Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P5 Calculation of individual costs and WACC. Dillon Labs has asked its financial manager to measure the cost of each specific type of capital

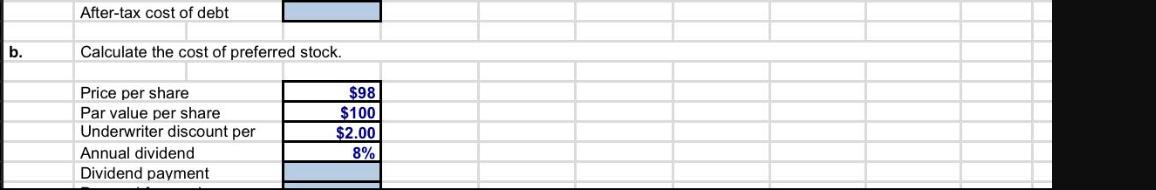

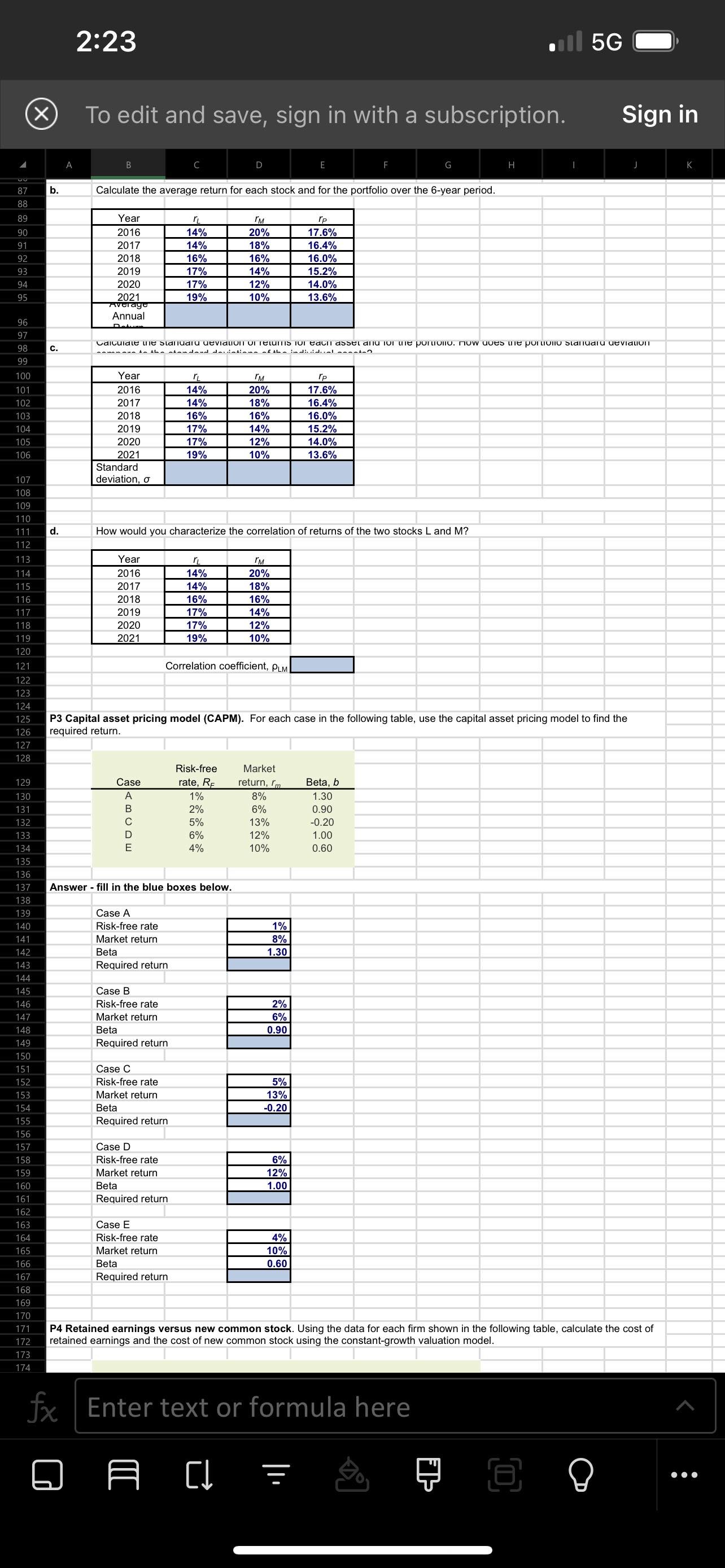

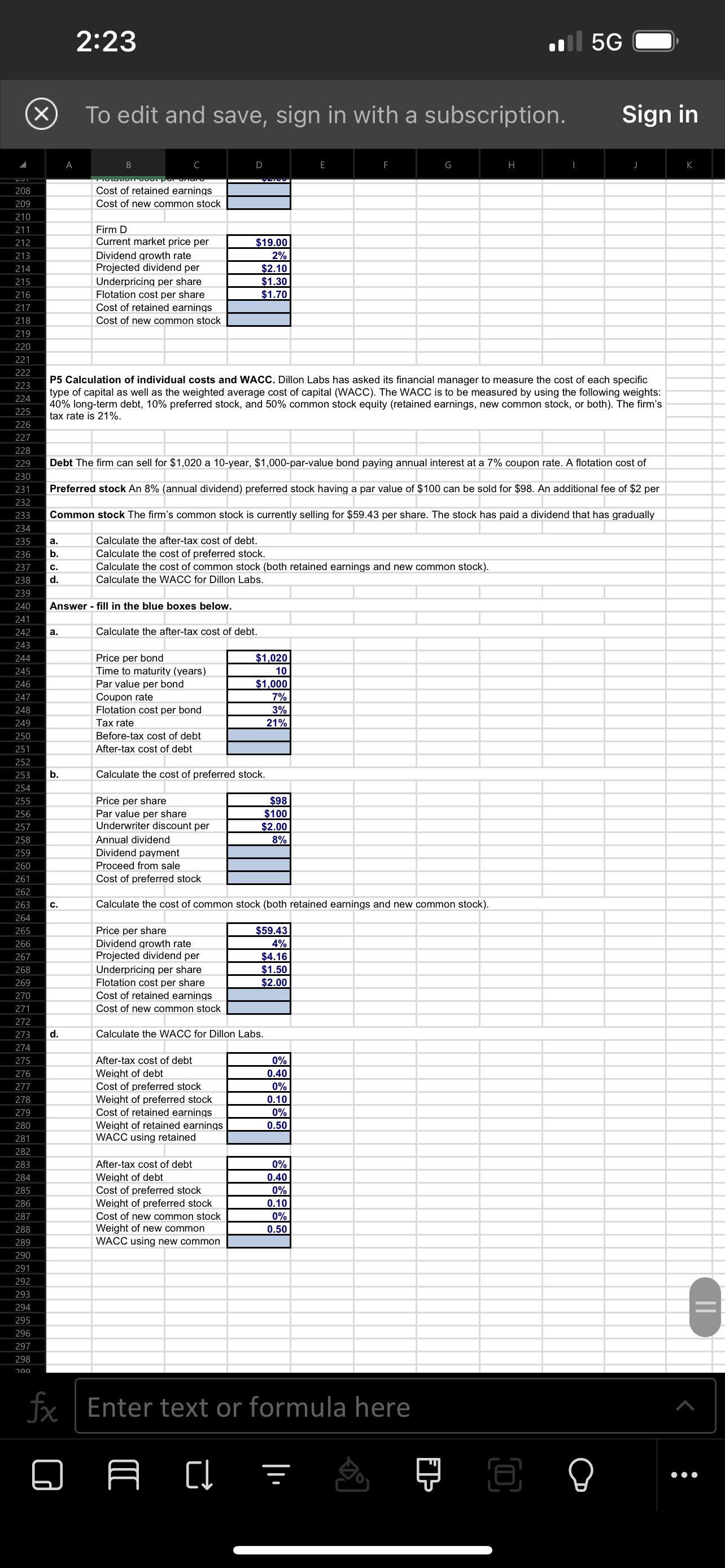

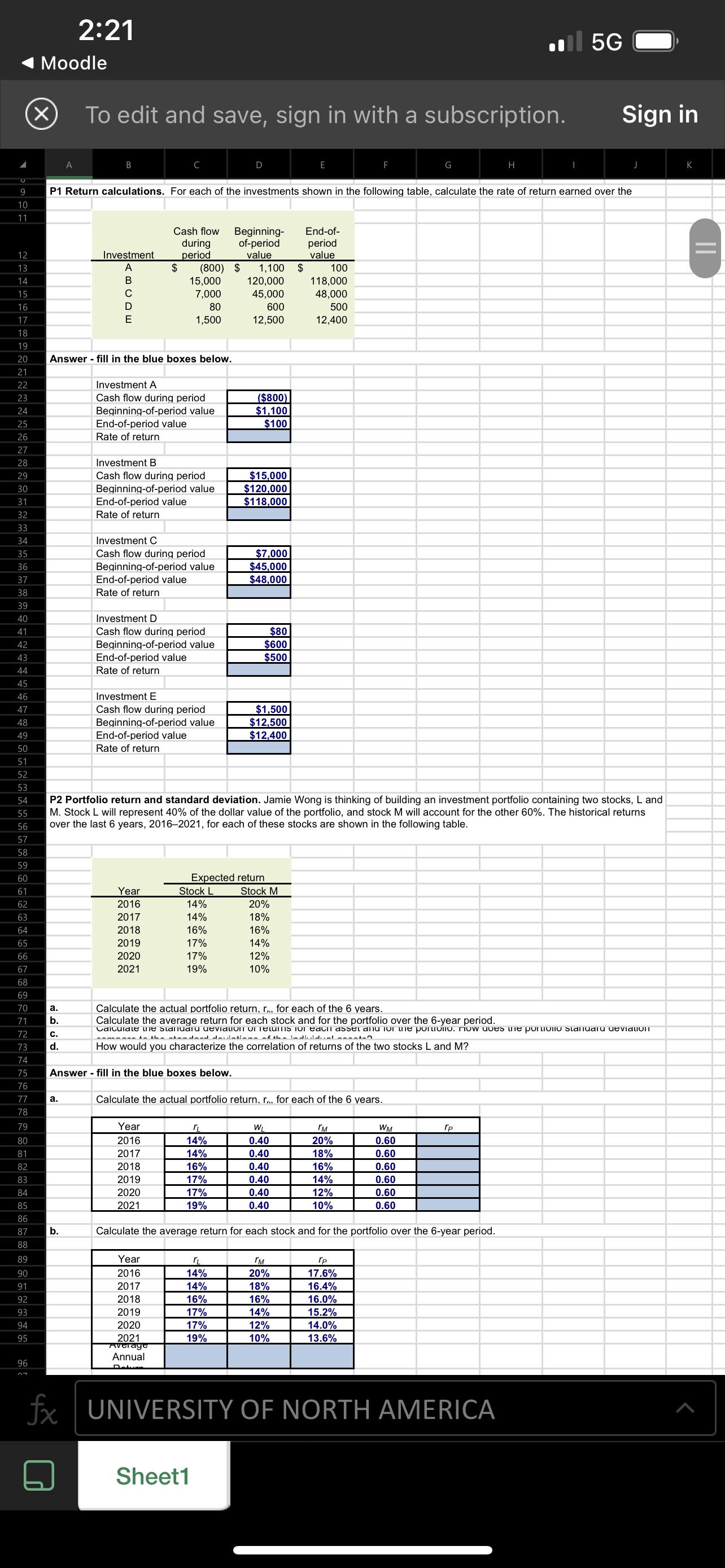

P5 Calculation of individual costs and WACC. Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital (WACC). The WACC is to be measured by using the following weights: 40% long-term debt, 10% preferred stock, and 50% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 21%. Debt The firm can sell for $1,020 a 10-year, $1,000-par-value bond paying annual interest at a 7% coupon rate. A flotation cost of Preferred stock An 8% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $2 per Common stock The firm's common stock is currently selling for $59.43 per share. The stock has paid a dividend that has gradually Calculate the after-tax cost of debt. Calculate the cost of preferred stock. Calculate the cost of common stock (both retained earnings and new common stock). Calculate the WACC for Dillon Labs. a. b. C. d. Answer - fill in the blue boxes below. a. Calculate the after-tax cost of debt. Price per bond Time to maturity (years) Par value per bond Coupon rate Flotation cost per bond Tax rate Before-tax cost of debt After-tax cost of debt $1,020 10 $1,000 7% 3% 21% || b. After-tax cost of debt Calculate the cost of preferred stock. Price per share Par value per share Underwriter discount per Annual dividend Dividend payment $98 $100 $2.00 8% Uu 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 X To edit and save, sign in with a subscription. b. C. d. 2:23 A B Year 2016 2017 2018 2019 2020 2021 Average Annual Dalum Calculate the average return for each stock and for the portfolio over the 6-year period. Year 2016 2017 2018 2019 2020 2021 Standard deviation, o Year 2016 2017 2018 2019 2020 2021 Case A B C D E "L 14% 14% 16% 17% 17% 19% Case A Risk-free rate Market return Beta Required return Calculate the standard deviation of Tetris for each ass and for the portiollo. How does the portion stand un mann to the abovdand desiation of the individiral natan Case B Risk-free rate Market return Beta Required return PL 14% 14% 16% 17% 17% 19% Case C Risk-free rate Market return Beta Required return How would you characterize the correlation of returns of the two stocks L and M? rL 14% 14% 16% Answer fill in the blue boxes below. Case D Risk-free rate Market return Beta Required return D 17% 17% 19% Correlation coefficient, PLM Case E Risk-free rate Market return Beta Required return rM 20% 18% 16% 14% 12% 10% Risk-free rate, RF 1% 2% 5% 6% 4% M 20% 18% 16% 14% 12% 10% rM 20% 18% 16% 14% 12% 10% P3 Capital asset pricing model (CAPM). For each case in the following table, use the capital asset pricing model to find the required return. Market return, m 8% 6% 13% 12% 10% 1% 8% 1.30 E 2% 6% 0.90 5% 13% -0.20 rp 17.6% 16.4% 16.0% 15.2% 14.0% 13.6% 6% 12% 1.00 rp 17.6% 4% 10% 0.60 16.4% 16.0% 15.2% 14.0% 13.6% G Beta, b 1.30 0.90 -0.20 1.00 0.60 H 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 P4 Retained earnings versus new common stock. Using the data for each firm shown in the following table, calculate the cost of 172 retained earnings and the cost of new common stock using the constant-growth valuation model. 173 174 fx Enter text or formula here A C HE 5G Sign in J K X 2:23 A To edit and save, sign in with a subscription. C. B 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 a. 236 b. 237 C. 238 d. 239 240 Answer - fill in the blue boxes below. 241 242 a. 243 244 245 246 247 248 249 250 251 252 253 b. 254 255 256 257 258 259 260 261 262 263 264 265 266 267 268 269 270 271 272 273 d. 274 275 276 277 278 279 280 281 282 283 284 285 286 287 288 289 290 291 292 293 294 295 296 297 298 200 Cost of retained earnings Cost of new common stock Firm D Current market price per Dividend growth rate Projected dividend per Underpricing per share Flotation cost per share Cost of retained earnings Cost of new common stock Price per bond Time to maturity (years) Par value per bond Calculate the after-tax cost of debt. Coupon rate Flotation cost per bond Tax rate Before-tax cost of debt After-tax cost of debt Calculate the after-tax cost of debt. Calculate the cost of preferred stock. Calculate the cost of common stock (both retained earnings and new common stock). Calculate the WACC for Dillon Labs. Price per share Par value per share. Underwriter discount per D P5 Calculation of individual costs and WACC. Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital (WACC). The WACC is to be measured by using the following weights: 40% long-term debt, 10% preferred stock, and 50% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 21%. Annual dividend Dividend payment Proceed from sale Cost of preferred stock $19.00 2% $2.10 $1.30 $1.70 Debt The firm can sell for $1,020 a 10-year, $1,000-par-value bond paying annual interest at a 7% coupon rate. A flotation cost of Preferred stock An 8% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $2 per Common stock The firm's common stock is currently selling for $59.43 per share. The stock has paid a dividend that has gradually Calculate the cost of preferred stock. Price per share Dividend growth rate Projected dividend per Underpricing per share Flotation cost per share Cost of retained earnings Cost of new common stock After-tax cost of debt Weight of debt Cost of preferred stock Weight of preferred stock Cost of retained earnings Weight of retained earnings WACC using retained $1,020 10 $1,000 7% 3% 21% After-tax cost of debt Weight of debt Cost of preferred stock Weight of preferred stock Cost of new common stock Weight of new common WACC using new common $98 $100 $2.00 8% Calculate the cost of common stock (both retained earnings and new common stock). Calculate the WACC for Dillon Labs. E $59.43 4% $4.16 $1.50 $2.00 F 0% 0.40 0% 0.10 0% 0.50 0% 0.40 0% 0.10 0% 0.50 G fx Enter text or formula here A C H HE 5G Sign in J K || 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 Moodle X a. 71 b. 72 C. 73 d. 74 75 76 77 78 2:21 A To edit and save, sign in with a subscription. a. B b. Investment A B C D E P1 Return calculations. For each of the investments shown in the following table, calculate the rate of return earned over the Answer - fill in the blue boxes below. Cash flow Beginning- of-period value $ during period End-of-period value Rate of return Investment A Cash flow during period Beginning-of-period value End-of-period value Rate of return Investment B Cash flow during period Beginning-of-period value End-of-period value Rate of return Investment C Cash flow during period Beginning-of-period value End-of-period value Rate of return (800) $ Investment D Cash flow during period Beginning-of-period value. Year 2016 2017 2018 2019 2020 2021 15,000 7,000 80 1,500 End-of-period value Rate of return Investment E Cash flow during period Beginning-of-period value Year 2016 2017 2018 2019 2020 2021 Year 2016 2017 2018 2019 2020 2021 Average Annual DAW Answer - fill in the blue boxes below. Stock L 14% 14% 16% 17% 17% 19% D PL 14% 14% 16% 17% 17% 19% 1,100 120,000 45,000 600 12,500 ($800) $1,100 $100 P2 Portfolio return and standard deviation. Jamie Wong is thinking of building an investment portfolio containing two stocks, L and M. Stock L will represent 40% of the dollar value of the portfolio, and stock M will account for the other 60%. The historical returns over the last 6 years, 2016-2021, for each of these stocks are shown in the following table. Expected return "L 14% 14% 16% Sheet1 $15,000 $120,000 $118,000 17% 17% 19% $7,000 $45,000 $48,000 $80 $600 $500 $1,500 $12,500 $12,400 Stock M 20% 18% 16% 14% 12% 10% Calculate the actual portfolio return, r. for each of the 6 years. E $ Calculate the actual portfolio return. r. for each of the 6 years. Calculate the average return for each stock and for the portfolio over the 6-year period. valuuiale Lie slanuaru utviaLOIT UI TELLITIS IUI taill assei aiu IUI LITE POTOMIU. Uw uUES LIE POLLUMIU staiiualu Ueviduum awamaua ko the abandand donciation of the individual conten How would you characterize the correlation of returns of the two stocks L and M? WL 0.40 0.40 0.40 0.40 0.40 0.40 End-of- period value 100 118,000 48,000 500 12,400 M 20% 18% 16% 14% 12% 10% Calculate the average return for each stock and for the portfolio over the 6-year period. rM 20% 18% 16% 14% 12% 10% WM 0.60 0.60 0.60 0.60 0.60 0.60 rp 17.6% 16.4% 16.0% 15.2% 14.0% 13.6% H rp 5G fx UNIVERSITY OF NORTH AMERICA Sign in J K ||

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations for Dillon Labs WACC a Cost of debt Price per bond 1020 Par valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started