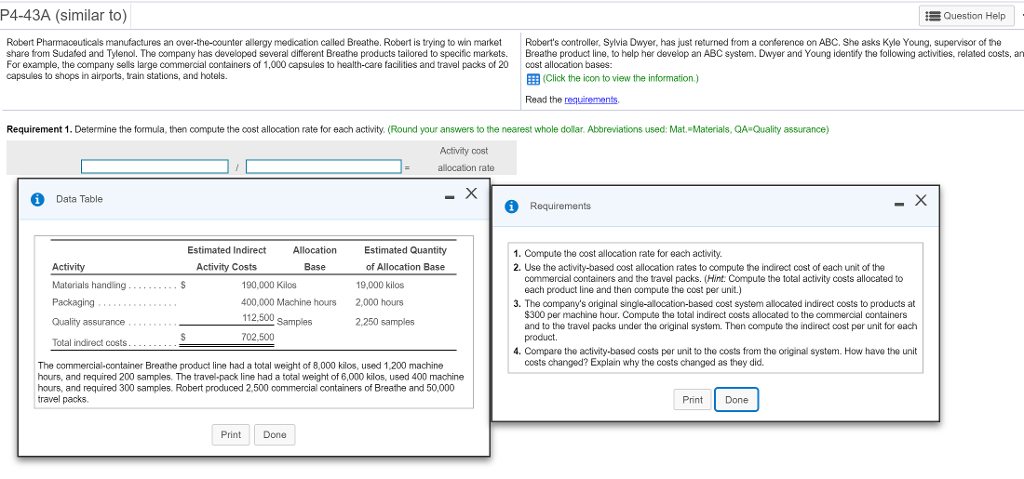

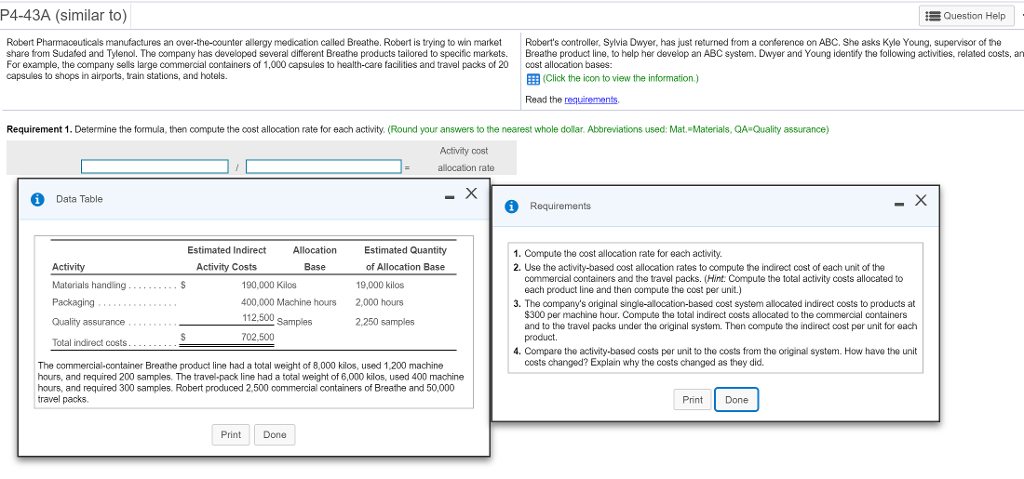

P4-43A (similar to) EQuestion Help Robert Pharmaceuticals manufactures an over-the-oounter allergy medication called Breathe. Robert is trying to win market Robert's controller, Sylvia Dwyer, has just returned from a conference on ABC. She asks Kyle Young, supervisor of the share from Sudafed and Tylenol. The company has developed several different Breathe products tailored to specific markets. Breathe product line, to help her develop an ABC system. Dwyer and Young identify the following activities, related costs, an For example, the company sels large commercial containers of 1,000 capsules to health-care facilities and travel packs of 20 cost allocation bases: capsules to shops in airports, train stations, and hotels. EEB (Click the icon to view the information.) Read the equitements Requirement 1. Determine the formula, then compute the cost allocation rate for each activity. (Round your answers to the nearest whole dollar. Abbreviations used: Mat.-Materials, QA Quality assurance) Activity cost allocation rate Data Table i Requirements Estimated Indirect Allocation Estimated Quantity 1. Compute the cost allocation rate for each activity. 2. Use the activity-based cost allocation rates to compute the indirect cost of each unit of the Activity Costs Base of Allocation Base 19,000 kilos 2,000 hours 2,250 samples commercial containers and the travel packs. (Hint: Compute the total activity costs allocated to each product line and then compute the cost per unit) Materials handling Packaging Quality assurance Total indirect costs 190,000 Kilos 400,000 Machine hours 112,500 702,500 3. The company's original cost system allocated indirect costs to products at $300 per machine hour. Compute the total indirect costs allocated to the commercial containers and to the travel packs under the original system. Then compute the indirect cost per unit for each product Samples 4. Comparo the activity-based costs por unit to the costs from the original system. How havo the unit costs changed? Explain why the costs changed as they did. The commercial-container Breathe product line had a total weight of 8,000 kilos, used 1,200 machine hours, and required 200 samples. The travel-pack line had a total weight of 6,000 kilos, used 400 machine hours, and required 300 samples. Robert produced 2,500 commercial containers of Breathe and 50,000 travel packs Print Done PrintDone