Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P5-29 Creating an endowment On completion of her introductory finance course, Marla Lee was so pleased with the amount of useful and interesting knowledge

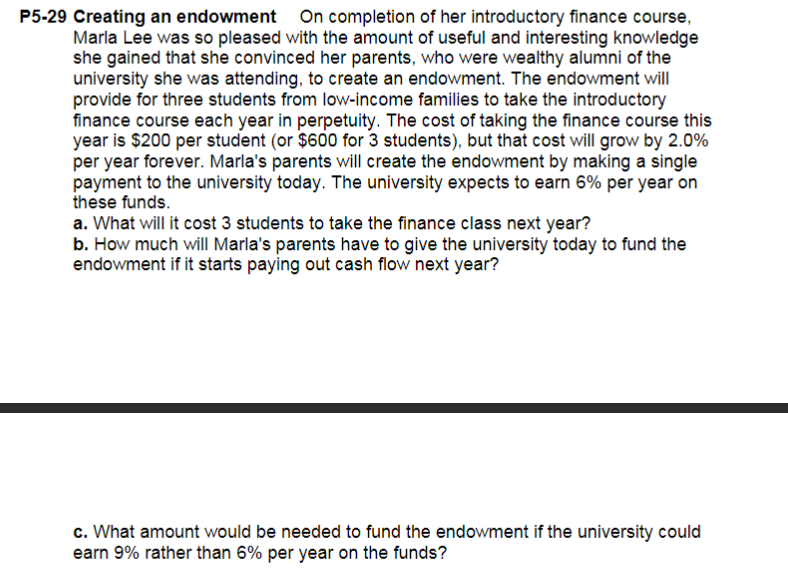

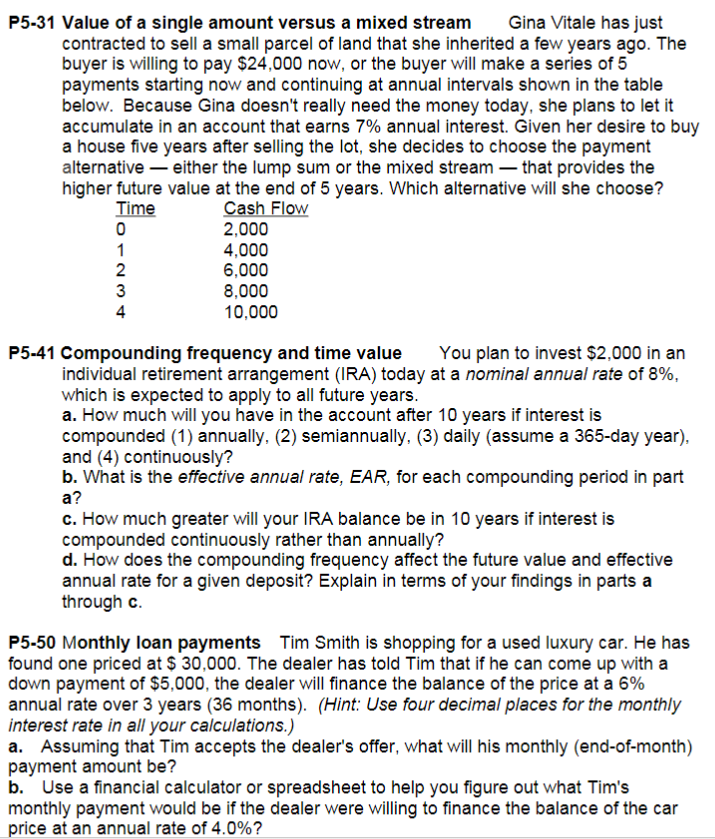

P5-29 Creating an endowment On completion of her introductory finance course, Marla Lee was so pleased with the amount of useful and interesting knowledge she gained that she convinced her parents, who were wealthy alumni of the university she was attending, to create an endowment. The endowment will provide for three students from low-income families to take the introductory finance course each year in perpetuity. The cost of taking the finance course this year is $200 per student (or $600 for 3 students), but that cost will grow by 2.0% per year forever. Marla's parents will create the endowment by making a single payment to the university today. The university expects to earn 6% per year on these funds. a. What will it cost 3 students to take the finance class next year? b. How much will Marla's parents have to give the university today to fund the endowment if it starts paying out cash flow next year? c. What amount would be needed to fund the endowment if the university could earn 9% rather than 6% per year on the funds? P5-31 Value of a single amount versus a mixed stream Gina Vitale has just contracted to sell a small parcel of land that she inherited a few years ago. The buyer is willing to pay $24,000 now, or the buyer will make a series of 5 payments starting now and continuing at annual intervals shown in the table below. Because Gina doesn't really need the money today, she plans to let it accumulate in an account that earns 7% annual interest. Given her desire to buy a house five years after selling the lot, she decides to choose the payment alternative either the lump sum or the mixed stream that provides the higher future value at the end of 5 years. Which alternative will she choose? Time Cash Flow 0 2,000 1 4,000 234 2 6,000 3 8,000 4 10,000 P5-41 Compounding frequency and time value You plan to invest $2,000 in an individual retirement arrangement (IRA) today at a nominal annual rate of 8%, which is expected to apply to all future years. a. How much will you have in the account after 10 years if interest is compounded (1) annually, (2) semiannually, (3) daily (assume a 365-day year), and (4) continuously? b. What is the effective annual rate, EAR, for each compounding period in part a? c. How much greater will your IRA balance be in 10 years if interest is compounded continuously rather than annually? d. How does the compounding frequency affect the future value and effective annual rate for a given deposit? Explain in terms of your findings in parts a through c. P5-50 Monthly loan payments Tim Smith is shopping for a used luxury car. He has found one priced at $ 30,000. The dealer has told Tim that if he can come up with a down payment of $5,000, the dealer will finance the balance of the price at a 6% annual rate over 3 years (36 months). (Hint: Use four decimal places for the monthly interest rate in all your calculations.) a. Assuming that Tim accepts the dealer's offer, what will his monthly (end-of-month) payment amount be? b. Use a financial calculator or spreadsheet to help you figure out what Tim's monthly payment would be if the dealer were willing to finance the balance of the car price at an annual rate of 4.0%?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the cost for three students to take the finance class next year we need to determine ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started