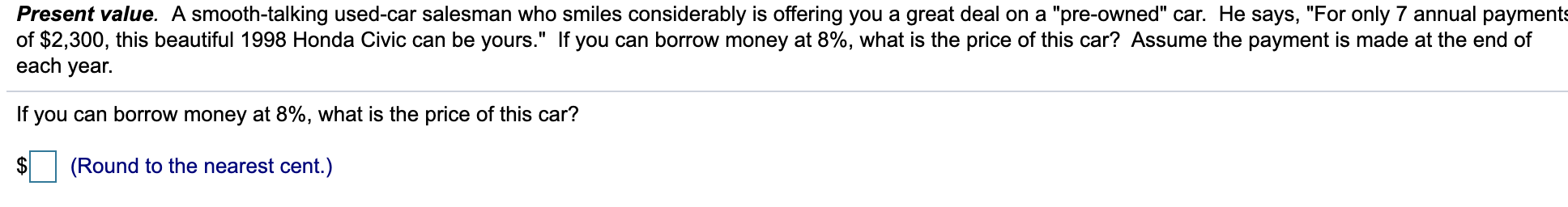

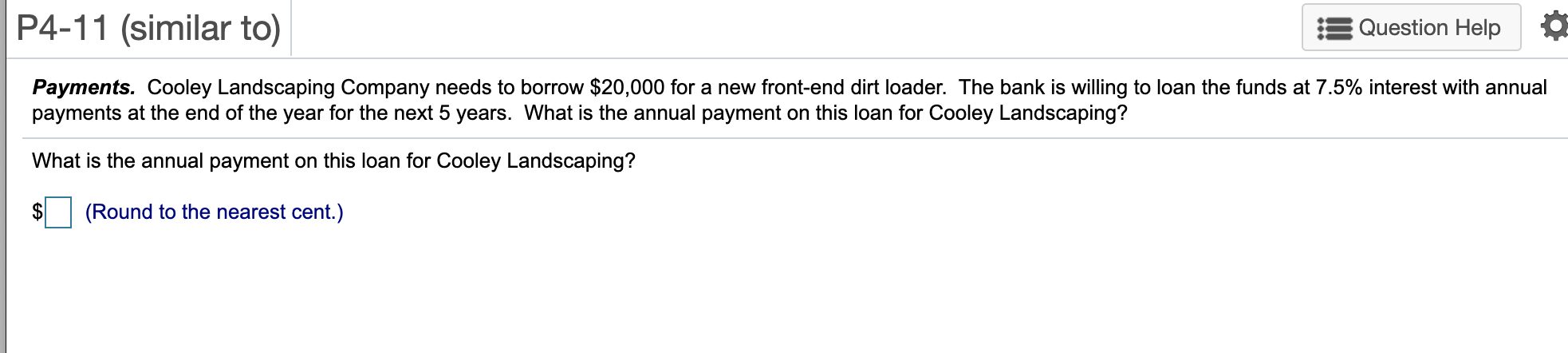

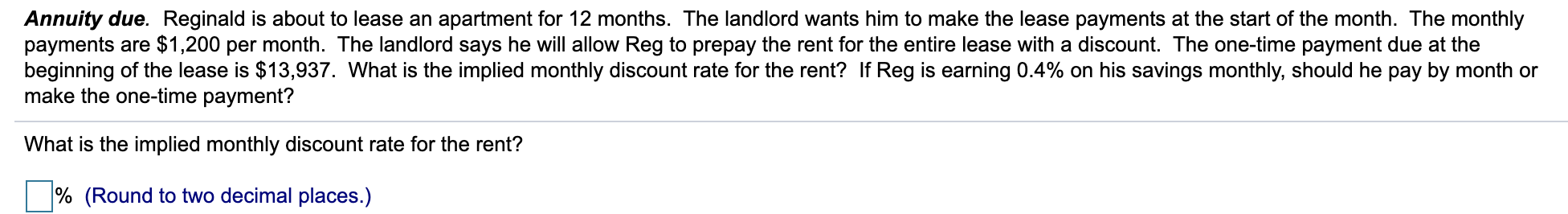

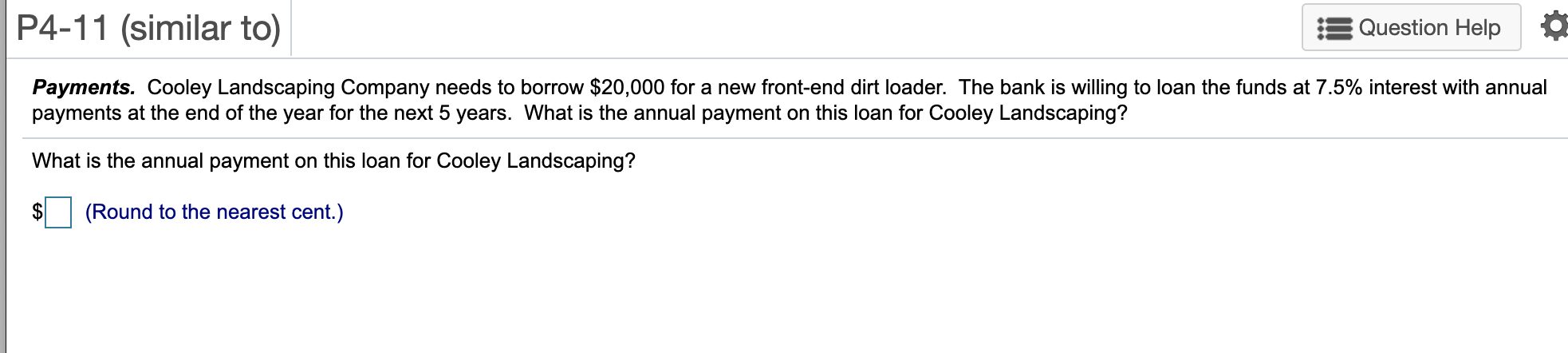

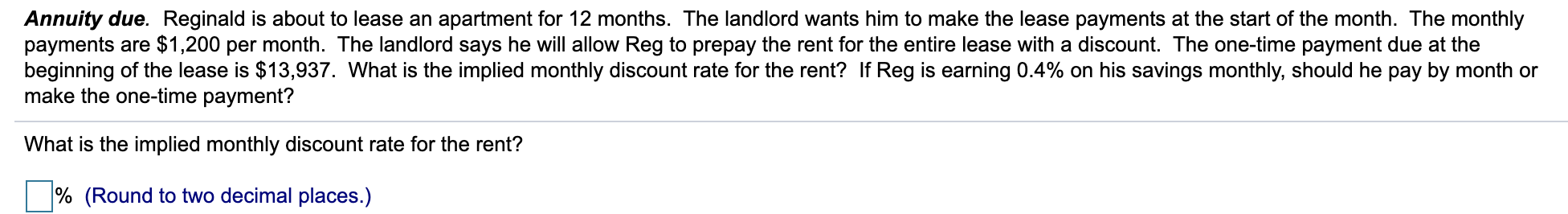

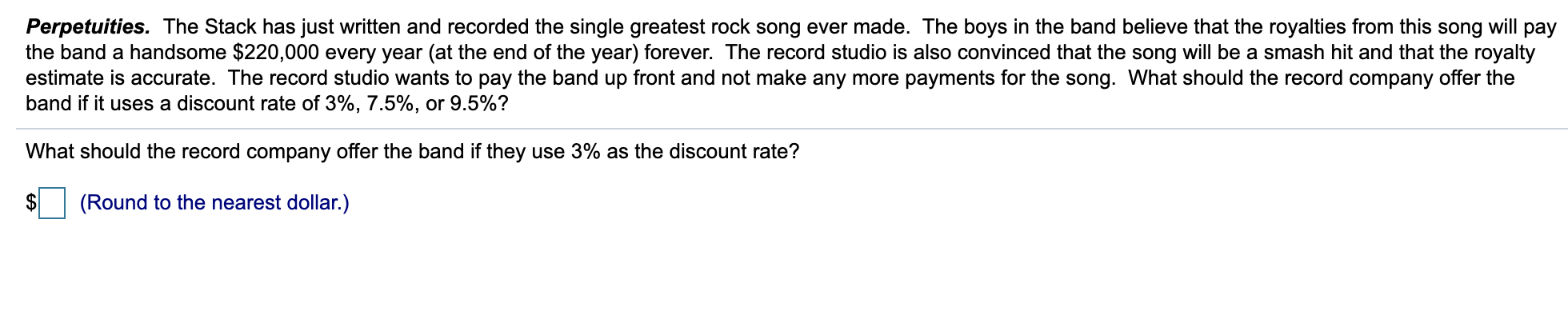

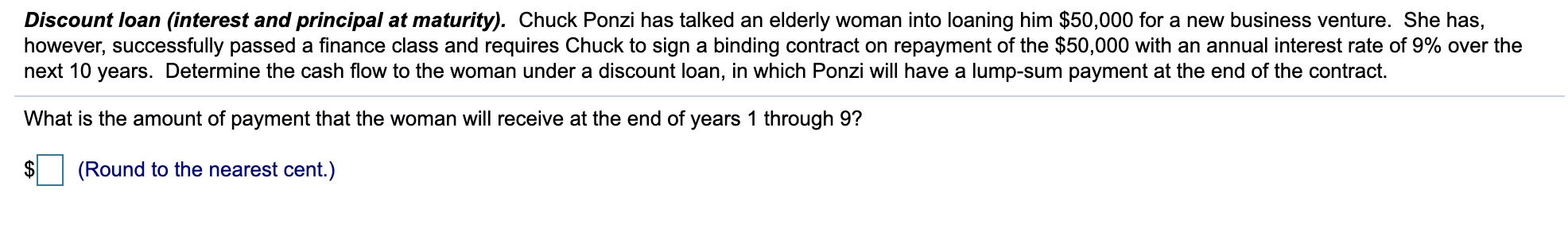

P4-4 (similar to) :$ Question Help Future value. Jack and Jill are saving for a rainy day and decide to put $50 away in their local bank every year for the next 30 years. The local Up-the-Hill Bank will pay them 10% on their account. a. If Jack and Jill put the money in the account faithfully at the end of every year, how much will they have in it at the end of 30 years? b. Unfortunately, Jack had an accident in which he sustained head injuries after only 10 years of savings. The medical bill has come to $800. Is there enough in the rainy-day fund to cover it? a. If Jack and Jill put the money in the account faithfully at the end of every year, how much will they have in it at the end of 30 years? $ (Round to the nearest cent.) Present value. A smooth-talking used-car salesman who smiles considerably is offering you a great deal on a "pre-owned" car. He says, "For only 7 annual payments of $2,300, this beautiful 1998 Honda Civic can be yours." If you can borrow money at 8%, what is the price of this car? Assume the payment is made at the end of each year. If you can borrow money at 8%, what is the price of this car? $ (Round to the nearest cent.) P4-11 (similar to) Question Help Payments. Cooley Landscaping Company needs to borrow $20,000 for a new front-end dirt loader. The bank is willing to loan the funds at 7.5% interest with annual payments at the end of the year for the next 5 years. What is the annual payment on this loan for Cooley Landscaping? What is the annual payment on this loan for Cooley Landscaping? $ (Round to the nearest cent.) Annuity due. Reginald is about to lease an apartment for 12 months. The landlord wants him to make the lease payments at the start of the month. The monthly payments are $1.200 per month. The landlord says he will allow Reg to prepay the rent for the entire lease with a discount. The one-time payment due at the beginning of the lease is $13,937. What is the implied monthly discount rate for the rent? If Reg is earning 0.4% on his savings monthly, should he pay by month or make the one-time payment? What is the implied monthly discount rate for the rent? | % (Round to two decimal places.) Perpetuities. The Stack has just written and recorded the single greatest rock song ever made. The boys in the band believe that the royalties from this song will pay the band a handsome $220,000 every year (at the end of the year) forever. The record studio is also convinced that the song will be a smash hit and that the royalty estimate is accurate. The record studio wants to pay the band up front and not make any more payments for the song. What should the record company offer the band if it uses a discount rate of 3%, 7.5%, or 9.5%? What should the record company offer the band if they use 3% as the discount rate? $ (Round to the nearest dollar.) Discount loan (interest and principal at maturity). Chuck Ponzi has talked an elderly woman into loaning him $50,000 for a new business venture. She has, however, successfully passed a finance class and requires Chuck to sign a binding contract on repayment of the $50,000 with an annual interest rate of 9% over the next 10 years. Determine the cash flow to the woman under a discount loan, in which Ponzi will have a lump-sum payment at the end of the contract. What is the amount of payment that the woman will receive at the end of years 1 through 9? Round to the nearest cent.)