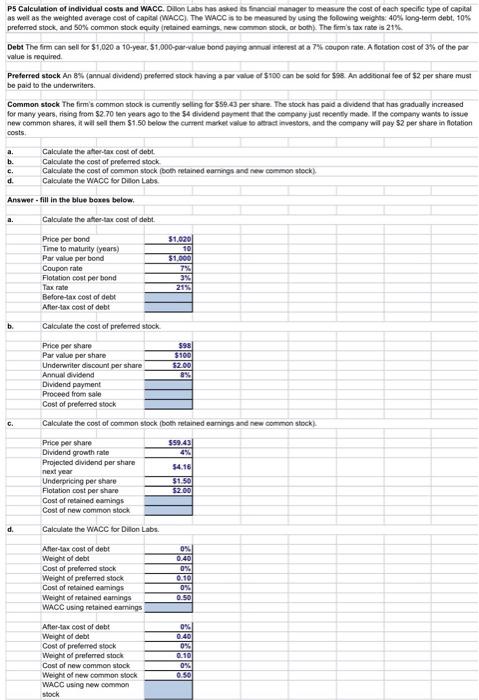

P5 Calculation of individual costs and wacc. DAlon Labs has asied \& fnancia manager to measune the cost of each specific type of capital as welt as the weighted average cest of capea (MACC). The WACC is to be measured by ising the following weights: 40% long-term debt. 10N preferred stock and 50% common slock equity (retaned eamings, new common stock, ar both). The frmm is tax rate is 21% Debt The frm can sell for $1,020 a 10-year, 51,000 -ber-value bond obing amnus iriecest at a 7% coupon rale. A flotation cost of 3% of the par value is required Preferred stock An 8% (annual dividend) preferred stock having a par value of $100 ean be sold for $98. An addibonal fee of $2 per share must be paid to the underwriters. Common stock The firm is common stock is currently seling for $50,43 per share. The atock has pad a dividend that has gradually increased for many years, rising from $2.70 ten years age to the 54 dividend ptymea that the company just recensy made. it the company warts to issie new common shares, in will sell them $1.50 below the currert makbet value so ataet investors, and the company wit pay $2 per share in fotation costs. a. Calculate the atier.tar cost of debt. b. Calculate the cost of preterred stock c. Caleulabe the cost of cornmon shock fooh retained earnins and new cemmen stock): d. Calculate the WacC tor Dilon Labs. Answer - fill in the blue bores below. a. Calculate the athertax cost of debt. Price per bond Time to maturity (years) Par value per bond Coupon rate Flotation cost per bond Tax rate Before-tax cost of debt Afler-tax cest of debt b. Calculate the cost of prelened stock. \begin{tabular}{l} Price per share \\ \hline Par value per share \\ Underwriter dscounl per share \\ Annual dividend \\ Dividend payment \\ Proceed from sale \\ Cost of prefered stock \\ \hline \end{tabular} c. Calculate the cost of common slock (both retained earnings and new common stick). d. Calculate the WaCC tor Dillon Labs. Aflertax cost of debt Weight of debt Cost of preferred stock Weight of preferred slock Cost of retained eamings Weight of retained eamings WACC using retaned eamings \begin{tabular}{r|} \hline 0.46 \\ \hline 0.40 \\ \hline 0.6 \\ \hline 0.10 \\ \hline 0.50 \\ \hline 0.50 \\ \hline \\ \hline \end{tabular} Afler-tax cost of debt Weight of debt Cost of preferred stock Weght of peeferred stock Cost of new common stock Weight of new commen slock WACC using new common stock P5 Calculation of individual costs and wacc. DAlon Labs has asied \& fnancia manager to measune the cost of each specific type of capital as welt as the weighted average cest of capea (MACC). The WACC is to be measured by ising the following weights: 40% long-term debt. 10N preferred stock and 50% common slock equity (retaned eamings, new common stock, ar both). The frmm is tax rate is 21% Debt The frm can sell for $1,020 a 10-year, 51,000 -ber-value bond obing amnus iriecest at a 7% coupon rale. A flotation cost of 3% of the par value is required Preferred stock An 8% (annual dividend) preferred stock having a par value of $100 ean be sold for $98. An addibonal fee of $2 per share must be paid to the underwriters. Common stock The firm is common stock is currently seling for $50,43 per share. The atock has pad a dividend that has gradually increased for many years, rising from $2.70 ten years age to the 54 dividend ptymea that the company just recensy made. it the company warts to issie new common shares, in will sell them $1.50 below the currert makbet value so ataet investors, and the company wit pay $2 per share in fotation costs. a. Calculate the atier.tar cost of debt. b. Calculate the cost of preterred stock c. Caleulabe the cost of cornmon shock fooh retained earnins and new cemmen stock): d. Calculate the WacC tor Dilon Labs. Answer - fill in the blue bores below. a. Calculate the athertax cost of debt. Price per bond Time to maturity (years) Par value per bond Coupon rate Flotation cost per bond Tax rate Before-tax cost of debt Afler-tax cest of debt b. Calculate the cost of prelened stock. \begin{tabular}{l} Price per share \\ \hline Par value per share \\ Underwriter dscounl per share \\ Annual dividend \\ Dividend payment \\ Proceed from sale \\ Cost of prefered stock \\ \hline \end{tabular} c. Calculate the cost of common slock (both retained earnings and new common stick). d. Calculate the WaCC tor Dillon Labs. Aflertax cost of debt Weight of debt Cost of preferred stock Weight of preferred slock Cost of retained eamings Weight of retained eamings WACC using retaned eamings \begin{tabular}{r|} \hline 0.46 \\ \hline 0.40 \\ \hline 0.6 \\ \hline 0.10 \\ \hline 0.50 \\ \hline 0.50 \\ \hline \\ \hline \end{tabular} Afler-tax cost of debt Weight of debt Cost of preferred stock Weght of peeferred stock Cost of new common stock Weight of new commen slock WACC using new common stock